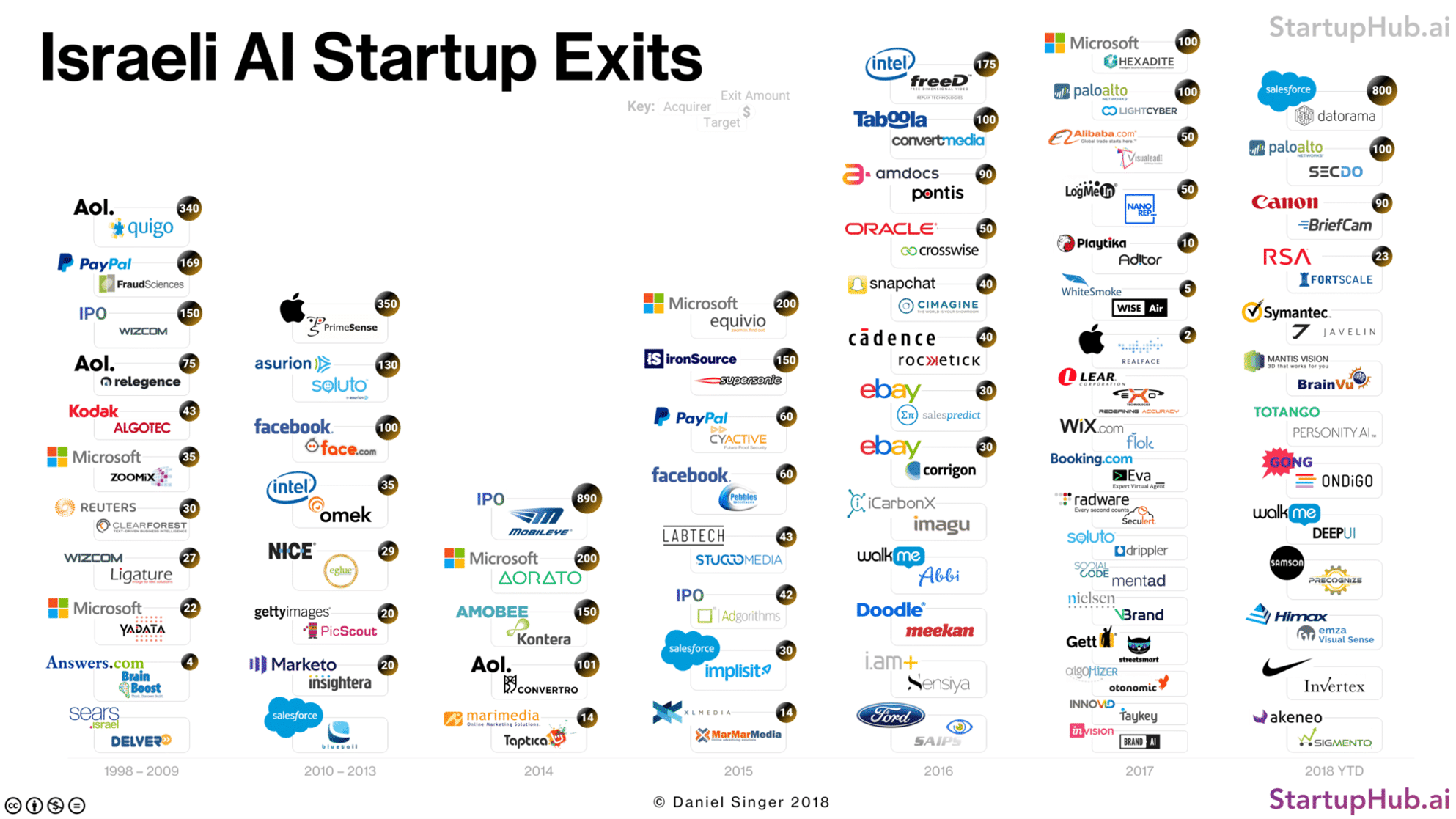

Here’s the top 10 highlights from analysis of the startup exit data:

- In total, Israeli AI startups have sold for $5.1 billion in cumulative exit considerations across 82 deals dating back to 1998. 50 deals occurred over the last two years.

- The average exit consideration is $109 million since 1998, and over the last five years averages $119 million.

- The average lifespan of an Israeli AI startup is 6.0 years. Startups that sold between 6 to 8 years after founding yielded the highest exit growth multiples.

- The average amount of funding raised before exit is $17.8 million over an average of two funding rounds. The average exit growth multiple is 7.2 times (exit consideration divided by total funding).

- The most active corporate acquirers of Israeli AI startups are Salesforce, Microsoft and AOL (Oath Inc.).

- 82% of startups that exited were B2B-facing, 12% were B2C-facing and 6% focused on government clients (B2G).

- 86% of startups sold software, while 14% sold hardware with embedded software.

- By sector analysis, the volume count of exits are led by Core AI Technologies (29%), Marketing (26%) and Enterprise (23%). By dollar value, the leading sectors are Marketing (36%), Core AI Technologies (20%), Automotive (17%) and Enterprise (15%). Diving deeper, Computer Vision related software and hardware technologies represent 15 exits totaling $947 million in exit considerations. Marketing startups in the Analytics/Insight segment sold for a cumulative $1.1 billion across 5 exits while startups in the Advanced Targeting segment sold for a cumulative $458 million across 10 exits. Lastly, 7 Enterprise startups in the Cyber Security segment sold for $513 million in total.

- The average number of founders per team is two.

- Nearly one third of exits are comprised of deals between $100 million and $500 million. The largest Israeli AI startup exits to date are Mobileye’s IPO in 2014 for $890 million and Salesforce’s acquisition of Datorama earlier this year for $800 million. That cohort should see more new additions in the next two years considering the large number of mature unicorn/pre-unicorn Israeli AI startups set for either IPO or entertaining exit discussions.