Jim Cramer, in a recent segment of 'Mad Money,' delivered a stark warning to investors fixated on the artificial intelligence boom, asserting that the market’s singular focus on data center spending has created a "pollis market" where many opportunities in the AI space "feel picked over." This pronouncement signals a critical juncture for founders, venture capitalists, and AI professionals who have largely ridden the wave of massive infrastructure investment supporting AI’s ascent.

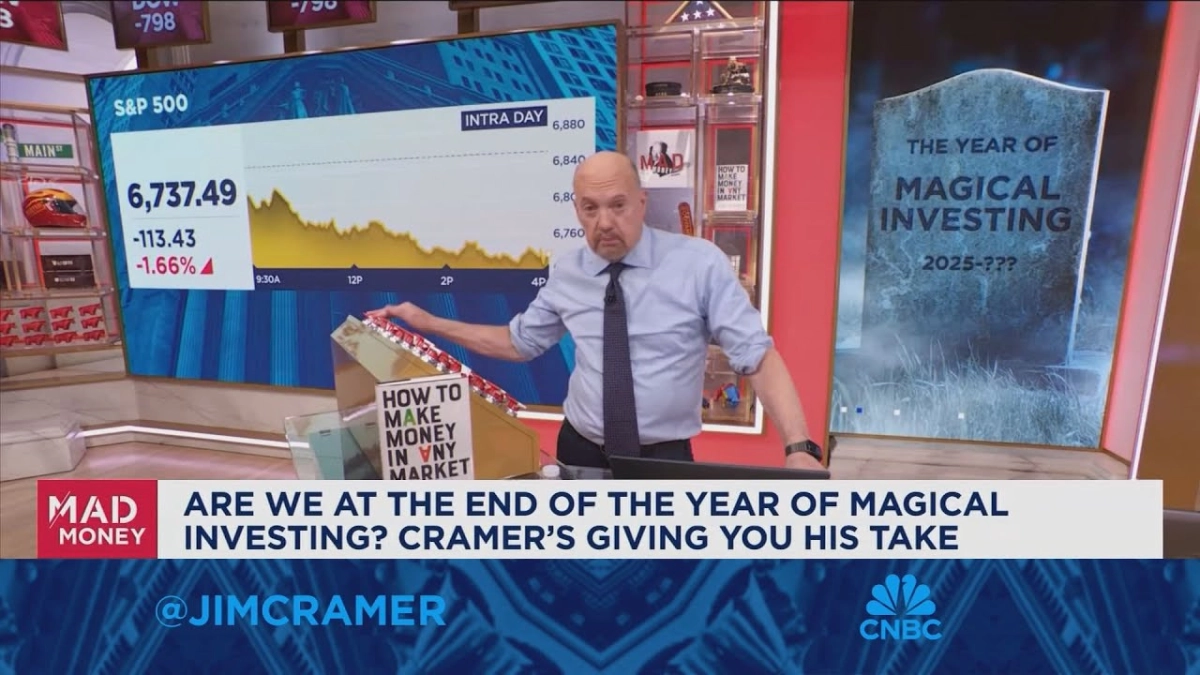

Cramer, speaking on his CNBC program, discussed the latest market movements, particularly highlighting a notable rotation away from the tech-heavy Nasdaq towards broader, more industrially-focused sectors like the Dow. His commentary suggested a fundamental re-evaluation of where genuine value and future growth lie, moving beyond the seemingly insatiable demand for AI-enabling hardware.

The core insight Cramer presented is that the market's previous reliance on data center expenditure as the sole driver of upward momentum is unsustainable. He declared, "A market that only goes higher because of data center spending is a pollis market." This provocative statement challenges the prevailing wisdom that endless investment in computing infrastructure will perpetually fuel tech stock growth. For those deeply entrenched in the AI ecosystem, this implies a necessary shift in investment thesis, moving away from pure infrastructure plays to applications and services that demonstrate tangible, widespread economic impact without requiring "trillions of dollars of data center spending to pan out."

His analysis further suggested that the AI sector, while undoubtedly transformative, has reached a point of saturation for easy gains. Cramer articulated this shift by stating, "Increasingly, I feel like there are better places to hunt for winners than the AI space, where many, not all, but many feel picked over." This perspective is crucial for VCs evaluating new AI startups and founders strategizing their go-to-market approaches. It suggests that the low-hanging fruit in foundational AI infrastructure might be gone, necessitating a deeper dive into niche applications, efficiency gains, or entirely new business models that leverage AI without demanding exponential hardware scaling. The era of simply building bigger models on more GPUs might be ceding ground to a more nuanced, value-driven approach.

The market’s recent performance, with the Dow industrials jumping and the Nasdaq declining, served as Cramer’s empirical evidence for this rotation. He described this phenomenon as "the revenge of the nerds, people, with the nerds this time being reasonably priced stocks of companies that don't need trillions of dollars of data center spending to pan out and aren't usually found on the Nasdaq." This highlights a significant recalibration of market sentiment. Investors are seemingly seeking out companies with solid fundamentals, sustainable business models, and attractive valuations, rather than chasing the speculative highs often associated with cutting-edge tech. For AI startups, this means a heightened scrutiny on unit economics, profitability pathways, and market validation beyond just technological prowess.

Related Reading

- Bitcoin is the most interesting market trade apart from AI, says WSJ's Gregory Zuckerman

- Wells Fargo Strategist: AI's True Play Beyond Tech Giants

Cramer was quick to qualify that this shift does not signify a bearish outlook for the broader market. Quite the contrary, he argued that it demonstrates underlying strength. He asserted, "If this were a bad market, the weakness in the data center related plays would have sent everything down." The fact that capital is rotating into other sectors, rather than exiting the market entirely, indicates a healthy, adaptive financial landscape. "The fact that instead we had a rotation into lots of other groups shows you this market has tremendous strength." This is an important distinction for venture capitalists who might interpret a slowdown in AI infrastructure spending as a broader economic contraction. Instead, it suggests a maturation and diversification of investment opportunities.

For founders, this signals a need to articulate value propositions that resonate beyond the initial hype cycle of AI. The focus shifts from merely leveraging AI to demonstrating how AI enables efficiency, creates new markets, or solves long-standing problems in a cost-effective manner. VCs, in turn, may increasingly prioritize companies with clear paths to profitability and robust customer acquisition strategies over those primarily dependent on speculative future growth tied to ever-increasing data center buildouts. The market, as Cramer suggests, is evolving, and the next wave of winners may not be those simply riding the largest tech trends, but those demonstrating fundamental business strength in diverse sectors.