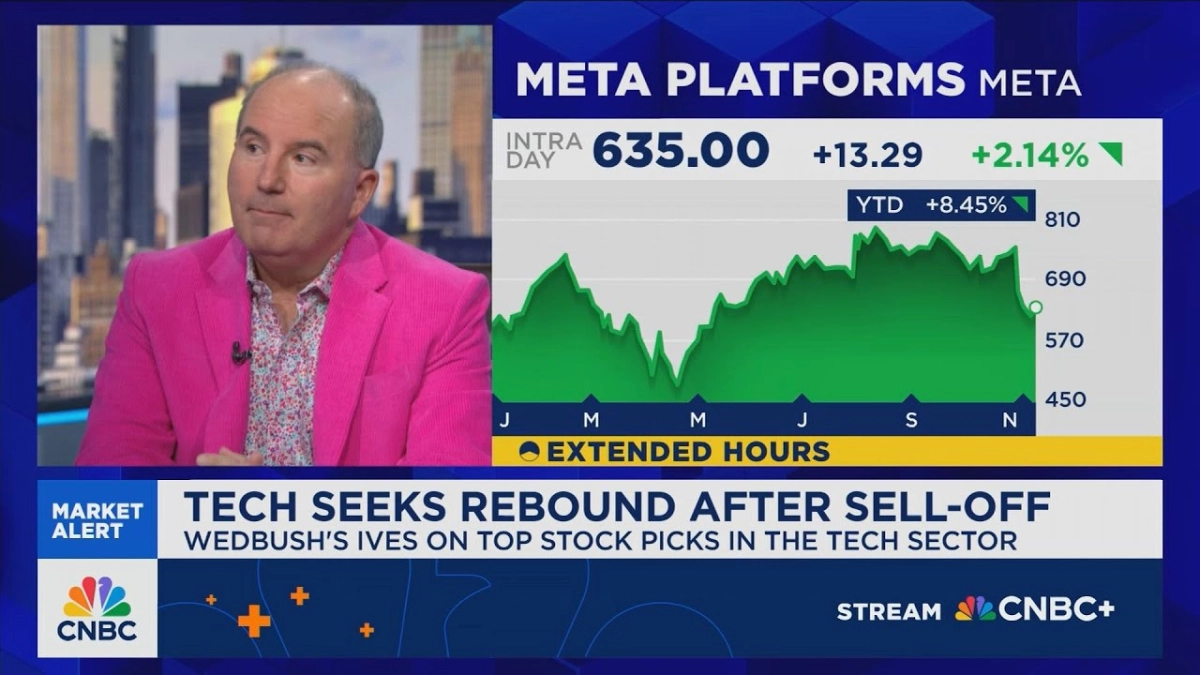

Dan Ives, Global Head of Technology Research at Wedbush Securities, recently engaged in a lively discussion on CNBC’s “Market Alert,” articulating a profoundly bullish stance on the tech sector, particularly those companies at the vanguard of artificial intelligence. His commentary arrived amidst a volatile period for tech stocks, yet Ives remained steadfast in his conviction, framing the current moment not as a fleeting bubble, but as the nascent stages of a monumental economic transformation. For founders, venture capitalists, and AI professionals, Ives's perspective offers a compelling narrative of sustained growth driven by unprecedented technological shifts.

Ives posits that the AI revolution is nothing less than "the fourth industrial revolution," a claim that underscores the magnitude of his optimism. He argues that this transformative era will unleash a multi-year bull run, spearheaded by key infrastructure providers like Nvidia and critical cybersecurity firms. His confidence is rooted in a fundamental belief that the market is still underestimating the sheer scale of investment and innovation poised to flow into AI over the coming years.

Addressing the interviewer's pointed questions regarding elevated valuations for companies like Zscaler, Palantir, and CrowdStrike—some trading at forward P/E ratios exceeding 80x or even 200x—Ives dismissed short-term metrics as insufficient for grasping the long-term potential. "If you look just at one year valuation or two year valuation, you miss every transformational tech stock the last 20 years," he asserted. His perspective demands a broader lens, urging investors to look beyond immediate earnings multiples to the profound, foundational changes AI is enacting across industries.

The core of Ives’s argument lies in the projected capital expenditure. He predicts an astonishing "three to four trillion that's going to be spent" on AI over the next three to four years, an amount he believes will surpass the total investment in tech over the past decade or more. This influx of capital, he contends, will fuel an expansive growth cycle, justifying current high valuations and propelling leading players to unprecedented market caps. Nvidia, the "Godfather of AI," remains central to this thesis, with Ives noting a persistent "10 to 1 demand to supply" ratio for its essential chips, highlighting the bottleneck and the immense value it commands.

Cybersecurity firms, often seen as a defensive play, are positioned by Ives as direct beneficiaries of this AI surge. As AI adoption scales, the attack surface for cyber threats expands exponentially, making robust security solutions indispensable. Companies like Zscaler and CrowdStrike, with their "zero trust" models and expanding solution sets, are not merely responding to threats but are integral to enabling secure AI deployment. Their innovative platforms are critical infrastructure for the AI economy.

Ives argues that the market is "underestimating the second, third, fourth derivatives" of AI's impact. This means not just the direct AI companies, but those that enable, secure, and integrate AI into broader enterprise solutions. The burgeoning need for AI-driven security, for instance, represents a massive and growing market opportunity. These companies are in the "sweet spot," ready to capitalize on the increasing complexity and scale of AI operations.

Related Reading

- Google's Ironwood Chip Reshapes the AI Hardware Battle

- Fed Flags AI Valuation Risk to Economy, Warns of Algorithmic Manipulation

- OpenAI's Trillion-Dollar Ambition Meets Wall Street Skepticism

Despite recent market jitters and a tech sell-off, Ives maintains that the underlying strength of the AI narrative remains intact. He views recent pullbacks as temporary noise in a much larger, enduring bull market. He even used a memorable metaphor to describe the current state of affairs: "In the AI party, it started at 9 PM, it's now 10:30 PM, and the party goes to 4 AM." This conveys his belief that the AI boom is still in its early-to-mid stages, with significant growth runway ahead.

The current environment, therefore, represents a pivotal juncture for strategic investment. For tech leaders and investors, the imperative is to identify and back the companies building the foundational layers, the enabling technologies, and the essential security infrastructure that will underpin this multi-trillion dollar revolution. The market may experience short-term fluctuations, but the long-term trajectory, according to Ives, is undeniably upward, driven by the profound and pervasive integration of artificial intelligence across the global economy.