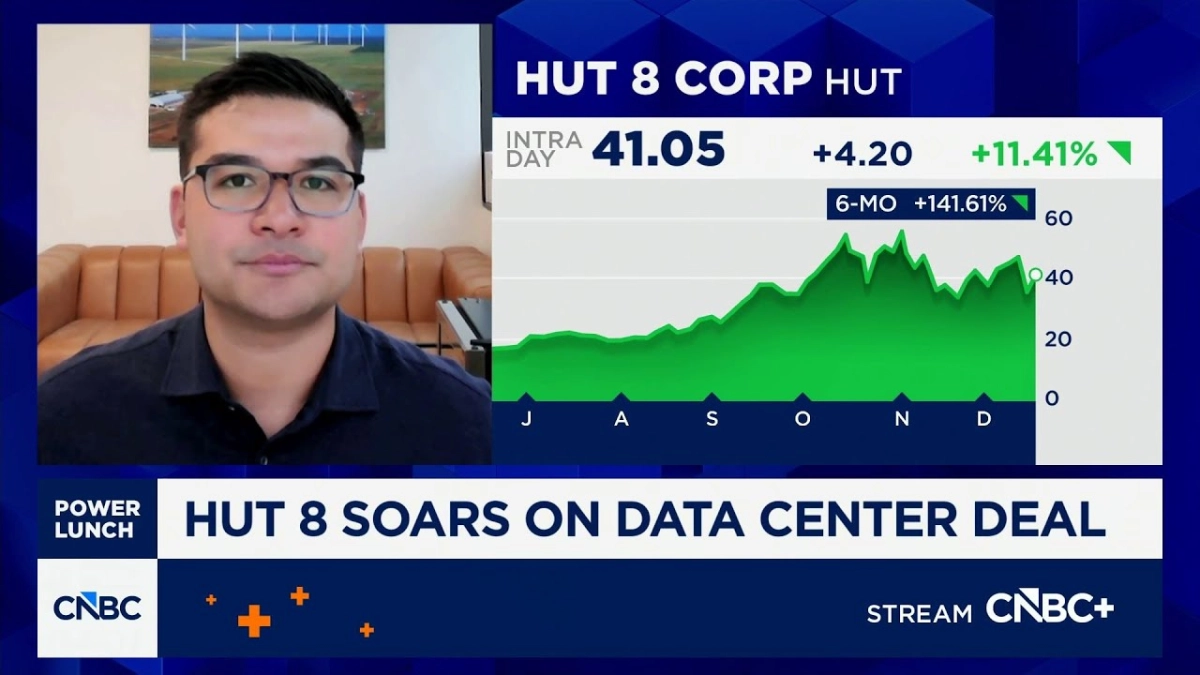

"Credit counterparty was extremely important," stated Asher Genoot, CEO of Hut 8, on CNBC's "Power Lunch," underscoring a pivotal shift in the digital infrastructure landscape. Genoot, speaking with the CNBC team, provided commentary on Hut 8's recent deal with Fluidstack, backed by Google, and its implications for data center demand and energy infrastructure. His insights reveal a strategic evolution within the compute sector, where the convergence of AI and robust financial partnerships is redefining growth trajectories.

For Hut 8, a company historically known for its significant presence in Bitcoin mining, the new venture represents a calculated expansion into the burgeoning field of artificial intelligence compute. This move is not merely an opportunistic pivot but a testament to a foundational strategy: building energy infrastructure platforms capable of supporting diverse computational demands. Genoot articulated that their infrastructure is designed to support "various compute," encompassing both Bitcoin mining and AI, rather than a conversion of existing assets. This diversified approach allows Hut 8 to mitigate the inherent volatility of single-purpose operations, creating a more resilient business model.

A core insight from Genoot's discussion is the paramount importance of securing investment-grade credit counterparties for large-scale infrastructure projects. In a capital-intensive sector characterized by multi-billion dollar, multi-year commitments, the financial stability of partners is not just beneficial, but "critical." He highlighted Google as "one of the most credible counterparties... from an investment grade credit in the world," whose operational cash flow can fund substantial AI investments. This backing by a tech giant like Google, with its diverse portfolio spanning hardware (TPUs), autonomous vehicles (Waymo), and media (YouTube), provides an unparalleled level of confidence and financial security for the 15-year data center commitment.

This strategic alignment with a financially robust entity like Google also unlocks significant financing advantages. Genoot revealed that the deal brings in partners like JPMorgan and Goldman Sachs, who are "willing to use their balance sheets to back us as well," providing competitive project-level financing at an impressive 85% loan-to-cost percentage. Such favorable financing terms are a direct consequence of Google's involvement, validating the project's long-term viability and significantly reducing Hut 8's capital outlay while enhancing its returns. This illustrates how strategic partnerships with established financial players are essential for de-risking and accelerating infrastructure development in high-growth tech sectors.

Another key insight is the synergistic relationship between Bitcoin mining infrastructure and the rapidly expanding demand for AI data centers. While the demand profiles differ, the underlying energy infrastructure requirements often overlap. Bitcoin mining operations, frequently located in bespoke areas with access to abundant, often curtailed, power, provide a unique foundation. These sites, which might otherwise struggle to attract traditional data center clients due to their remote nature or power curtailment schedules, become viable thanks to the flexibility of crypto mining. Genoot explained that these sites "allow us to underwrite new megawatts that otherwise we may not be able to underwrite." He cited the 1-gigawatt Lon Hill project in Corpus Christi, Texas, as an example, where initial investment for Bitcoin compute now positions it for AI data center opportunities. This dual-purpose utility maximizes asset utilization and creates new revenue streams, showcasing an innovative approach to energy infrastructure development.

Hut 8's ability to operate data centers for both Bitcoin and AI compute positions it uniquely in the market. It demonstrates a sophisticated understanding of energy markets and computational demands. This dual capability allows for a flexible response to market shifts, optimizing resource allocation between different compute types based on profitability and demand cycles. The strategic decision to spin out American Bitcoin, while continuing to manage its data centers, further refines Hut 8's focus on infrastructure management and diversified compute services.

The company's trajectory exemplifies a broader trend in the tech industry: the increasing convergence of energy infrastructure, financial engineering, and advanced computing. For founders, VCs, and AI professionals, Hut 8's model offers a blueprint for navigating the complex, capital-intensive demands of AI development. It highlights that success in this arena hinges not just on technological prowess, but equally on astute financial partnerships and adaptive infrastructure strategies.