Securitize, a key player in the plumbing for tokenizing real-world assets, is going public. The company announced a definitive agreement to merge with Cantor Equity Partners II, a special purpose acquisition company (SPAC), in a deal that gives Securitize a pre-money equity valuation of $1.25 billion. The move is a major test for the entire thesis of putting real-world assets on a blockchain, bringing the concept from the crypto world squarely into the public markets.

The deal will see the combined company trade on Nasdaq under the ticker “SECZ.” It’s backed by a who’s who of institutional finance, with existing investors like BlackRock, Morgan Stanley Investment Management, and ARK Invest rolling 100 percent of their equity into the new public entity. According to the announcement, the transaction is expected to deliver up to $469 million in gross proceeds, including a $225 million committed PIPE financing from investors like ParaFi Capital and Borderless Capital.

Putting Its Own Stock on the Blockchain

In a move that screams “eat your own dog food,” Securitize plans to tokenize its own equity post-merger. This is a bold, industry-first demonstration designed to show how public company stock can live and trade onchain, a core part of its mission to make financial markets operate at the “speed of the internet,” as CEO Carlos Domingo put it.

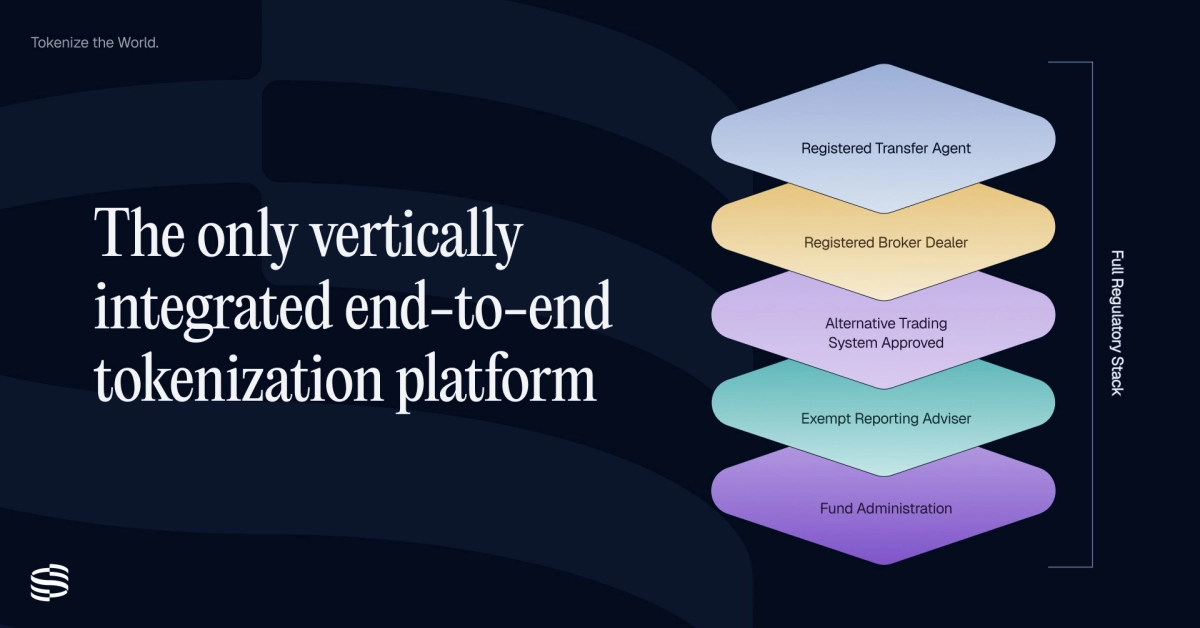

For years, Securitize has been building the regulated infrastructure to turn assets like fund shares and private equity into digital tokens. It operates as an SEC-registered transfer agent, broker-dealer, and alternative trading system (ATS). This isn't just theory; the company is the engine behind some of the industry’s biggest projects, including BlackRock’s BUIDL fund—now the world’s largest tokenized real-world asset—and a tokenized KKR fund.

This Securitize IPO isn’t just another SPAC deal. It’s a bellwether for the entire real-world asset (RWA) sector. With backing from the very Wall Street giants it aims to serve, Securitize’s performance on Nasdaq will be a closely watched signal of whether tokenization is ready for the mainstream, or if it will remain a niche corner of finance.