The market's patience for capital expenditure, particularly in the burgeoning field of artificial intelligence, has become a defining factor in big tech's recent earnings reactions. This sentiment was acutely underscored when Eric Sheridan, Goldman Sachs' Co-Head of Tech, Media, and Telecom Research, joined CNBC's "Squawk on the Street" team to dissect the third-quarter earnings of Alphabet and Meta. His analysis highlighted a stark divergence in investor confidence, largely driven by the immediate visibility of returns on significant AI and infrastructure investments.

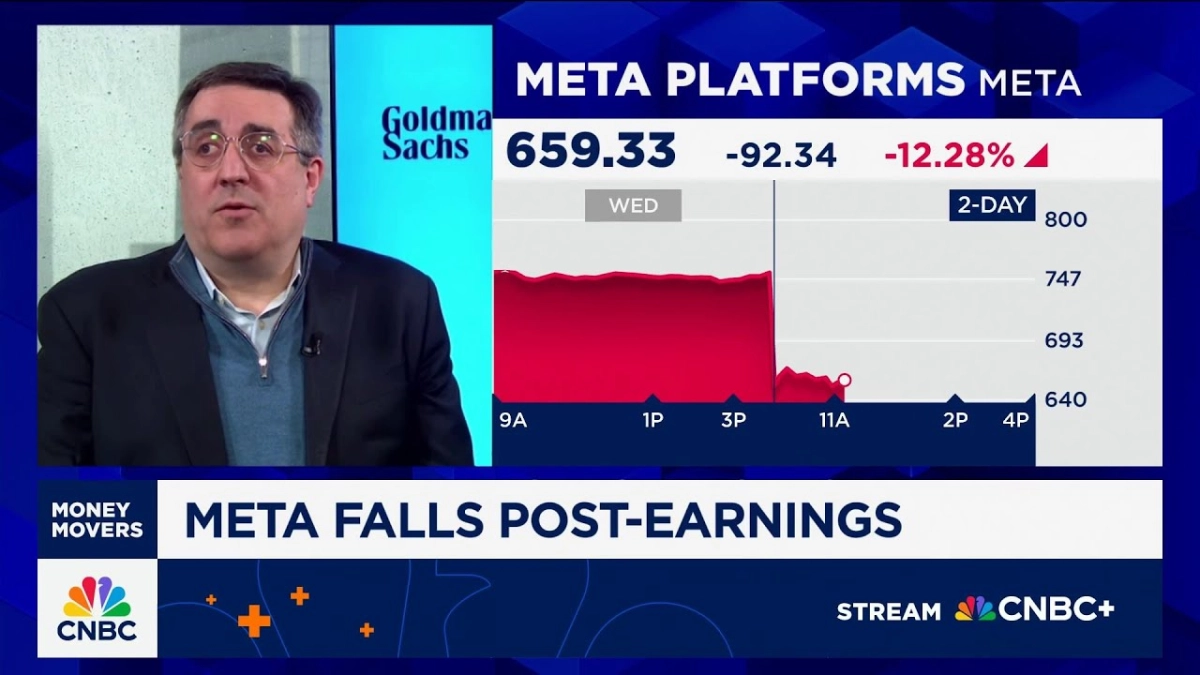

Sheridan observed that the market currently places "a premium on visibility into return on capital spent," a standard Meta Platforms, despite its aggressive AI push, struggled to meet in the eyes of investors. Meta's stock experienced a sharp downturn of over 12% post-earnings, a reaction largely attributed to its substantial capital expenditure guidance for AI and Reality Labs, without a clear, near-term revenue correlative. This marks a critical juncture for companies pouring billions into foundational AI models and infrastructure, as the path to monetization remains an open question for many.

Mark Zuckerberg's framing of Meta's AI strategy on the earnings call was telling: "We've rebuilt our AI efforts, we have constructed the super intelligence labs, and now you need to give us time to have an output from those labs and those efforts in the months ahead." Sheridan views this as a "show me story" for the next six months, suggesting that investors are seeking tangible results beyond mere investment. The expectation is that it could take "well into the first half of the year before we see anything on the foundational model front coming out of Meta," leaving a gap in the immediate return profile that the market is currently unwilling to overlook.

This isn't an unfamiliar narrative for Meta, or indeed for its predecessor, Facebook. Sheridan pointed out a recurring pattern: "when Mark talks about investment cycles and there's lower levels of visibility... they typically have a negative reaction on day one." This cyclical investor behavior suggests that while the long-term vision for AI and the metaverse may be compelling, the short-term market prioritizes predictable returns over aspirational spending, especially without a clear revenue stream to offset the investment.

In contrast to Meta's struggle for immediate investor appeasement, Alphabet's Q3 earnings painted a more favorable picture, particularly concerning its Google Cloud segment. The cloud business, Sheridan noted, offers "a lot of certainty that CapEx put into the ground will have a revenue dynamic that you can correlate back to over the next one to two years." This visibility provides a crucial buffer, demonstrating a clearer trajectory for returns on infrastructure investments, which are also vital for AI development.

Beyond cloud, YouTube emerged as a significant, and perhaps underappreciated, growth driver for Alphabet. The video platform demonstrated robust performance with ad revenues climbing 15% year-over-year. More profoundly, Sheridan highlighted the growing importance of YouTube's subscription revenue, which is often aggregated into Alphabet's overall subscription figures. He asserted, "we believe YouTube ads plus subscription is actually a business that's slightly larger than Netflix and growing at a faster rate." This insight reveals a powerful, diversified revenue stream within Alphabet that provides stability and growth, directly contrasting Meta's more speculative AI investments.

Related Reading

- Amazon's AI Power Play: Inside the $11 Billion Indiana Data Center

- The AI Infrastructure Gold Rush: Opportunities, Risks, and Strategic Moats

- AI Investment Cycle: Early Innings, Driven by Fundamentals

The confidence derived from YouTube's dual revenue engine was palpable. The earnings call provided "very confidence building to hear that from Chief Business Officer Philipp Schindler... not only the strength in ads, but the rising strength in subscriptions as well." This diversified and visible growth within Alphabet’s portfolio allows it to absorb significant AI investments with less immediate market scrutiny than Meta.

The core insight here for founders and investors alike is the prevailing market demand for tangible, traceable returns on capital, even in a transformational era of AI. While audacious bets are necessary for long-term leadership, companies with diversified, revenue-generating segments—like Alphabet’s Cloud and YouTube—are better positioned to weather the interim periods of heavy investment and lower visibility. Meta’s challenge is not just to build cutting-edge AI, but to articulate and demonstrate its path to consumer scale and, crucially, monetization, to regain investor confidence. The market is less forgiving of abstract future potential when immediate capital deployment is so immense.