Bureau, a risk intelligence platform specializing in fraud prevention, has raised $30 million in Series B funding as global fraud losses reach $486 billion annually. The funding round, led by Sorenson Capital with participation from PayPal Ventures, Commerce Ventures, GMO Venture Partners, Village Global, Quona Capital, and XYZ Ventures, will support product innovation and expansion into new markets.

Bureau's solutions address the growing sophistication of fraud, which includes threats like money mule accounts, deepfake identities, account takeovers, and payment fraud. The company's AI-driven platform, built on Graph Neural Networks, provides advanced fraud prevention by integrating device intelligence, behavioral analysis, identity data, and predictive modeling. Over the past year, Bureau has achieved 3x revenue growth, driven by increasing global demand for its technology.

"Bureau is at the forefront of combating the surge in AI-powered cyber fraud," said Ranjan Reddy, CEO and Founder of Bureau. After personally experiencing cyber fraud, Reddy founded Bureau to enhance digital identity verification and fraud detection. Drawing on his expertise from building Qubecell and Boku Identity, he emphasized that every digital interaction requires answering two critical questions: "Who are you?" and "Can I trust you?"

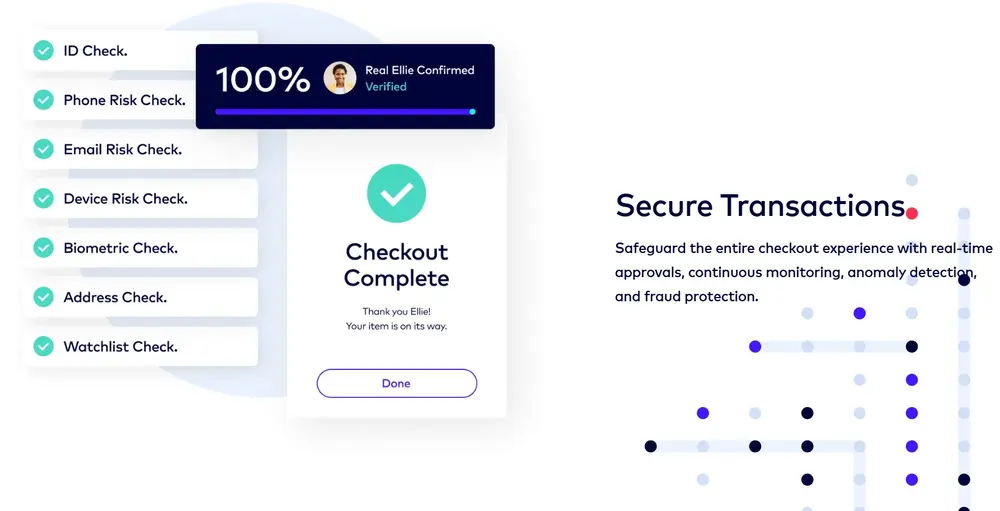

Bureau's platform consolidates traditionally siloed compliance, fraud, security, and credit risk processes into a unified solution. Its proprietary identity knowledge graph includes over half a billion identities and behavioral patterns, delivering real-time risk intelligence across the customer lifecycle.

"Bureau utilizes a unique combination of device, behavior, financial, and partner data to quickly block scammers without creating deal-breaking headaches for users,” said Rob Rueckert, a Partner at Sorenson Capital. “By preventing fraud while avoiding any harm to customer retention, revenue, and growth, Bureau is truly differentiated in the vast and significant fraud-prevention space, and the proof is in their success.”

Bureau's capabilities include money mule detection, account takeover prevention, fraud ring identification, onboarding compliance, and decisioning workflows. Unlike data brokers, Bureau provides actionable decisions through tokenized identities, ensuring privacy and security. Its platform is particularly effective for industries such as banking, fintech, gaming, and e-commerce, which face complex cyber threats and regulatory challenges.

With the new funding, Bureau aims to enhance its data and AI capabilities in fraud prevention while expanding its presence beyond Asia to serve global markets. The company remains committed to fostering digital trust and protecting businesses from emerging fraud threats.

"In an era where fraud is increasingly powered by AI, Bureau is advancing the fight with innovative technology and a mission to safeguard the digital economy," added Reddy.