Google's Q3 2025 earnings reveal a pivotal moment, marking the company's first-ever $100 billion quarter. This significant financial milestone, doubling revenue in just five years, underscores the profound impact of artificial intelligence across Alphabet's diverse portfolio. CEO Sundar Pichai highlighted AI as the primary catalyst driving these unprecedented business results.

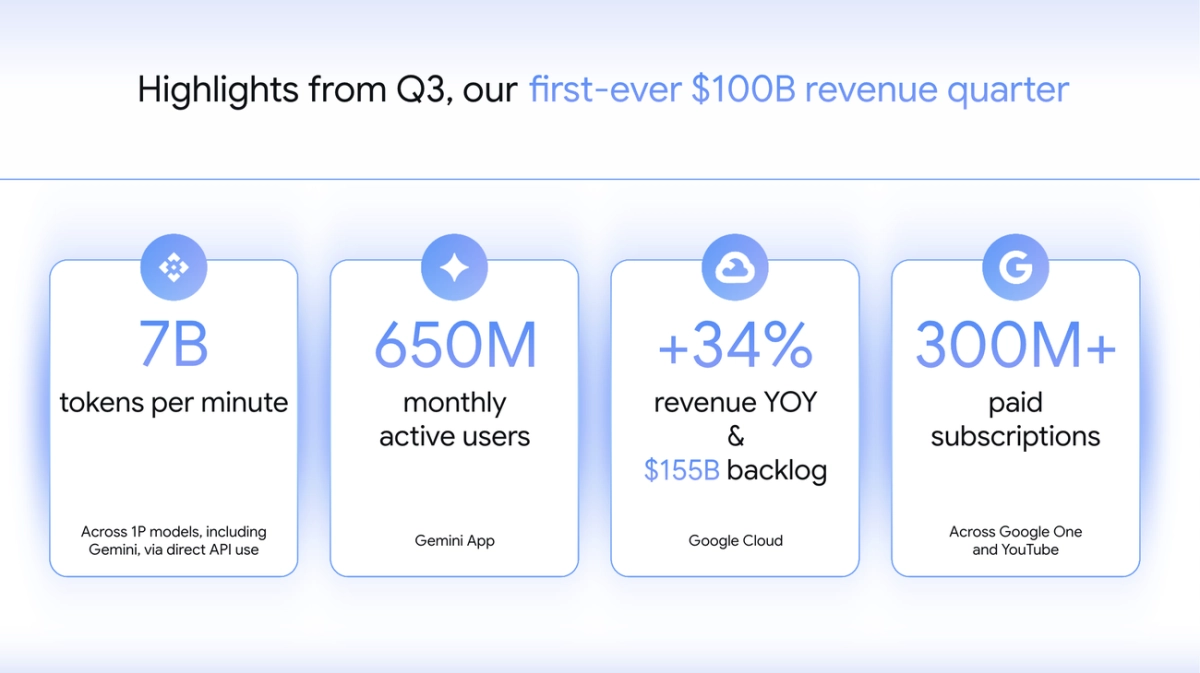

The earnings call painted a clear picture of AI's deep integration, extending beyond experimental features to core revenue drivers. Gemini, Google's flagship AI model, now processes an astounding 7 billion tokens per minute via direct API use, indicating robust enterprise adoption. The Gemini app itself has seen remarkable consumer engagement, tripling queries from Q2 and reaching over 650 million monthly active users. This dual-pronged approach, serving both developers and end-users, is critical for sustained Google AI revenue growth.

Google Cloud emerged as a standout performer, demonstrating accelerating growth with AI revenue as a key driver. The division's backlog swelled to $155 billion, a 46% quarter-over-quarter increase, fueled by a 34% rise in new GCP customers and a surge in multi-billion dollar deals. Crucially, over 70% of existing Cloud customers now leverage Google's AI products, with revenue from generative AI models alone soaring over 200% year-over-year. This illustrates a successful strategy of embedding AI deeply into enterprise solutions, attracting major clients and solidifying Google Cloud's position as a leader in the AI infrastructure race.

Google's Full-Stack AI Strategy Delivers

Google's "full-stack" AI approach, encompassing infrastructure, research, and product integration, is clearly paying dividends. The company's investment in advanced AI chips, including NVIDIA's A4X Max instances and its proprietary Ironwood TPUs, provides a critical competitive edge, attracting partners like Anthropic for massive TPU access. Beyond infrastructure, AI is reimagining core products; Chrome is evolving with Gemini and AI Mode in Search, while new Pixel devices and Android XR are built around the Tensor G5 chip, showcasing a commitment to pervasive AI experiences. The rapid global rollout of AI Mode in Search, now with 75 million daily active users and driving incremental query growth, confirms user appetite for these intelligent enhancements.

While AI is the central narrative, Google's diversified portfolio also contributed significantly. The company crossed 300 million paid subscriptions, led by Google One and YouTube Premium, demonstrating strong recurring revenue streams. YouTube itself is leveraging AI to enhance content creation and monetization, with Shorts now outperforming traditional in-stream ads in revenue per watch hour in the U.S. Even Waymo, Google's autonomous driving unit, is poised for significant expansion, with plans for new services in major global cities and new business models, indicating future growth vectors beyond the immediate AI services.

Google's Q3 2025 results are more than just impressive numbers; they signal a fundamental shift in how AI translates directly into market dominance and financial performance. The company's aggressive investment in AI infrastructure, research, and product integration has created a powerful flywheel effect, driving unprecedented Google AI revenue growth across its ecosystem. This quarter firmly establishes Google's leadership in the generative AI era, setting a high bar for competitors and promising continued innovation that will reshape both enterprise operations and consumer experiences. According to the announcement