Dubai-based accounting technology startup Oncount raises $1.5M in seed funding. This investment, led by seasoned tech entrepreneur Sergey Panov, will accelerate the development and launch of Oncount's proprietary artificial intelligence-driven accounting platform. The platform aims to transform how SMBs manage finances across the UAE and broader region.

Oncount intends to leverage the UAE's expanding finance and accounting business process outsourcing market. This market generated $663.6 million in revenue in 2024. Projections indicate it will reach $918.6 million in the coming years, demonstrating strong demand for digital-first financial management solutions.

SMBs form the backbone of the UAE and MENA economies. They represent 90% of all businesses and contribute up to 50% of national GDP. In Dubai alone, SMEs account for 42% of the workforce and contribute approximately 40% of the city's economic value.

Oncount's AI Platform Addresses SMB Financial Pressures

Businesses now face significant cost pressures in the UAE. These include a new 9% corporate tax on profits exceeding AED 375,000. Accountant salaries also increased by 15%, now averaging AED 130,400 annually for mid-level professionals. Furthermore, potential penalties of up to AED 50,000 exist for tax non-compliance. Oncount raises $1.5M to directly address these challenges with its accurate and efficient AI-powered accounting platform.

The platform aims to streamline accounting processes for Middle Eastern businesses. It specifically targets those facing increasing compliance costs. The founding team combines decades of expertise in IT, SaaS, and digital accounting. Sergey Panov, former CEO of Action, leads the team alongside Nicol Kuznetsova, a serial B2B entrepreneur. Ivan Anohin, previously a product leader at OSOME, also contributes his experience.

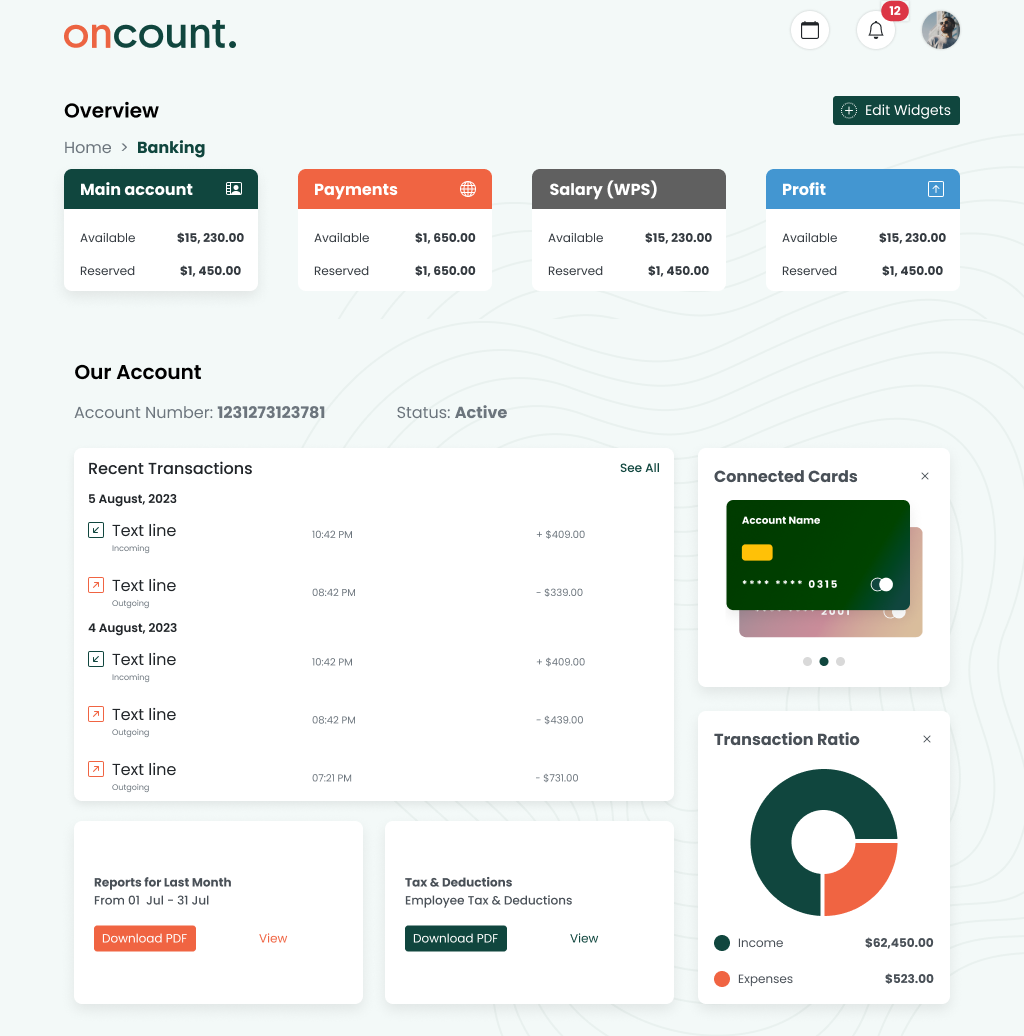

Oncount's platform distinguishes itself by utilizing AI and automation. It streamlines bookkeeping and tax workflows, consequently reducing costs and enhancing accuracy. Unique features include AI-powered document processing for invoices and contracts. It also offers automated bank transaction reconciliation and client-specific task management with personalized tax calendars. Accountant-managed quality control further ensures precision.

Oncount's platform prioritizes data integrity and operational speed. It offers premium features like voice-activated document creation with accountant verification. Same-day transaction processing is also available. The company guarantees a 20-minute response time for accounting questions. Professional liability insurance is included in all service plans.

Oncount's subscription model offers plans ranging from 508 AED to 4,212 AED monthly. These plans scale to business size and complexity. Each subscription includes tax registration and filing (CT and VAT), full-service accounting, and a dedicated team. This team comprises a senior accountant, bookkeeper, assistant accountant, and tax lawyer. Comprehensive compliance support and financial reporting are also provided.

After its UAE launch, Oncount is set for expansion throughout the MENA region and Central Asia. The company will focus on markets with underserved SMB segments and increasing regulatory complexity. Oncount explores opportunities in Saudi Arabia, Egypt, Kazakhstan, and Uzbekistan. This strategic expansion follows the successful seed round where Oncount raises $1.5M.

SMBs across MENA and Central Asia face mounting pressures from taxes, higher wages, and compliance risks. Oncount identifies a significant opportunity to introduce its tech-first model to these markets. This approach aims to provide business owners with peace of mind, allowing them to focus on growth. Oncount’s launch coincides with the rapid transformation of the accounting sector, driven by digitalization and AI.