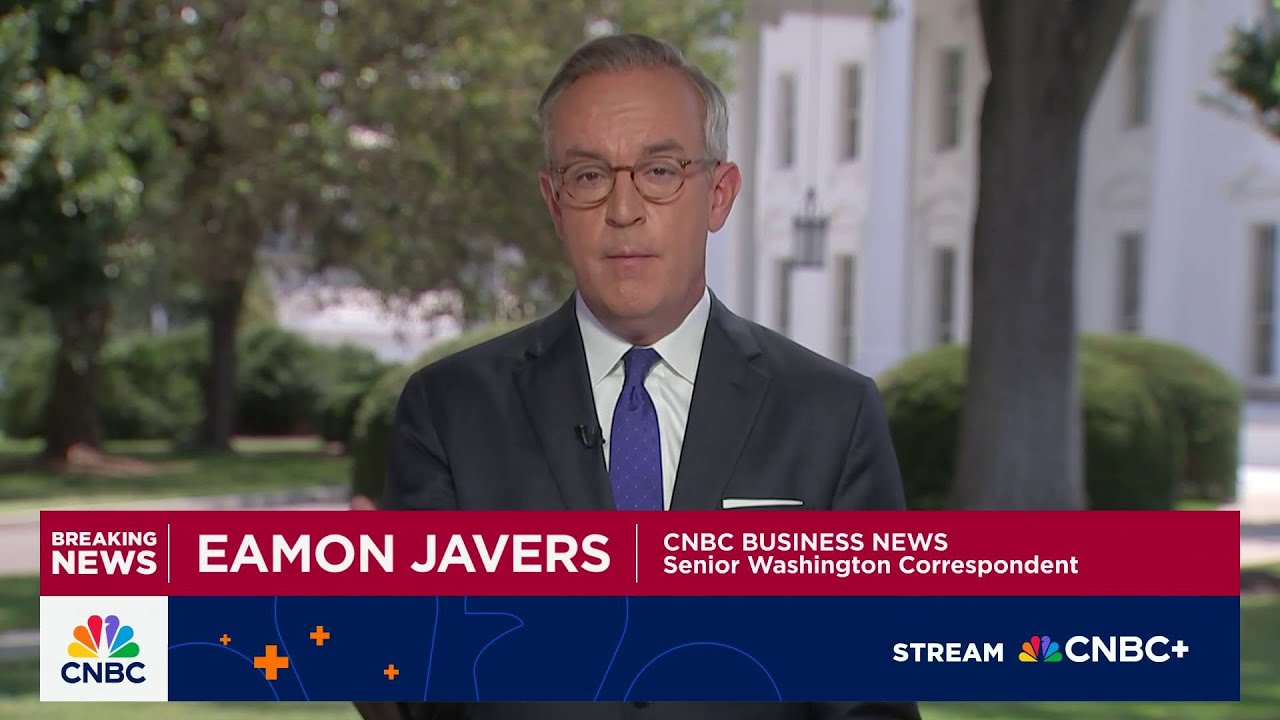

The unprecedented demand by the U.S. government for a percentage of AI chip sales in China from American tech giants like Nvidia and AMD signals a profound shift in export control policy, transforming it into a transactional revenue-sharing model. This development, discussed on CNBC's Halftime Report by host Scott Wapner and Senior Washington Correspondent Eamon Javers, highlights a new, uncharted territory in international trade and technological competition.

Eamon Javers spoke with Scott Wapner on CNBC’s Halftime Report, discussing the latest trade negotiation headlines from a morning press conference involving former President Trump. The central revelation was that Nvidia and AMD would be required to pay the U.S. government 15% of their AI chip sales in China to secure export licenses. This effectively introduces a novel "tax of sorts" on American companies seeking to engage in this critical market.

The genesis of this arrangement, as recounted by Javers, emerged from a meeting between President Trump and Jensen Huang, CEO of Nvidia, at the White House. Trump initially sought 20% of the revenue, stating, "If I'm going to do this for you, I need 20%." The negotiation ultimately settled at 15%, marking a direct financial imposition by the government on corporate foreign sales. This transactional approach deviates significantly from traditional regulatory frameworks, where export controls typically involve outright prohibitions or strict licensing criteria without direct revenue kickbacks to the treasury.

President Trump further elucidated the rationale behind distinguishing between different generations of AI chips. He described the Nvidia H20 chip, which is part of this deal, as "an old chip" that China already possesses in various forms. However, he drew a clear line at Nvidia's "super-duper advanced" Blackwell chip, stating, "I wouldn't make a deal with that." This suggests a strategic intent to protect cutting-edge U.S. AI technology from reaching foreign adversaries, even if it means foregoing potential revenue.

The broader implications of this "pay-to-play" model are a significant concern for industry analysts. Stacy Rasgon, a semiconductor analyst at Bernstein, articulated this unease, stating, "...we aren't sure we like the precedent this sets (will it stop with Chinese AI? Will it stop with controlled products? Will other companies be required to pay to sell into the region? It feels like a slippery slope to us...)." This sentiment underscores the potential for this transactional framework to expand beyond AI chips, impacting a wider array of controlled technologies and setting a potentially disruptive global trade precedent.

The President's self-perception as a "dealmaker" appears to be the driving force behind this policy. His administration views these arrangements as a means to secure a "return for the taxpayers," whether through direct financial payments or even equity stakes in companies. This approach was further underscored by the news of Intel's CEO visiting the White House, a meeting that follows previous contentious remarks from the President regarding Intel. This new transactional approach to export licensing signals a departure from established norms, introducing a direct financial cost for companies seeking to operate in critical overseas markets.