Uzbekistan's first unicorn, Uzum, closed a new funding round, raising $65.5 million. China's Tencent and New York- and London-based VR Capital co-led this significant Uzum funding round. U.S.-based FinSight Capital also participated.

This all-equity investment boosts the Tashkent-headquartered startup's post-money valuation to approximately $1.5 billion. Consequently, this represents a nearly 30% increase from its $1.16 billion valuation achieved in March last year.

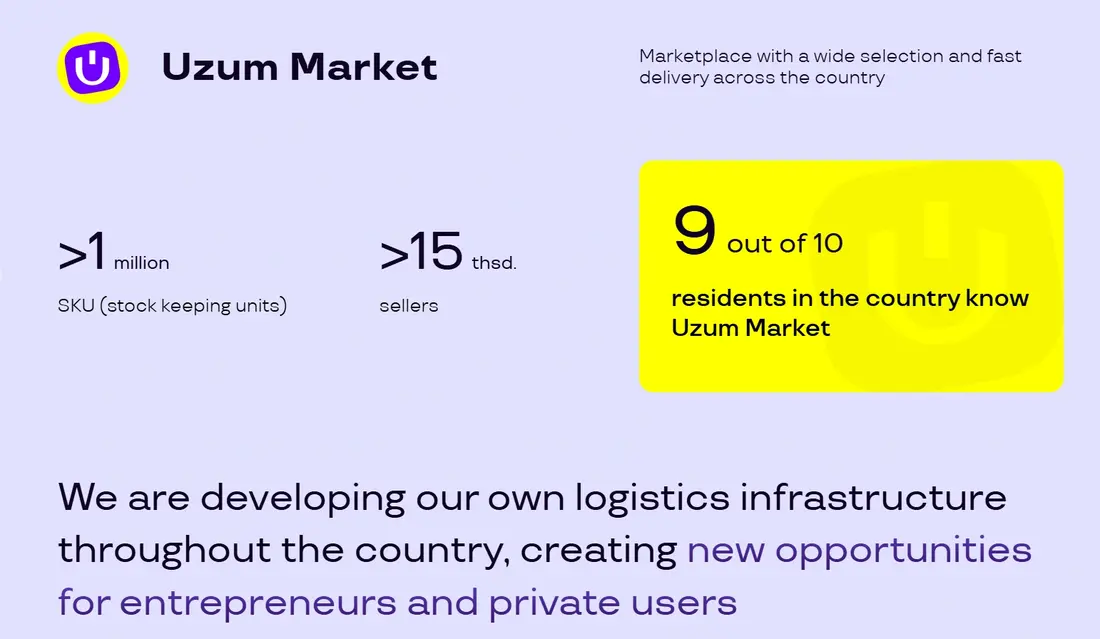

Founded in 2022, Uzum began with its e-commerce marketplace, Uzum Market. Subsequently, the company expanded into fintech services, including a debit card, and launched its express food delivery service, Uzum Tezkor.

Uzum currently serves over 17 million monthly active users and 16,000 merchants. Its digital banking arm, Uzum Bank, introduced a co-branded Visa debit card with pre-approved credit limits.

The Visa card product has issued 2 million cards and targets 5 million by year-end. Meanwhile, Uzum's unsecured lending business reached $200 million in financed volume in Q1, growing 3.4 times year-over-year.

The startup recorded $250 million in gross merchandise value during the first half of 2025. Furthermore, Uzum posted $150 million in net income in 2024, marking a 50% year-over-year jump.

Uzum's Rapid Expansion and Future Plans

Uzum built its digital and physical infrastructure from the ground up. Its logistics capacity now exceeds 112,000 square meters, processing over 200,000 orders daily.

The company established over 1,500 pickup points across 450 cities and villages. These points enable next-day deliveries and facilitate Uzum Bank card distribution, similar to networks used by Jumia or MercadoLibre.

Uzum plans to introduce a deposit product in September. It will also launch a long-term credit facility for B2C customers.

The company intends to expand its merchant base and QR code payment processing system. Additionally, it will open its e-commerce marketplace to international merchants, starting with China and Turkey in September.

Uzum aims to scale its financial infrastructure further, embedding AI across credit scoring and fraud protection. This strategic Uzum funding round supports these ambitious growth initiatives.

The startup plans a Series B round of $250-$300 million in the first half of 2026. Uzum has raised $137 million in total equity to date, positioning it as a key player in digital banking in the region, alongside companies like Sea Limited.