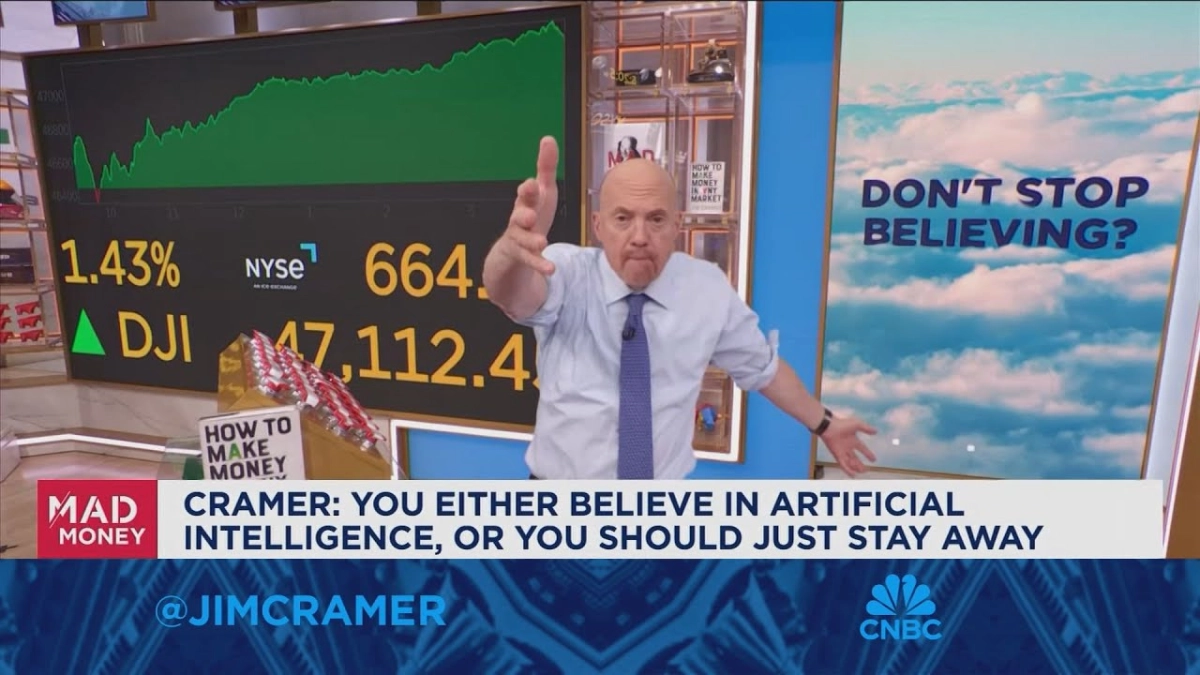

In the volatile landscape of modern finance, Jim Cramer, host of CNBC's Mad Money, offers an uncompromising ultimatum to investors eyeing the artificial intelligence boom: "You either believe in artificial intelligence, or you should just stay away." His recent commentary dissects the psychological barriers that prevent many from capitalizing on what he sees as an undeniable technological revolution, delivering a stark message about the conviction required to navigate this transformative sector.

Cramer's monologue on Mad Money addressed the current state of the AI trade, emphasizing a binary choice for investors: full commitment or complete abstention. He argues that half-hearted engagement, driven by fear or skepticism, is a losing proposition in a market defined by rapid innovation and significant upside. For founders, venture capitalists, and AI professionals, this isn't merely stock-picking advice; it's a commentary on the prevailing sentiment and the strategic imperative of belief in the underlying technology.

Cramer posits that a "zero-sum investing logic" has historically "kept people from making millions upon millions of dollars because they live in fear." This fear, he suggests, blinds investors to the profound shifts occurring, leading them to miss out on substantial gains. He contrasts this with the bold, trust-based approach necessary to reap rewards from the current AI cycle, pushing back against the notion that all investments are inherently risky in a way that necessitates constant hedging.

The essence of his argument hinges on trust. He champions a philosophy where investors must implicitly trust the companies they back, particularly those at the forefront of AI innovation. This isn't just about market timing; it's about a deeper conviction in the leadership, technology, and long-term vision of these enterprises. "You should never buy anything if you don't trust enough to buy more on weakness," Cramer declares, adding that "Trust is how you benefit from stocks these days." This perspective resonates deeply within the startup ecosystem, where investor confidence in a founder's vision and team is often the bedrock of early-stage funding.

He challenges the notion that investors must obsess over every market fluctuation, instead advocating for a steadfast belief in the AI narrative. For those building or funding AI solutions, this implies that the market is currently rewarding genuine innovation and strong execution, rather than fleeting trends. The companies that are truly driving the AI revolution are not merely speculative plays; they are foundational shifts.

Cramer points to the "Magnificent Seven" as prime examples of this principle in action. These tech giants, heavily invested in AI, embody the success that comes from relentless innovation and consistent performance. "Everyone who's in the Magnificent Seven should recognize that they didn't become magnificent by missing quarters and screwing up," he explains. "They didn't rise to these lofty levels by being fooled by other companies or being duped or dropped as vendors because they're second-rate." This highlights that the market leaders in AI are there for a reason: their ability to execute, adapt, and continually deliver value.

Related Reading

- Gemini's Ascent: Google's Existential Challenge to OpenAI

- Google's AI Surge Reshapes Hyperscaler Battle, Challenges Nvidia Narrative

- Venture's Dual Reality: Carnage and Value in the AI Wave

His commentary implies that the current AI landscape is not for the faint of heart or the perpetually cautious. It demands a clear stance. Those who hesitate, or who view AI merely as another speculative bubble, risk being left behind as the technology continues its exponential growth trajectory. The opportunity, Cramer suggests, is for those who align their capital with profound technological conviction.

The choice, according to Cramer, is stark: embrace the future AI offers, or retreat to more traditional, potentially lower-growth avenues. He dismisses the idea of dabbling, instead advocating for a full-throttle commitment to the companies and technologies poised to redefine industries. This isn't about avoiding risk entirely, but about understanding where the significant long-term value is being created and having the confidence to invest accordingly.