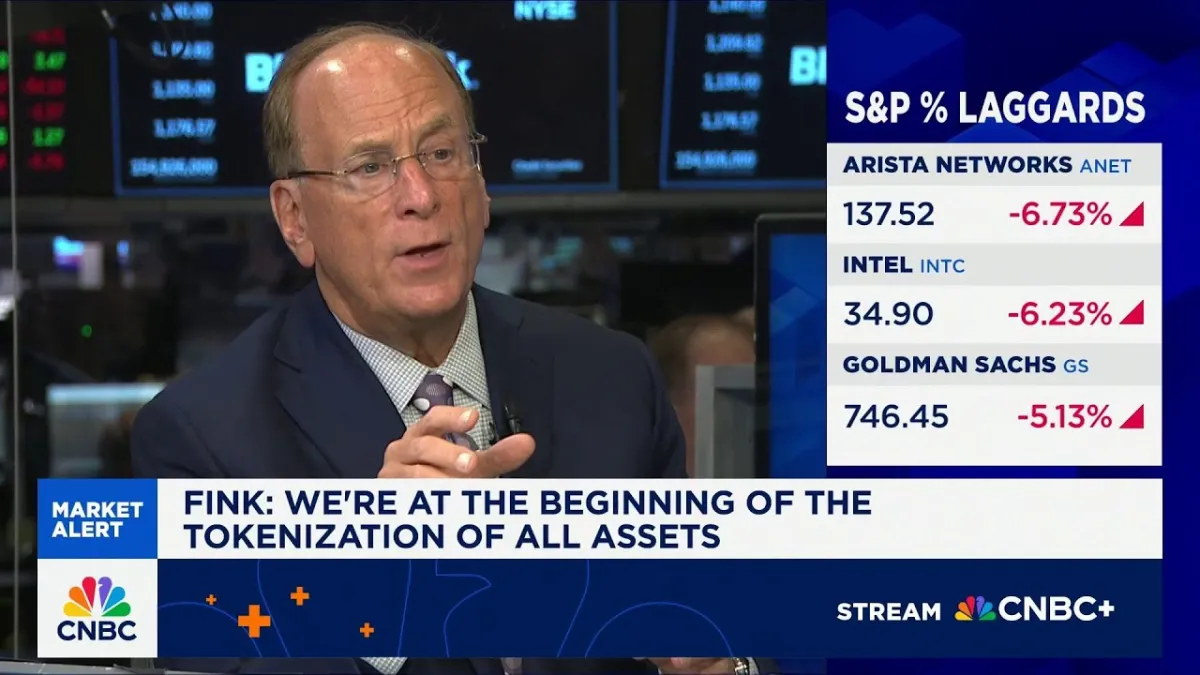

Larry Fink, Chairman and CEO of BlackRock, declared that the massive capital flowing into artificial intelligence is not merely an investment bubble, but a strategic necessity for the United States to maintain its global leadership. Speaking on CNBC's "Squawk on the Street" with Jon Fortt and Jim Cramer, Fink offered a profound perspective on the burgeoning AI landscape, linking it directly to national competitiveness and long-term economic stability. His commentary moved beyond the immediate market euphoria, framing AI as an existential infrastructure project requiring unprecedented investment across various sectors.

The discussion, prompted by questions regarding the "skyrocketing capital" being committed to AI, particularly by entities like OpenAI, quickly pivoted from a purely financial analysis to a geopolitical one. Fink acknowledged the immense scale of investment, noting, "There is certainly a skyrocketing amount of capital that's being put to work." However, he firmly rejected the notion of an AI bubble in the traditional sense, asserting that this influx of capital is largely well-spent and fundamental to the nation's future.

Fink underscored that the scope of AI investment extends far beyond the highly publicized advancements in generative models or the production of GPUs and chips. He articulated a broader, more foundational view, explaining, "Investing in AI does not just mean investing in GPUs and chips. It means investing in H-VAC, and investing in power grids and power supplies." This insight highlights that the true infrastructure for an AI-driven future involves a complete overhaul and expansion of existing physical systems. Data centers, cooling systems, and robust energy grids are not ancillary but integral components, demanding trillions in new capital expenditure. This comprehensive approach signifies a shift from viewing AI as a software phenomenon to recognizing it as a critical national infrastructure project.

The BlackRock CEO emphasized that this extensive investment is pivotal for the United States to achieve a sustained economic growth rate of 3% annually, which he deems essential to manage the nation's escalating deficits. He cautioned, "If we do not grow our economy by 3% a year over the next 10 years, our deficits are going to overwhelm this economy." Fink believes that unlocking private capital and directing it towards these transformative AI-related build-outs is the key to stimulating such growth. He stated, "We need to be focusing on how do we unlock this capital, we need to focus on how to build this out, this is why I love this AI build-out, why I believe we need to be building out our grids, building all this out. This is the type of stuff that could power a 3% economy." This perspective suggests that AI, far from being a speculative venture, holds the potential to be a powerful engine for national economic resurgence, addressing fundamental fiscal challenges through innovation and productivity gains.

While acknowledging that some failures are inevitable in such a dynamic and high-stakes environment – "We're going to have some big winners and we're going to have some big losers" – Fink maintains a constructive outlook. He pointed to the strong position of hyperscalers like Meta, Alphabet, and Microsoft, and the transformative efforts of companies such as Oracle and Broadcom, as indicators of robust, well-directed investment. These established players are not just dabbling in AI; they are fundamentally reorienting their strategies and investing heavily in the underlying infrastructure, from cloud computing to specialized hardware.

Related Reading

- The AI Bubble: A Dot-Com Analogy with Broader Implications

- The AI Economy: Bubble or Breakthrough Demand?

- Former Intel CEO Declares "Of Course" We're In An AI Bubble

Fink expressed a clear sense of national pride and urgency regarding the US leadership in AI. He stated unequivocally, "We, as a country, need these investments if we're going to be the leader in AI technology." This commitment to being first is not just about technological supremacy but about maintaining geopolitical influence and economic advantage. He highlighted that the US is unique in its current level of capital expenditure on technology compared to Europe and other regions, a factor he views as a strong indicator of future success.

The conversation illuminated a critical distinction: the current wave of capital expenditure often attributed solely to AI is, in many instances, still foundational cloud infrastructure. This suggests that the direct AI investment phase, particularly in novel applications and specialized hardware, is still in its early stages, implying even greater future capital requirements. Fink's analysis provides a sobering yet optimistic view, recognizing the inherent risks of a rapidly evolving technological frontier but emphasizing the imperative for aggressive, strategic investment. His perspective challenges founders and VCs to think broadly about the ecosystem required to support AI, from chips to power grids, and to consider the long-term national implications of their investment decisions. The future of the American economy, and its global standing, hinges on this massive, sustained commitment to the AI revolution.