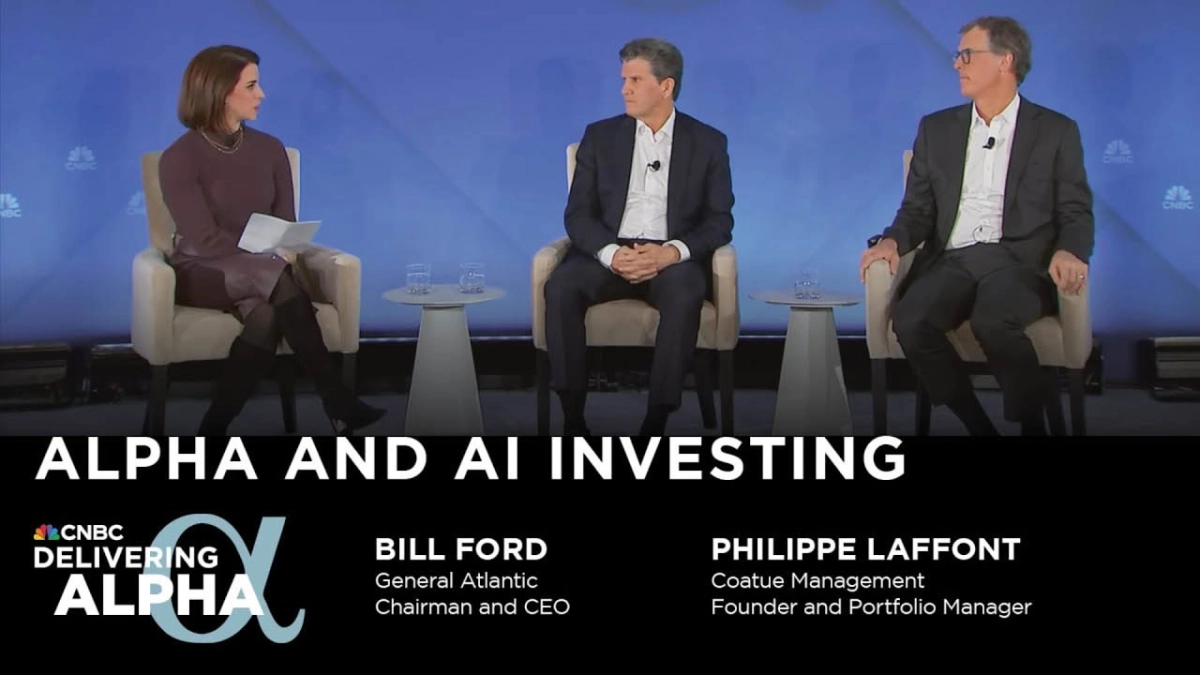

Artificial intelligence is not a bubble, but rather a "very real tech cycle" akin to the PC, internet, mobile, and cloud revolutions, asserts Bill Ford, Chairman and CEO of General Atlantic. This perspective, shared during a CNBC Delivering Alpha interview alongside Philippe Laffont, Founder and Portfolio Manager of Coatue Management, and moderated by Leslie Picker, highlighted the transformative power of AI while acknowledging potential "moments of overvaluation" and "misallocation of capital." The discussion delved into the profound societal shifts AI promises, the evolving investment landscape, and the global race for innovation.

The conversation at the CNBC Delivering Alpha event centered on the monumental wave of artificial intelligence and its implications for investment strategies, economic structures, and global power dynamics. Both seasoned investors offered sharp analysis on the immediate opportunities and long-term challenges presented by this technological leap.

Laffont, while agreeing with the "super cycle" assessment, articulated a more cautious long-term view, expressing concern that if AI becomes "so successful, you could imagine the economy growing very fast, but a lot of job destruction along the way." This profound shift, he posited, goes to the heart of replacing human labor in both white-collar and blue-collar roles, citing examples like robotic surgery. The world will look "very different" in five, ten, or fifteen years.

A key distinction between this AI cycle and previous tech revolutions, according to Ford, is the significant advantage held by incumbents. "In this cycle, the incumbents have an edge," he stated, attributing this to the capital, engineering, and data intensity required to build foundational large language models (LLMs) and intelligence-on-demand capabilities. While new entrants like OpenAI and Anthropic will emerge, the established tech giants possess the existing assets to lead this charge.

Laffont echoed this sentiment, suggesting that the changes brought by AI would be "dramatic," far exceeding the incremental shifts of past cycles. He envisions a future where robots, currently reliant on human joysticks, will learn from every surgery ever performed, potentially eliminating the need for a human surgeon. This democratization of advanced procedures could drastically reduce costs and expand access globally, particularly in healthcare and education—two sectors that saw less disruption in prior tech cycles. Ford agreed, emphasizing that AI would transform these industries by enhancing productivity and intelligence, from doctors to teachers.

The discussion also touched on the dynamics of public versus private markets in the context of AI investment. Ford noted that his firm, General Atlantic, primarily focuses on private markets, but understanding the public market is crucial. Laffont, whose firm invests in both, views the IPO market as "totally broken," citing the dramatic decrease in new public offerings compared to decades past. He argued that this trend is unfair to retail investors, who are largely excluded from the early growth stages of innovative companies that now stay private for longer, often reaching multi-billion dollar valuations before public listing.

However, Laffont predicted that the rise of tokenization could eventually fix this imbalance. By tokenizing private assets, companies could effectively become "public," allowing for broader access and trading. He foresaw a future where "all assets are going to be public and tradable," driven by competition rather than regulation, potentially creating a battle between companies choosing to tokenize and those preferring traditional private structures.

Related Reading

- Reflexivity AI Accelerates Investment Insights for Institutions

- Infrastructure Investor Sadek Wahba Navigates AI Boom with Caution, Not Abstinence

- Top investors gauge AI opportunity: Here's what to know

On the international front, both investors recognized the United States as the dominant force in AI innovation, possessing the engineers, companies, and capital to lead. Laffont confidently stated, "the US is the greatest country and the greatest place to live, and even more so with AI." He highlighted the concentration of talent and groundbreaking AI companies in the US.

While acknowledging China's significant potential due to its vast pool of STEM talent, large domestic market, and strong players like Alibaba, Tencent, and ByteDance, Laffont expressed caution regarding direct private investment. He preferred public market exposure in China, citing geopolitical complexities and the need to respect the US government's rules and regulations. Ford shared this view, confirming that China remains a "strong innovation economy" with leaders in areas like robotics and industrial automation, making the global AI landscape a "two-horse race" between the US and China.