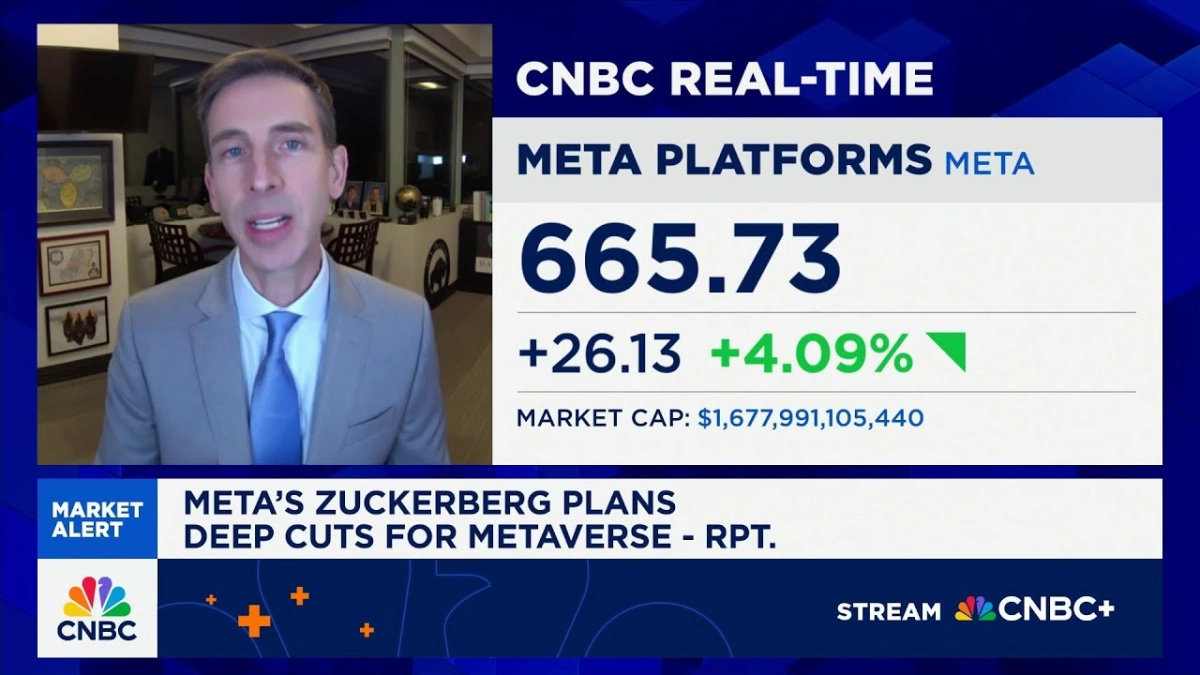

The market's enthusiastic response to reports of Meta Platforms significantly curtailing its Metaverse investments speaks volumes about current investor sentiment and the evolving technological landscape. As CNBC’s “Squawk on the Street” team discussed, Meta shares surged higher on news that CEO Mark Zuckerberg plans deep cuts for its metaverse effort, with budgets potentially slashed by as much as 30% next year. This strategic realignment signals a critical shift, prioritizing the more immediate and competitive frontier of artificial intelligence over the long-term, capital-intensive hardware development of the Metaverse.

Gil Luria, Managing Director and Head of Technology Research at D.A. Davidson, provided sharp commentary on this pivot, explaining the financial rationale and strategic implications during his interview on CNBC. His insights illuminate how Meta is navigating the dual pressures of ambitious long-term vision and the imperative for near-term financial prudence, particularly in a high-interest rate environment.

Luria underscored the stark financial drain of Meta’s Reality Labs division, the engine behind its metaverse ambitions. He starkly noted, "If they shut down the Reality Labs business, earnings would go up by about 25%." This division, he revealed, lost a staggering "$18 billion dollars last year," a figure that undoubtedly contributed to investor unease and pressure on Meta’s bottom line. Such a substantial loss highlights the immense capital expenditure required for a venture as speculative and nascent as the metaverse, forcing a re-evaluation of its immediate priority.

Zuckerberg's long-term vision for Meta remains rooted in owning the next computing platform, moving beyond the current mobile ecosystem dominated by Apple and Google. He envisions this future platform as "a combination of glasses and goggles, not a handset," aiming to escape the "30% off the top" that Meta currently pays to platform owners for app store revenue. This ambition for platform independence is a powerful motivator, yet the path to achieving it has proven more protracted and costly than initially anticipated.

The pivot towards AI, therefore, is not an abandonment of the metaverse vision but a recalibration of priorities based on technological readiness and market dynamics. Luria elucidated this by stating that Zuckerberg "has realized that AI is much further down the road than the shift to the hardware platform." This suggests a pragmatic acknowledgment that the underlying AI capabilities are more mature and offer more immediate, tangible opportunities for competitive advantage and product enhancement across Meta’s existing platforms.

Indeed, the competitive intensity in the AI space is another significant driver for this strategic shift. Meta faces formidable rivals in this arena, including "Google, with OpenAI, with Anthropic, and to some extent with Amazon, Microsoft, and many Chinese players." To compete effectively and build superior frontier models and chat capabilities, Meta needs to funnel substantial resources into AI research and data center infrastructure. This is a battle for foundational technology, one that Meta cannot afford to lose if it intends to power future immersive experiences, whether through glasses or other interfaces.

Investors had expressed considerable disappointment when Meta reported its quarterly earnings, despite robust top-line growth. The company reported "25% top-line growth in the quarter," which Luria pointed out was "almost twice as much as Google, it's faster than Microsoft, Apple, and Amazon." However, the stock was down because Meta had concurrently announced plans for "increasing CapEx and operating expenses even faster than that next year," which would inevitably lead to "lower margins and not as much earnings growth." This disconnect between revenue growth and profitability outlook was a major red flag for the market.

Related Reading

- C3.ai CEO Details Enterprise AI's Core Operational Impact

- OpenAI's Future Hinges on Enterprise Adoption and Sustained Funding

- AI's Maturation: From Model Supremacy to Infrastructure Dominance

In response to this investor feedback, Zuckerberg is demonstrating a willingness to adjust. He is shifting resources from Reality Labs to AI to stabilize margins and ensure earnings growth aligns with revenue growth. This tactical move is essential for maintaining investor confidence and demonstrating fiscal responsibility while still pursuing groundbreaking technological advancements.

This strategic pivot by Meta underscores a broader trend in the tech industry: the increasing recognition of AI as the immediate, transformative force. While the metaverse remains a long-term aspiration for many, the practical realities of development cycles, capital requirements, and competitive pressures are driving companies to invest where the technology is more mature and the returns more proximate. Meta’s decision reflects a calculated move to secure its position in the AI race, ensuring its relevance and profitability in the interim, even if it means slowing the pace of its hardware-centric metaverse ambitions. The reallocation of resources towards AI is a testament to its current primacy in the tech hierarchy.