Republic is acquiring regulated digital asset platform INX in a deal that values the company at up to $60 million, a move designed to create a one-stop shop for issuing and trading tokenized securities. The deal represents a massive 457 percent premium over INX’s closing share price on April 2nd, signaling Republic’s aggressive push to dominate the infrastructure for real-world assets (RWAs) on the blockchain.

The acquisition, announced Thursday, formalizes a partnership that was already bearing fruit. Republic, a global investment firm known for its retail-focused platforms, will fully absorb INX, which provides regulated trading platforms for digital securities and cryptocurrencies. Republic already held a stake in the company.

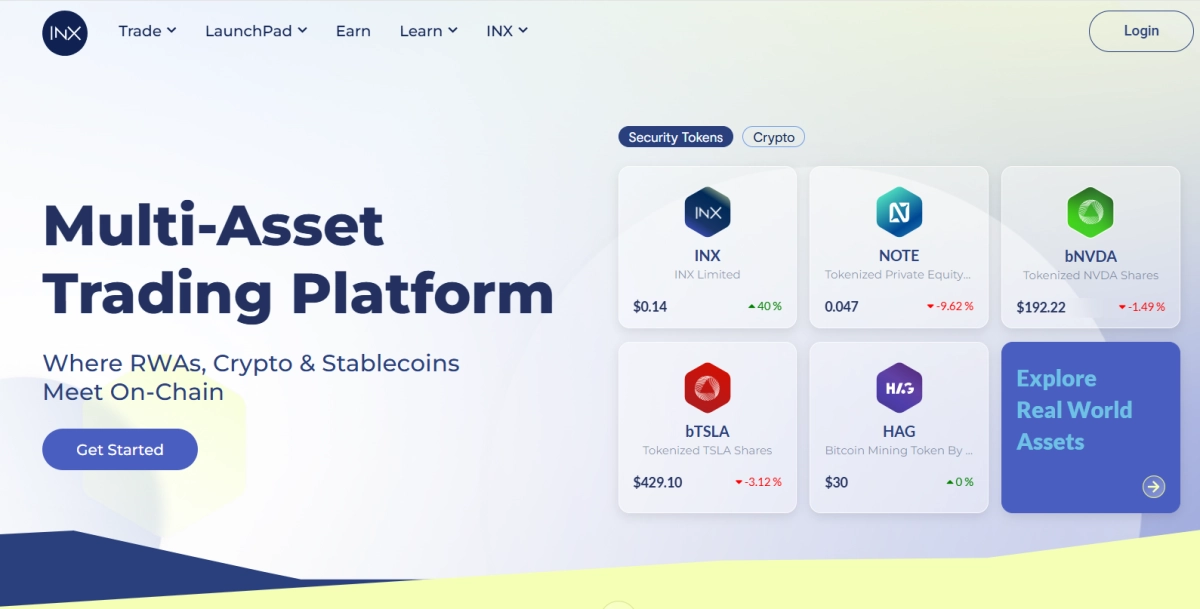

This isn't just a simple buyout; it's a strategic play to build a complete, end-to-end pipeline for tokenized assets. Republic handles the primary issuance—helping companies raise capital—while INX provides the crucial, regulated secondary market where those assets can be traded. Think of it as combining AngelList with a mini-NASDAQ, but for the blockchain era.

Building a regulated pipeline for RWAs

The combined entity aims to bridge the notoriously wide gap between traditional finance and the crypto world. "This acquisition is about more than just expansion—it's about reshaping access to financial markets," said Andrew Durgee, Co-CEO of Republic, in a statement. The goal is to create a seamless ecosystem where everything from private equity to real estate can be tokenized, issued, and traded in a compliant environment.

The two companies have already tested this model with initiatives like the launch of a tokenized fund for private equity giant Hamilton Lane and the listing of Republic's own Republic Note on the INX.One platform.

For investors, the INX Republic acquisition promises access to a broader range of tokenized assets in a regulated space. For companies, it offers a streamlined path to raising capital through security tokens.

The deal structure is a mix of cash and contingent value rights (CVRs). Non-rollover shareholders will receive $20 million in cash upfront and another $16 million in CVRs payable after 18 months. INX founder and CEO Shy Datika is among the key shareholders rolling his equity into SAFEs (simple agreements for future equity) in Republic, a vote of confidence in the merged company's future. The final purchase price will land between $48.9 million and $60 million, depending on how many other shareholders opt to roll over their shares.

"Joining forces with Republic accelerates our vision of a fully regulated, tokenized economy that empowers investors globally," Datika commented.

A crucial point for the INX community is the fate of the INX Token. The company confirmed it will continue to trade on the INX.One platform. More importantly, INX will make good on a long-standing promise: its cash reserve fund, currently holding approximately $34.3 million, will be fully distributed to INX Token holders after the transaction closes.

The deal, which was supervised by a special committee of independent INX directors, is expected to close within eight months, pending shareholder and regulatory approvals. It’s a significant consolidation in the digital asset space, creating a formidable player with the ambition to build the core infrastructure for the next generation of financial markets.