Prediction market platform Kalshi just closed a monumental $1 billion funding round. This transaction propels the company's valuation sharply upward to $11 billion.

This massive injection of capital arrives less than two months following a $300 million raise that valued the firm at $5 billion. Such rapid revaluation underscores intense investor belief in the future of event contracts.

Returning heavyweights Sequoia and CapitalG spearheaded this latest financing effort. Other notable participants include Andreessen Horowitz and Paradigm, signaling broad VC confidence.

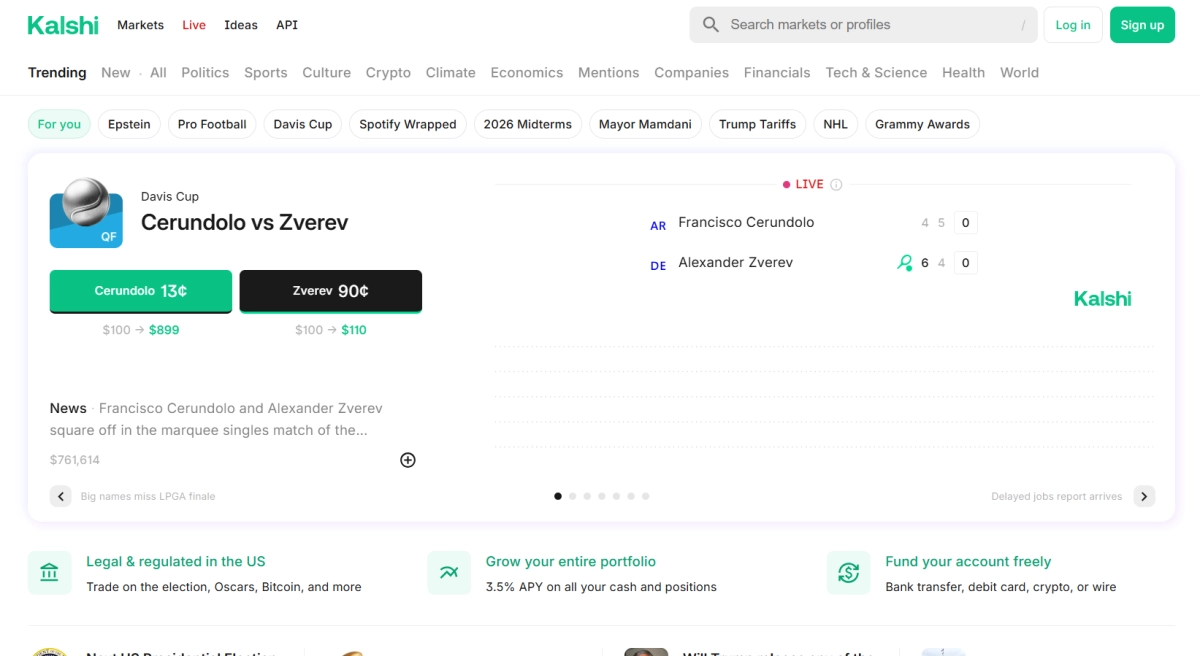

Kalshi permits users globally to place wagers on quantifiable future outcomes. These range from entertainment scores to major political election results.

The platform saw dramatic volume growth, exceeding $50 billion in annualized trading volume recently. This represents a massive increase from the previous year's reported figures.

This sector is heating up significantly, evidenced by rival Polymarket's own recent high-value fundraising. The competitive landscape suggests broad market acceptance for regulated prediction platforms.

However, the sector operates under ongoing scrutiny regarding its classification as gambling versus financial instruments. Kalshi maintains federal clarity following a lawsuit but faces state-level regulatory challenges.

The company plans to leverage this substantial financing to accelerate expansion and potentially navigate complex legal jurisdictions more effectively. This capital provides significant runway for growth initiatives.