Google Finance is undergoing a significant transformation, integrating advanced AI capabilities that promise to redefine how users interact with financial markets. This strategic upgrade introduces Deep Search, prediction market data, and enhanced earnings features, aiming to democratize sophisticated financial research for a broader audience. The move positions Google Finance as a powerful, intelligent assistant for investors, from novices seeking clarity to seasoned analysts demanding deeper insights.

The flagship Deep Search feature, powered by Gemini models, represents a substantial leap in information retrieval and synthesis. According to the announcement, it executes hundreds of simultaneous searches, reasoning across disparate data points to produce comprehensive, fully cited responses within minutes. This capability moves beyond simple keyword matching, offering users a structured research plan and the ability to ask follow-up questions, effectively transforming complex inquiries into actionable insights. For Google AI Pro and AI Ultra subscribers, higher limits further amplify this research potential, creating a tiered access model that caters to varying levels of analytical demand.

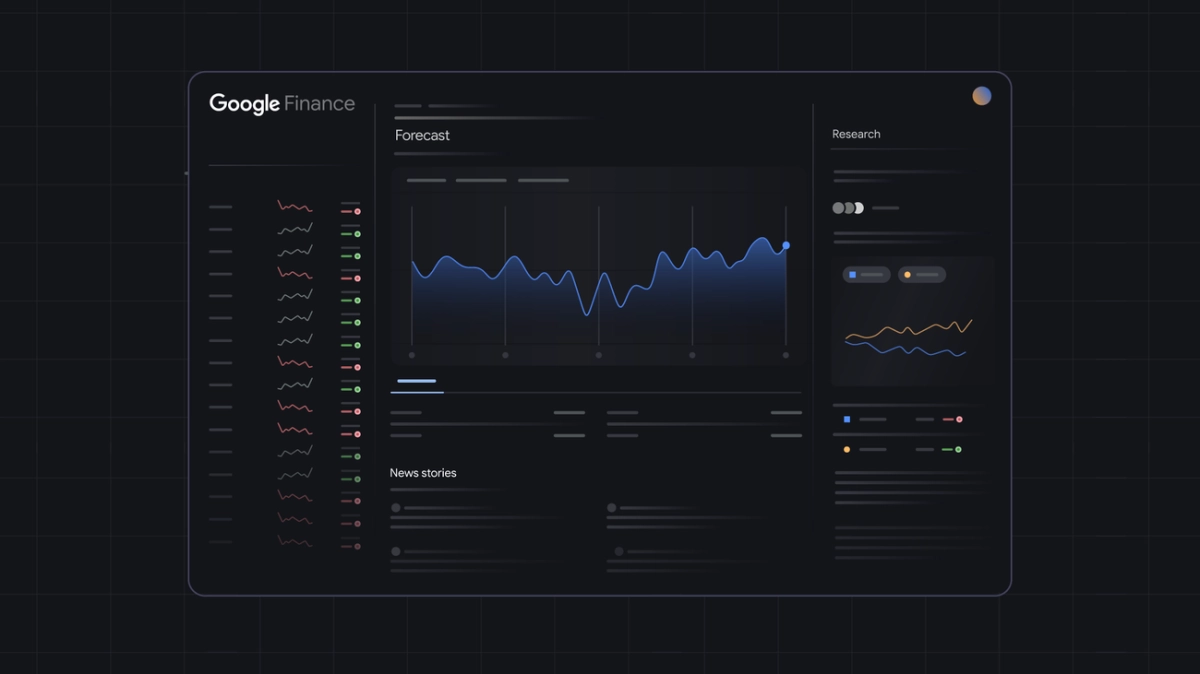

The integration of prediction market data from platforms like Kalshi and Polymarket introduces a novel dimension to market analysis, leveraging the "wisdom of the crowds." Users can now directly query future economic events, tapping into collective probabilities to gauge sentiment shifts and potential outcomes beyond traditional forecasts. Simultaneously, the revamped earnings experience provides critical real-time insights, including live audio streams with transcripts and AI-powered "At a glance" summaries that update before, during, and after calls. This holistic approach ensures investors remain fully informed and can react swiftly during crucial corporate reporting periods.

AI-Powered Insights Redefine User Engagement

These Google Finance AI features fundamentally alter the user experience, shifting from passive data consumption to interactive, intelligent analysis. The platform now acts as a proactive research assistant, capable of answering nuanced questions and providing immediate, context-rich insights derived from vast, real-time datasets. This level of AI integration sets a new standard for consumer-facing financial tools, potentially leveling the playing field for retail investors by granting them access to previously enterprise-grade analytical capabilities. The transparency of the research plan during Deep Search generation also builds crucial trust in AI-driven financial advice, a critical factor in adoption.

The strategic rollout of the new Google Finance in India, complete with English and Hindi language support, signals a clear intent for global expansion. While initial advanced features like Deep Search and prediction markets are US-first, their eventual broader availability will democratize sophisticated financial insights on an international scale. This move could significantly impact financial literacy and investment participation in emerging markets, fostering a more informed global investor base. Google's commitment to expanding these AI-powered tools suggests a long-term vision for making complex financial understanding universally accessible and actionable.

Ultimately, these Google Finance AI features represent more than just incremental updates; they signify a strategic pivot towards an AI-first financial platform. By combining powerful search, predictive analytics, and real-time corporate intelligence, Google Finance is poised to become an indispensable tool for navigating the complexities of the modern financial world. This evolution positions Google as a formidable innovator in the fintech landscape, pushing the boundaries of what personal finance platforms can achieve and setting new expectations for user-centric financial technology.