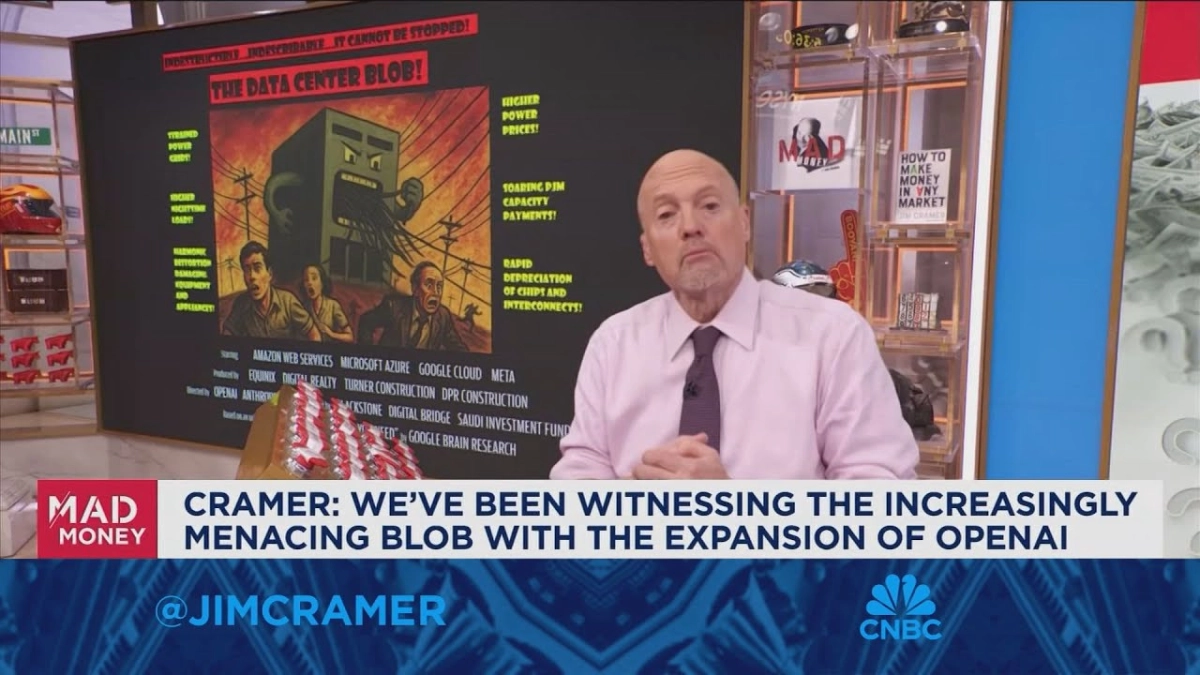

“We’ve been witnessing the increasingly menacing blob, with the expansion of OpenAI,” declared Jim Cramer, host of CNBC’s *Mad Money*, capturing the palpable anxiety permeating Wall Street. His commentary underscored a market grappling with unprecedented challenges, from a protracted government shutdown to the dizzying, and potentially precarious, build-out of artificial intelligence infrastructure. This confluence of factors, Cramer argued, has shifted the investment landscape from one of "magical investing" to a harsh reality dominated by negative headlines and a freezing of rational decision-making.

Cramer’s recent segment on *Mad Money* delved into the forces driving current market selling, highlighting a surprising shift in how Wall Street perceives government shutdowns and the burgeoning AI industry. He spoke candidly about the lack of reliable economic data due to the government's prolonged closure, coupled with unsettling trends in the job market and the colossal financial commitments underpinning the AI revolution.

The government shutdown, a recurring theme in U.S. politics, has traditionally been shrugged off by investors. However, this time, Cramer noted a stark difference. “We’ve been very dismissive of this government shutdown on Wall Street… they usually mean nothing to the stock market,” he observed. “Well, it turns out this one is different.” The prolonged closure has starved the market of crucial economic data, leaving investors flying blind. “Nobody knows what the heck is really happening,” Cramer lamented, emphasizing how this vacuum of information breeds uncertainty and paralyzes investment decisions.

This lack of transparency freezes decision-making, compelling investors to act on incomplete, often negative, information.

Further compounding the market’s unease is the unsettling trend in employment. Cramer cited the Challenger, Gray & Christmas report, which revealed that job cuts in October surpassed one million, marking the highest monthly total since 2003. Significantly, companies explicitly attributed these reductions to "cost-cutting, AI in October." This stark data, combined with the "hideous charts" of major payroll processors like ADP, Paychex, and Paycom, paints a grim picture of a contracting job market. “Who the heck wants to hire people in this environment? Certainly not me,” Cramer quipped, underscoring the widespread reluctance to expand payrolls. He asserted that these payroll processor charts "tell the entire story of this economy, better than any numbers that come out of Commerce or Labor."

The specter of AI-driven job displacement intertwines with the "data center blob," a term coined by Michael Cembalest of J.P. Morgan Asset Management. This "blob" represents the massive, capital-intensive expansion of data centers required to power the AI boom. Cramer highlighted OpenAI's aggressive commitment to building "hundreds of billions of dollars of data centers," with Oracle as a key partner. The sheer scale of this undertaking has raised eyebrows, particularly given Oracle's already substantial $18 billion debt to finance its contribution. Wall Street, Cramer noted, is concerned about the financial implications of such colossal borrowing.

A pivotal moment that further "sobered" the market, according to Cramer, was a comment made by OpenAI's CFO, Sarah Friar. She casually mentioned the possibility of a government "backstop" if needed for the company's data center build-out. While Friar quickly clarified that OpenAI was not actively seeking a bailout, the remark sent ripples of concern through the investment community. "It doesn't matter," Cramer stated, "her reputation is so pristine that it's hard to walk back the term backstop." The comment, however unintentional, inadvertently highlighted the immense, almost existential, financial demands of the AI build-out and raised questions about its long-term sustainability without external support. The implication that an entity as prominent as OpenAI might even *consider* government intervention for its infrastructure projects underscores the unprecedented scale and potential fragility of this technological leap.

Related Reading

- OpenAI's Trillion-Dollar Bet on AI Dominance

- OpenAI’s IPO Horizon: A Strategic Pause in the AI Race

- AI upside remains missing in latest earnings spate

This cocktail of uncertainty and massive, potentially under-secured, investment is defacing even the most robust tech stocks. Cramer pointed to Palantir and Nvidia, companies that have been "the faces of this bull market." Despite Palantir reporting a "picture-perfect quarter," its stock dipped. Similarly, Nvidia, a leader in AI semiconductors, faced a setback when the White House blocked its most sophisticated chip sales to China. These actions, combined with the market’s negative reaction to strong earnings from companies like Robinhood and DoorDash, signal a profound shift. "It's like a switch has been flipped," Cramer explained. "If a stock's highly valued... there's nothing it can do to satisfy Wall Street right now."

In summary, the market finds itself in a precarious position. The traditional economy is being "crushed by the government shutdown" and concerns about AI's impact on jobs and energy prices. The burgeoning data center economy, while promising, exhibits signs of needing government assistance, which may or may not materialize. Meanwhile, the speculative, high-flying stocks that once defined the market's "magical investing" era are rapidly descending. As Cramer concluded, "What matters is we need the darn government to go back to work, and we need the data center blob to be cordoned off from the rest of the economy... Until then, we are indeed at the mercy of the headlines, and lately, the darn negative headlines are the only ones that anyone's paying attention to."