OpenAI is projecting unprecedented financial scaling, forecasting its annualized revenue run rate (ARR) will hit $20 billion by 2025, a tenfold increase over two years.

The company’s CFO, Sarah Friar, revealed the figures in a new post detailing how the business model is evolving to match the value delivered by frontier intelligence.

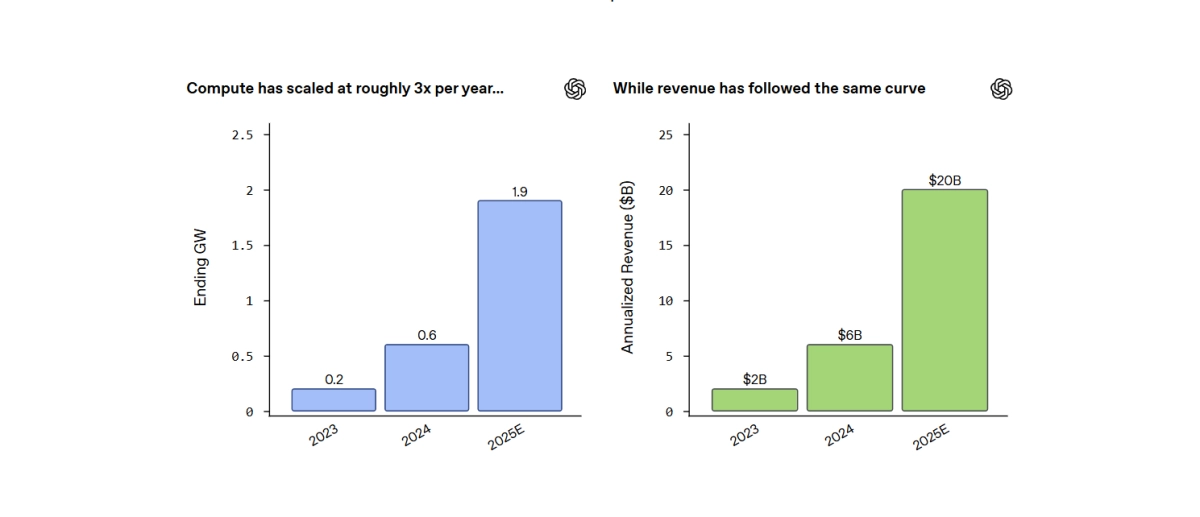

The core finding is that OpenAI’s revenue growth is almost perfectly tracking its access to compute. Friar notes that the company’s compute capacity is projected to scale from 0.2 GW in 2023 to approximately 1.9 GW in 2025—a near 10x increase—with revenue following the exact same curve: $2 billion ARR in 2023, $6 billion in 2024, and $20 billion plus in 2025.

The Compute Constraint

This correlation underscores the critical bottleneck facing the AI industry. Friar explicitly states that compute is the "scarcest resource" and suggests that greater capacity would have led to faster customer adoption and monetization. OpenAI is managing this constraint by shifting from a single provider to a diversified ecosystem, treating compute as an actively managed portfolio to ensure resilience and certainty.

The business model has rapidly matured beyond simple consumer subscriptions. As ChatGPT moved from a novelty tool to daily infrastructure, OpenAI layered in workplace subscriptions, usage-based API pricing for developers, and is now moving into commerce and advertising. The principle, according to Friar, is that monetization must feel native to the experience, helping users move from exploration to action.

Looking ahead, the company sees the next major revenue drivers in agents and workflow automation that run continuously, carrying context across tools. This shift, alongside a focus on practical adoption in high-value sectors like health, science, and enterprise, is intended to solidify AI as a foundation for the global economy.