Fintech unicorn Tipalti, globally recognized for its payables automation platform, has announced a $150 million credit financing round from JPMorgan Chase Bank and Hercules Capital, Inc. (NYSE: HTGC). This funding comes on the heels of a $270 million Series F round in 2021 that brought Tipalti's total funding to over $550 million and valued at $8.3 billion.

The company reported that transactions rose by 50% in 2022 to a total annualized payments volume of $43 billion. The company previously reported the year's growth rate higher at 120% year over year reaching $30 billion at the time of the Series F. At a similar rate, Tipalti now serves more than 3,000 mid-market customers worldwide, representing a 50% increase in the customer base in less than two years when it crossed the 2,000 customer mark. At the time of its Series E fundraise (three years ago), Tipalti reported transaction volume at $12 billion, up 80% from the year prior, with nearly 1,000 customers.

The company's last mega-round was tied to favorable market multiples and competitor performance, like Bill.com's (BILL) ascent post-IPO in 2019, according to commentary from CEO and co-founder, Chen Amit. Bill.com currently trades at $97, down nearly 70% from highs at the turn of 2022.

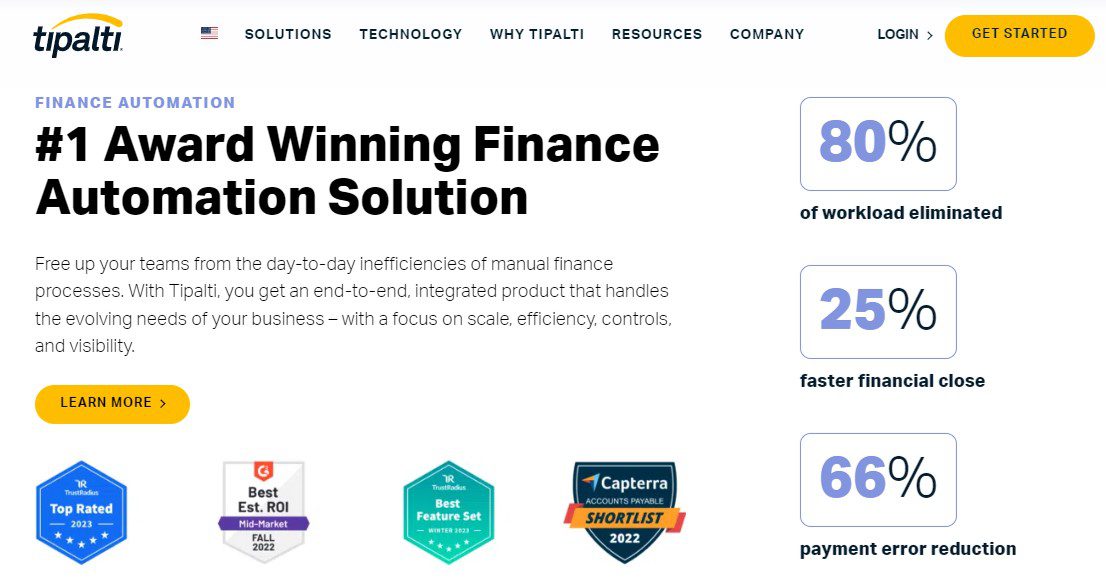

Tipalti harnesses AI to streamline Accounts Payable tasks like supplier management, invoice processing, tax compliance, and payments. On one single cloud platform, it aims to reduce operational workload and offer swift payments to partners and vendors.

The credit-based funding will further strengthen Tipalti's relationship with JPMorgan Chase Bank, a key banking partner that routes billions of dollars worth of supplier payments for the company each month. Tipalti plans to use the funding to fuel product innovation and potential acquisitions. As part of its long-term growth strategy, the company has also welcomed three new executives to its C-suite; Perla Stoeckert at Chief Compliance Officer, Alice Davidson at General Counsel, and Des Cahill at Chief Marketing Officer.