Stripe Atlas is making a significant play for the early-stage startup ecosystem, rolling out a new feature that lets founders raise capital directly through Simple Agreements for Future Equity (SAFEs) from within their Atlas dashboard. This move aims to strip away much of the friction and legal overhead traditionally associated with securing initial funding, particularly for Delaware C corporations.

To: founders@

— Jeff Weinstein (@jeff_weinstein) October 20, 2025

Subject: SAFEs

You can now send, sign, and track SAFEs in a few clicks, right from the @atlas dashboard.

Sincerely,

The Stripe team pic.twitter.com/tmlymZMcpk

For years, Stripe Atlas has been the go-to for founders looking to quickly incorporate a US company, offering streamlined setup for banking, payments, equity, and tax. Now, with the addition of a dedicated Fundraising tab, it’s evolving into a more comprehensive operational hub. This isn't just about adding another button; it's about integrating a critical, often daunting, aspect of startup life into a familiar, user-friendly interface.

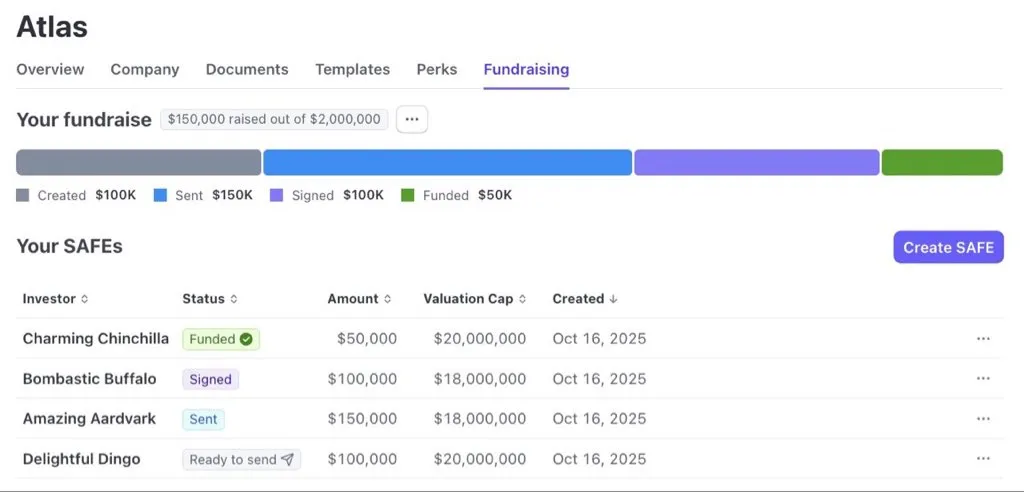

The new functionality allows founders to create, send, and track SAFEs entirely within the Atlas platform. This means less jumping between different tools and legal counsel, a common headache for cash-strapped startups. Before any funds change hands, Atlas automates the generation of a Cooley-drafted board consent document, a crucial legal step authorizing the fundraising amount. Founders can then secure necessary board approvals electronically via integrated DocuSign e-signatures, ensuring proper corporate governance without the usual back-and-forth.

Stripe Atlas SAFEs leverage the Y Combinator post-money SAFE with valuation caps, an agreement that has become an industry standard. This choice is strategic: using a widely recognized template reduces investor unfamiliarity and streamlines legal compliance, making it easier for founders to close deals. Founders retain control over investment terms, including valuation caps and amounts, and the platform assists in confirming accredited investor status – a key SEC compliance requirement that Cooley materials within Atlas help navigate. Once signed, investors transfer funds directly to the founder’s preferred bank account, with Atlas even offering pre-EIN bank account setup options through partners like Mercury or Brex.

Stripe's Broader Vision for Startup Infrastructure

This isn't merely a convenience; it's a strategic deepening of Stripe's commitment to the startup lifecycle. Jeff Weinstein, Stripe’s product lead, confirmed that Atlas is already looking ahead, exploring tools to import externally signed SAFEs for centralized documentation and functionality to manage multiple fundraising rounds with updated valuation caps and new board consents. This vision positions Atlas as an increasingly indispensable, all-in-one platform for company operations, building on its existing five feature tabs.

The partnership with Cooley LLP is central to the credibility and utility of Stripe Atlas SAFEs. Cooley provides the underlying legal templates for board consents and incorporation, ensuring that the documents are robust, standardized, and recognized by investors. This legal backbone significantly reduces fundraising friction, though Atlas advises founders to consult an attorney if they have complex questions or need to exceed initial board consent limits.

Currently, Atlas SAFEs only support valuation cap agreements, the most common type, with plans to introduce discount SAFEs in the future. This feature is available to US C Corps incorporated via Atlas after June 10th, 2024, further solidifying the platform's value proposition for its core user base.