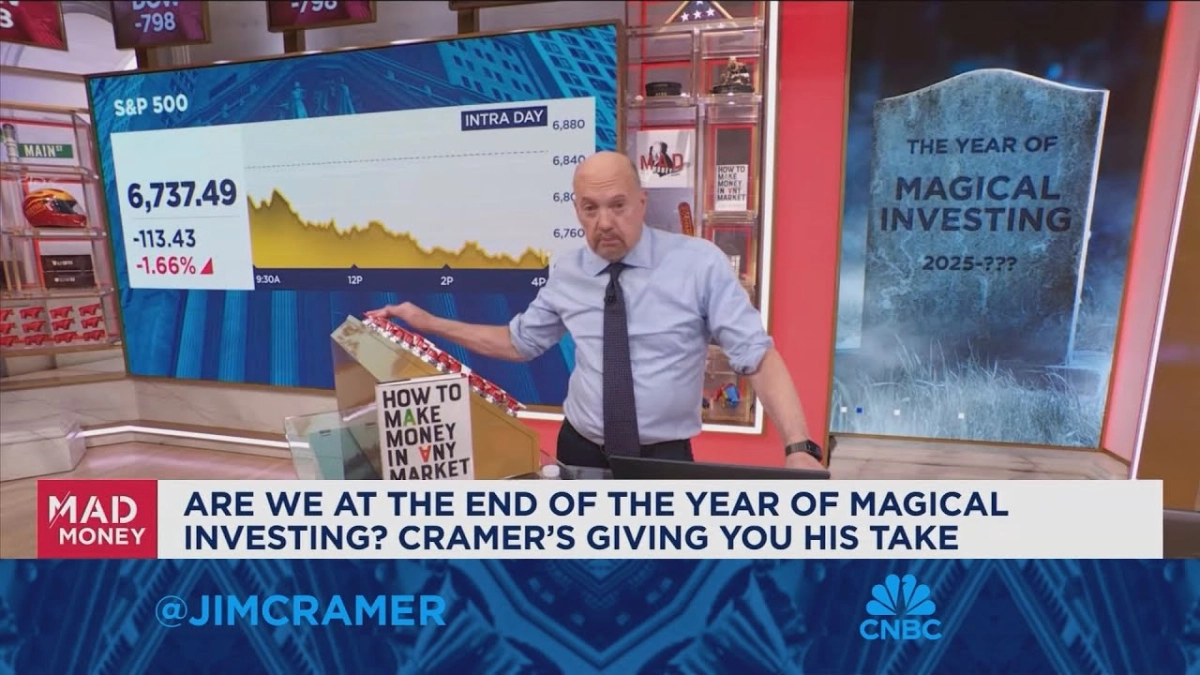

"I pulled the plug on the Year of Magical Investing. I pronounced it over. Dead." With this stark declaration, Jim Cramer, host of CNBC's Mad Money, signaled a significant shift in his outlook on the burgeoning artificial intelligence and data center sectors. Cramer spoke on Thursday's market sell-off, dissecting its implications for what he previously dubbed the "Year of Magical Investing" and drawing a sobering parallel to the dot-com bust of the early 2000s.

Cramer's commentary arrives amidst a tumultuous market day, which saw the Dow plummeting nearly 800 points, the S&P 500 down 1.66%, and the Nasdaq Composite plunging 2.29%. These figures, he noted, were anything but magical, particularly for technology stocks, with AI and data center names bearing the brunt of the decline. This market correction serves as a potent reminder that even in the most exciting technological revolutions, fundamental economic principles eventually reassert themselves.

For months, the AI boom has been characterized by an almost indiscriminate enthusiasm, where any venture even tangentially related to artificial intelligence or data infrastructure seemed destined for success. Cramer himself had previously championed this period, observing, "If you bought anything, anything at all that's involved in the data center, you made money." This sentiment, however, has evidently soured for the veteran market commentator, who now advises caution, especially regarding highly speculative plays. The recent market action suggests a widespread re-evaluation of risk, pushing capital away from unchecked growth narratives towards more tangible value.

Cramer’s newfound caution is rooted in his historical experience, particularly the dot-com bubble of 1999-2000. He recounted a personal anecdote from that era: "Back in 1999, I brought a company public that was losing tens of millions of dollars. It opened at $63... but before long it had fallen to two bucks." This vivid memory of unsustainable valuations and rapid collapses informs his current apprehension. He observed a similar pattern emerging in today's AI landscape, where companies with minimal revenue or clear paths to profitability are still attracting significant capital.

The central insight Cramer offers is the growing disparity between genuinely profitable AI companies and those that are merely riding the hype cycle. While he asserts, "I don't want to abandon the truly profitable companies involved in AI, my trust hasn't," he simultaneously warns that "I know a mania when I see one, and this one feels like it's starting to unwind." This distinction is crucial for founders, venture capitalists, and institutional investors navigating the current environment. The market is increasingly demanding substance over pure speculation, shifting its focus from future potential to present-day financial health and a clear business model.

Related Reading

- There are plenty of other places to hunt for winners rather than the data center, says Jim Cramer

- Cisco CEO on latest quarter: AI demand from hyperscalers is accelerating

- Bitcoin is the most interesting market trade apart from AI, says WSJ's Gregory Zuckerman

This recalibration implies that the era of easy money for all things AI may be drawing to a close. The market is becoming more discerning, penalizing companies that rely solely on buzzwords and aspirational roadmaps without concrete revenue or a clear path to profitability. The move by investors "to the sidelines or headed to high growth away from tech" indicates a broader search for stability and proven earnings, even as the underlying technological advancements of AI continue at a rapid pace. This is not a rejection of AI itself, but a rejection of speculative valuations built on thin air.

For the startup ecosystem, this means a heightened scrutiny on unit economics, sustainable growth, and verifiable traction. VCs will likely pivot towards companies demonstrating strong product-market fit, defensible moats, and disciplined capital allocation, rather than simply chasing the next big idea. The days of endless secondary offerings and insider selling while external capital flows in may be numbered. The market, in Cramer's view, has become "so obvious" in its signs of excess, mirroring the patterns he witnessed over two decades ago.