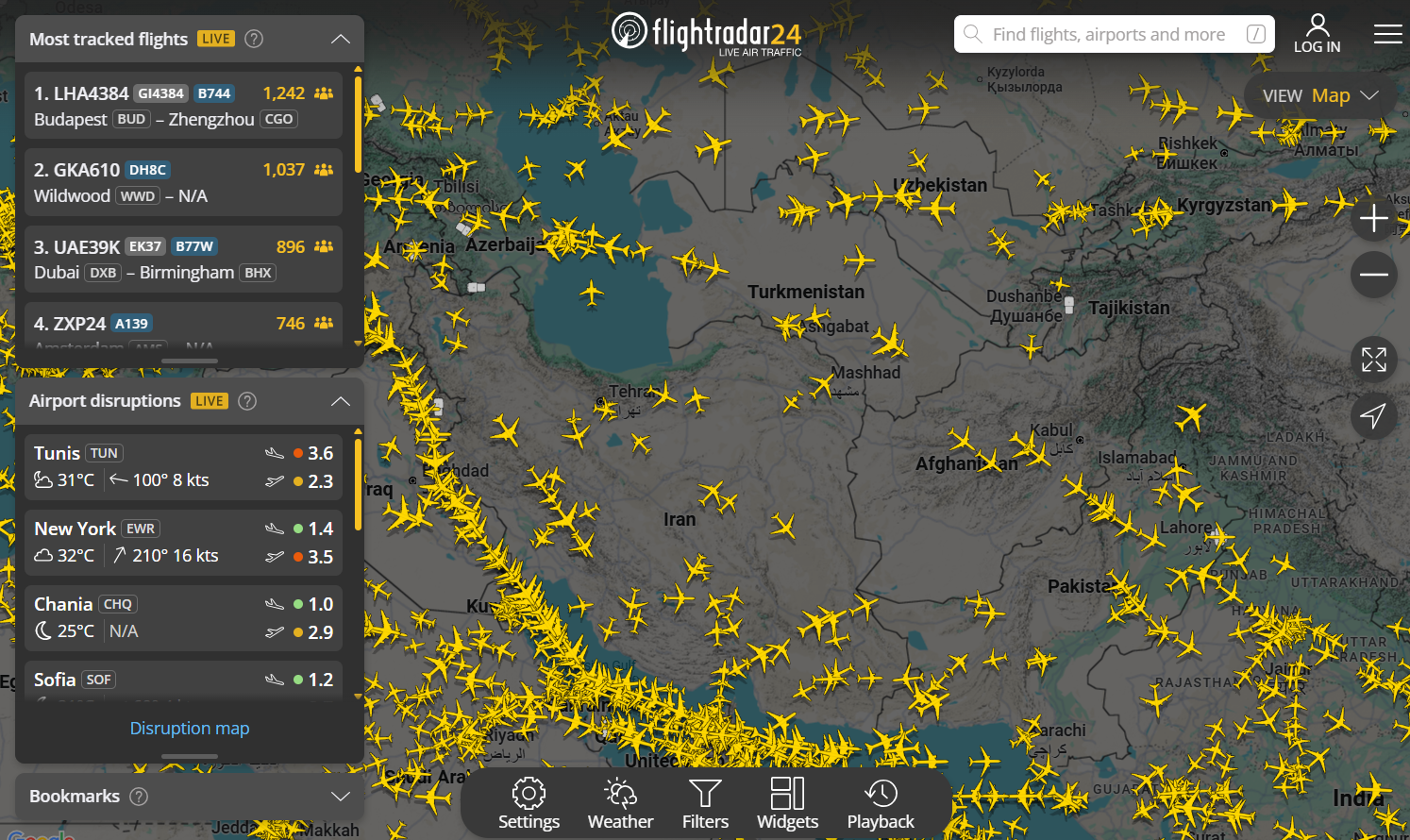

Flightradar24 (Flightradar), the popular flight tracking service known for its live air traffic map, has a new co-owner. A private equity firm has acquired a 35% stake in the company, a deal that reportedly values the Swedish tech company at a staggering $500 million.

The acquisition marks a significant milestone for Flightradar24, which was founded in 2006 by two Swedish aviation enthusiasts; Mikael Robertsson and Olov Lindberg. The service has grown from a niche tool for hobbyists into a global platform, used by millions of people to track everything from commercial flights to emergency aircraft. Its live data has also been relied upon by international media during major aviation events and incidents.

While the exact financial terms of the deal were not officially disclosed, a valuation of half a billion dollars for a 35% stake suggests a major payday for the original owners. The transaction structure, which appears to be a sale of existing shares, means that the capital from the investment went directly to the founders, rather than into the company's coffers for future expansion.

The news has sparked a mixed reaction among Flightradar24's dedicated user base, particularly on platforms like Reddit. Many users expressed concern that the private equity ownership could lead to scenario where the platform's user experience is deliberately degraded to maximize profits. The fear is that the new owners will prioritize aggressive monetization, potentially at the expense of the service's quality and the community of volunteers who operate the company's vast network of ground-based ADS-B receivers.

Flightradar24's business model is a blend of public and private data. The free service is supported by ads and offers a basic view of air traffic, while premium subscriptions (Silver and Gold) unlock advanced features like historical data, weather overlays, and detailed flight information. The company also generates revenue by selling its data to commercial entities, including airlines and aviation companies. The new ownership could accelerate the push toward these commercial data services, while the free and low-cost consumer offerings may see significant changes in the near future.