The prevailing market skepticism around AI's immediate profitability finds a powerful counter-narrative in Microsoft's recent earnings, suggesting a robust monetization strategy is already underway. Brent Thill, a Software & Internet Research Analyst at Jefferies, speaking on CNBC's 'Closing Bell Overtime' with Kelly Evans and Jon Fortt, offered a sharp analysis of Microsoft's Q1 results, highlighting how the tech giant is not merely investing in AI but actively converting it into tangible financial gains, defying expectations of margin erosion.

Thill’s commentary began by addressing the market's initial reaction to Microsoft's Azure cloud growth, which, at 40% year-over-year, was a slight miss against street estimates of 38.2%. However, this narrow focus overlooks deeper indicators of commercial momentum. He emphasized that the street is "not picking up on the booking and the actual RPO," referring to Microsoft's commercial booking number at a robust 112% and its Remaining Performance Obligation (RPO) growing over 50%. These figures represent future revenue commitments, signaling an exceptionally strong demand pipeline.

Crucially, this impressive RPO growth does not even factor in the monumental $250 billion incremental commitment from OpenAI, Microsoft's strategic partner in the generative AI space. This omission underscores the conservative nature of the reported figures and paints a picture of substantial future revenue streams yet to be fully recognized. Thill asserted that these metrics are "the future indication of health of this company," suggesting that Microsoft is not just meeting but "blowing the doors off" traditional growth benchmarks in the software industry.

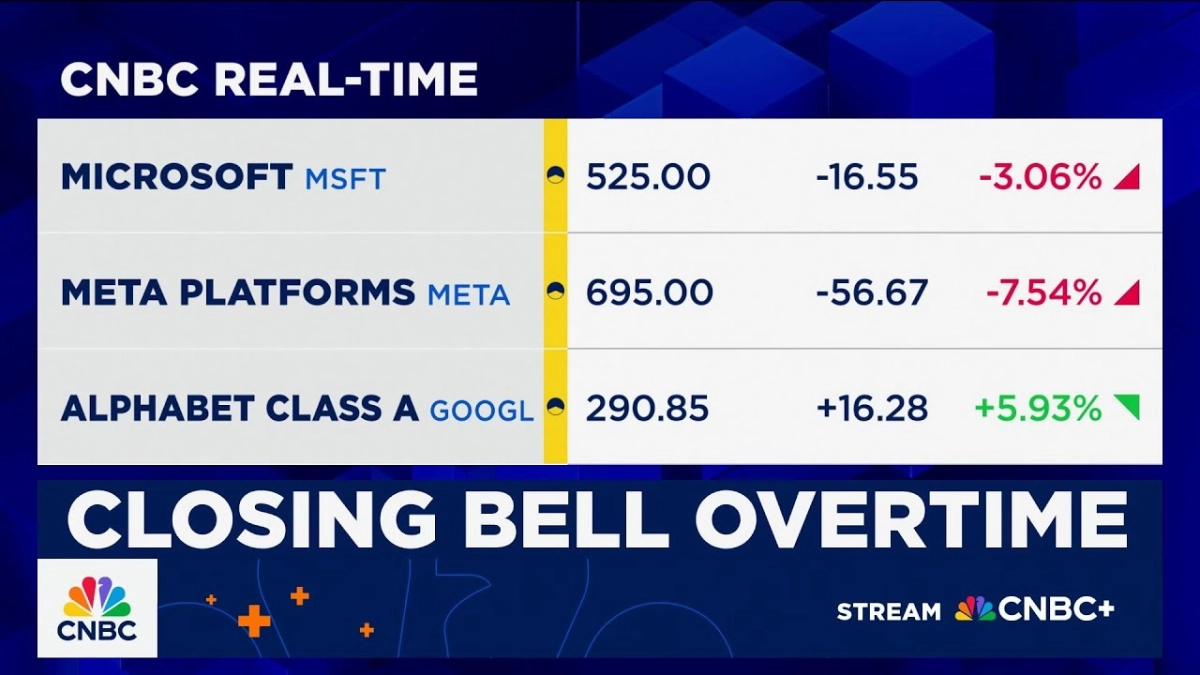

The discussion also touched upon the increase in Capital Expenditure (CAPEX), a common concern for investors wary of the massive infrastructure costs associated with AI development. Thill noted that Google and Meta also reported higher CAPEX, indicating an industry-wide investment trend. He reframed this as a long-term play, stating, "We're year three in AI buildout and many are indicating it's a 20-year cycle." This perspective shifts the narrative from immediate cost burdens to a sustained, multi-decade transformation that Microsoft is actively shaping.

A core insight from Thill's analysis is Microsoft's ability to drive profitability within this demanding AI landscape. He directly confronted the question, "How can you make money in AI?" by pointing to Microsoft's CFO, Amy Hood, who "put up better margins than expected." This achievement is particularly noteworthy given the widespread assumption that heavy AI investments would compress margins. Microsoft's cloud margins are approaching 40%, demonstrating not only efficiency but also pricing power in its AI-infused offerings.

This margin improvement is a testament to Microsoft's strategic advantage as a full-stack provider. Unlike many hyperscalers that primarily offer infrastructure, Microsoft spans the entire technology stack, from foundational cloud services to a vast array of application-layer products. This unique position allows them to embed AI directly into widely used tools like productivity suites, ERP systems, sales automation, and cybersecurity solutions. They are able to "price for it," charging a higher premium for these enhanced, AI-powered services.

Related Reading

- Microsoft's OpenAI Bet Yields 10x Return, Igniting AI Infrastructure Race

- Alphabet’s AI Reckoning: Cloud Momentum vs. Search Durability

- AI Valuations Spark Bubble Fears Amidst Broader Market Optimism

Thill articulated this advantage vividly, stating, "Microsoft is the best positioned of any hyperscaler to monetize AI because all the hyperscalers don't live in the application world to the degree that Microsoft does." This deep integration across the enterprise stack makes Microsoft an indispensable partner for businesses navigating the AI revolution. As Thill aptly put it, "Every CIO is going to Microsoft because they're the one vendor they want to be in a rowboat to a desert island because they have the entire stack infused with AI."

The ability to monetize AI at higher margins, coupled with robust commercial bookings and long-term investment cycles, indicates Microsoft's strategic prowess. They are not merely participating in the AI race but are actively establishing a profitable and defensible position. The market's initial focus on a minor Azure growth deviation appears to miss the profound implications of Microsoft's integrated AI strategy and its demonstrated capacity to translate innovation into sustained financial strength.