Tech giants are aggressively vying for talent and innovation, often driven by a fear of missing out on the next technological frontier. CNBC's Deirdre Bosa recently joined "Closing Bell" with Scott Wapner to dissect Meta Platforms' fervent pursuit of AI dominance, revealing the company's broad, often opportunistic, approach to securing its footing in this transformative sector.

Bosa detailed how Meta, under Mark Zuckerberg, has been on an extensive "AI talent hunt." This includes confirmed approaches to AI darlings like Perplexity, alongside significant deals such as the one with Scale AI, and reported attempts to poach top talent from entities like OpenAI. This expansive campaign, according to Bosa, suggests less of a meticulously planned roadmap and "more like strategic FOMO." Meta's strategy appears driven by a need to acquire assets before competitors, rather than a singular, cohesive vision across its diverse AI ventures.

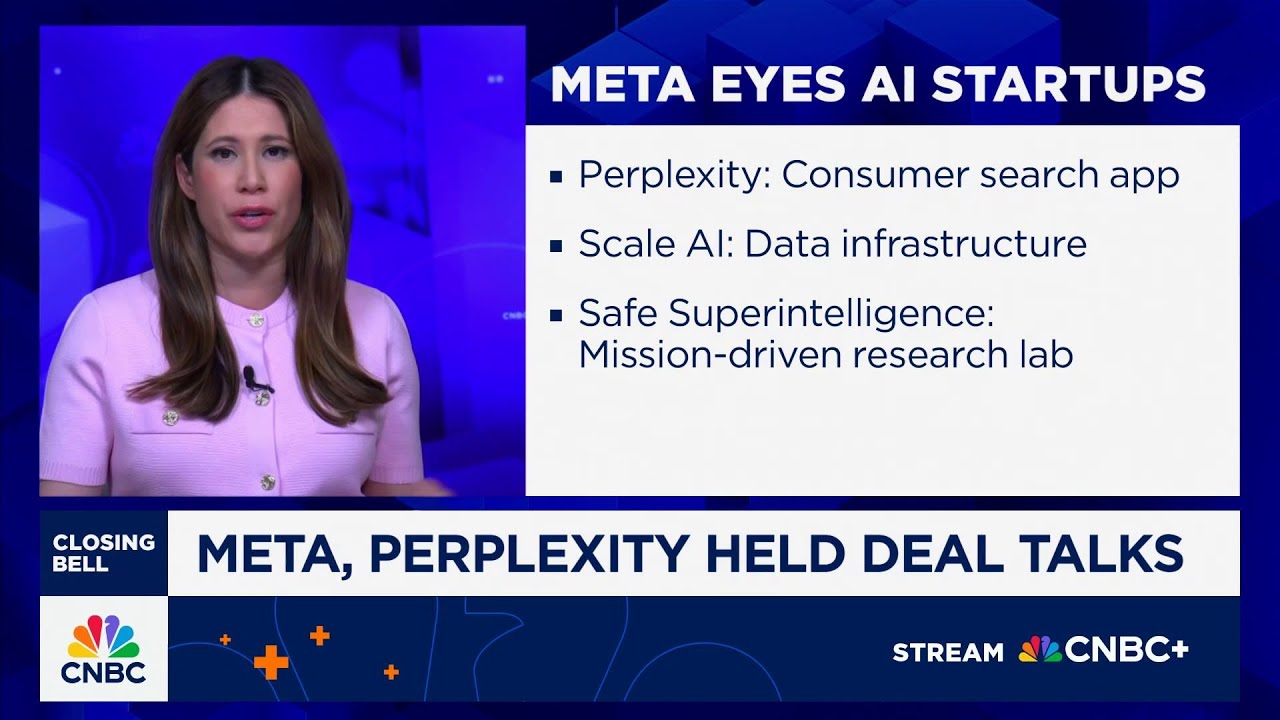

The varied nature of Meta’s targets further underscores this point. Perplexity is a consumer search application, Scale AI focuses on data infrastructure, and Safe Superintelligence (SSI) is a mission-driven research lab—distinct entities suggesting a broad, rather than deeply integrated, acquisition strategy.

A critical nuance highlighted is the motivation of leading AI researchers and founders. While substantial capital is available, particularly from mega-caps, Bosa observed that these innovators are often driven by a higher purpose. "They care about purpose," Bosa stated, adding, "They want to go somewhere where they can achieve superintelligence." This suggests that simply throwing money at talent or companies may not guarantee long-term commitment or success for larger entities.

The conversation also touched upon Coatue Management’s "Next Tech Order" list for 2030, which notably excludes Google. Scott Wapner expressed surprise, noting, "Alphabet is nowhere to be found." Bosa echoed this sentiment, finding it "just flabbergasting" given Google's current standing and advancements. She pointed out that Google's Gemini model, by third-party benchmarks, is "the cheapest and the best model on the market, beating even OpenAI and Anthropic's Claude latest models," underscoring the perceived oversight. Google's continued advancements in areas like Waymo further challenge its omission from such a forward-looking list.

The intensity of this AI talent and acquisition war reflects the perceived winner-take-all nature of the burgeoning AI market. Companies are scrambling to secure foundational capabilities and human capital. Ultimately, the ongoing reshuffling of AI talent and the aggressive, sometimes disjointed, strategies of tech giants signal a period of intense competition. The true victors in this race will likely be those who can not only acquire cutting-edge technology and talent but also foster an environment where innovation thrives beyond mere financial incentives, proving that strategic depth, not just sheer momentum, will define the next era of technological leadership.