The prospect of OpenAI, a titan in the artificial intelligence landscape, reportedly considering a departure from its California roots sends ripples across the tech industry, highlighting the intricate dance between rapid innovation and the slow march of regulatory oversight. This pivotal moment, brought to light by a Wall Street Journal report and discussed on CNBC's "Squawk Box" by Becky Quick, underscores a fundamental tension at the heart of the AI revolution: how do you reconcile a mission-driven, non-profit origin with the immense capital demands and market pressures of building world-changing technology?

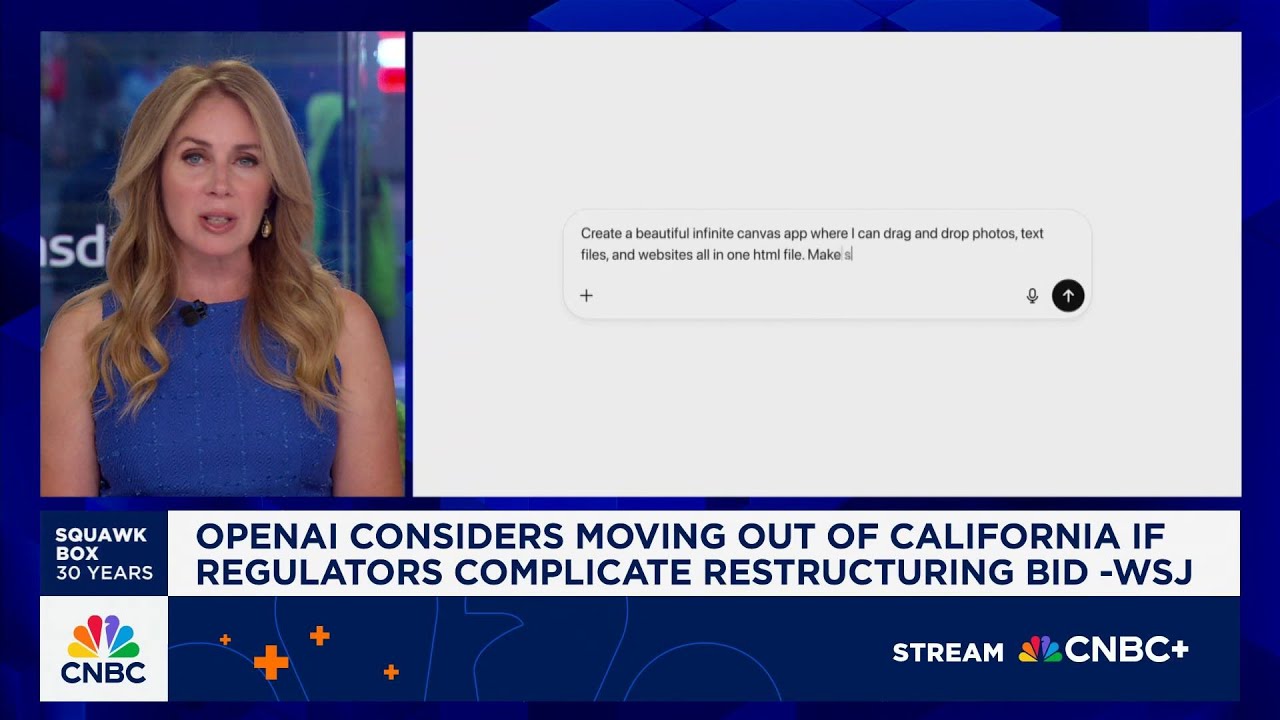

Becky Quick, reporting on CNBC, detailed how OpenAI is contemplating a move out of California should state regulators complicate its ambitious bid to restructure into a for-profit company. This potential relocation is not merely a logistical shift; it represents a profound challenge to the very operating model that has allowed OpenAI to attract vast investments and talent, propelling it to the forefront of AI development. The company's journey from a non-profit, founded with the goal of ensuring artificial general intelligence benefits all of humanity, to a capped-profit entity, has always been an experiment in balancing altruism with commercial necessity.

The core of the regulatory friction stems from OpenAI's unique hybrid structure, where a non-profit board retains control over the for-profit subsidiary. This arrangement was designed to allow the company to raise significant capital—billions from investors like Microsoft—while theoretically maintaining its original safety-first mission. However, as Quick noted, "that non-profit status is drawing scrutiny from regulators in the state who are obligated to protect their state's charities." California's Attorney General, in particular, is tasked with safeguarding charitable assets, and the conversion of a non-profit to a for-profit entity, even a capped-profit one, naturally invites a closer look at the potential implications for the original charitable intent and any assets accumulated under that status.

This situation reveals a critical insight: the existing legal and regulatory frameworks are struggling to keep pace with the unprecedented growth and novel corporate structures emerging in the AI sector. OpenAI's hybrid model, while innovative in its attempt to bridge the gap between philanthropic goals and market realities, finds itself in a gray area. Regulators, operating under established statutes designed for more conventional non-profits and corporations, are grappling with how to assess such a complex entity, particularly one with a valuation now reportedly exceeding $80 billion. The sheer scale of capital involved and the potential for immense future profits inevitably draw intense scrutiny.

OpenAI’s motivations for this restructuring are clear: to facilitate future fundraising and potentially an eventual stock exchange listing. Quick highlighted this, stating, "The company is eyeing the ability to raise funds in the future and a possible stock exchange listing as it tries to make that transition to a for-profit entity from one that is currently controlled by a non-profit." The development of cutting-edge AI models like GPT-4 and the upcoming GPT-5 demands colossal computational resources, requiring investments far beyond what traditional non-profit models can sustain. Attracting and retaining top-tier AI talent also necessitates competitive compensation structures, often tied to equity, which a pure non-profit cannot offer.

The regulatory pushback in California could force OpenAI to make a difficult choice, potentially setting a precedent for other AI companies navigating similar growth trajectories and ethical considerations. Should California's regulatory environment prove too restrictive, other states or even countries might actively court such high-value, strategically important companies. This could lead to a dispersion of AI innovation hubs, challenging Silicon Valley's traditional dominance. The long-term implications for California's tech ecosystem, already facing challenges with talent retention and cost of living, are significant.

While the Wall Street Journal report indicates OpenAI's contemplation of such a move, an OpenAI spokesperson offered a measured response, telling the Journal that the business "has no plans to relocate from California." This official statement, while reassuring on the surface, does not negate the underlying strategic considerations and the potential for future action if regulatory obstacles persist. It suggests that while relocation is not an immediate plan, it remains a lever in their strategic toolkit.

The unfolding situation at OpenAI serves as a potent case study for founders, venture capitalists, and AI professionals globally. It illustrates the inherent tension between the pursuit of AGI for societal benefit and the colossal financial and operational demands of achieving it. It also underscores the urgent need for regulators to develop more agile and sophisticated frameworks that can accommodate the unique characteristics of groundbreaking AI companies, rather than forcing them into ill-fitting traditional molds. The outcome of this regulatory dance will undoubtedly shape the future landscape of AI development and corporate governance for years to come.