The physical backbone of the artificial intelligence revolution is becoming as crucial as the algorithms themselves, with energy infrastructure giants like GE Vernova emerging as indispensable partners. CNBC’s Seema Mody, reporting on "Money Movers," recently elucidated GE Vernova’s pivotal role in this burgeoning ecosystem, detailing her conversation with CEO Scott Strazik regarding the company’s strategic alignment with OpenAI and its broader impact on the data center landscape. The discussion underscored how traditional industrial powerhouses are rapidly adapting to meet the unprecedented demands of next-generation computing, navigating both immense opportunity and inherent challenges.

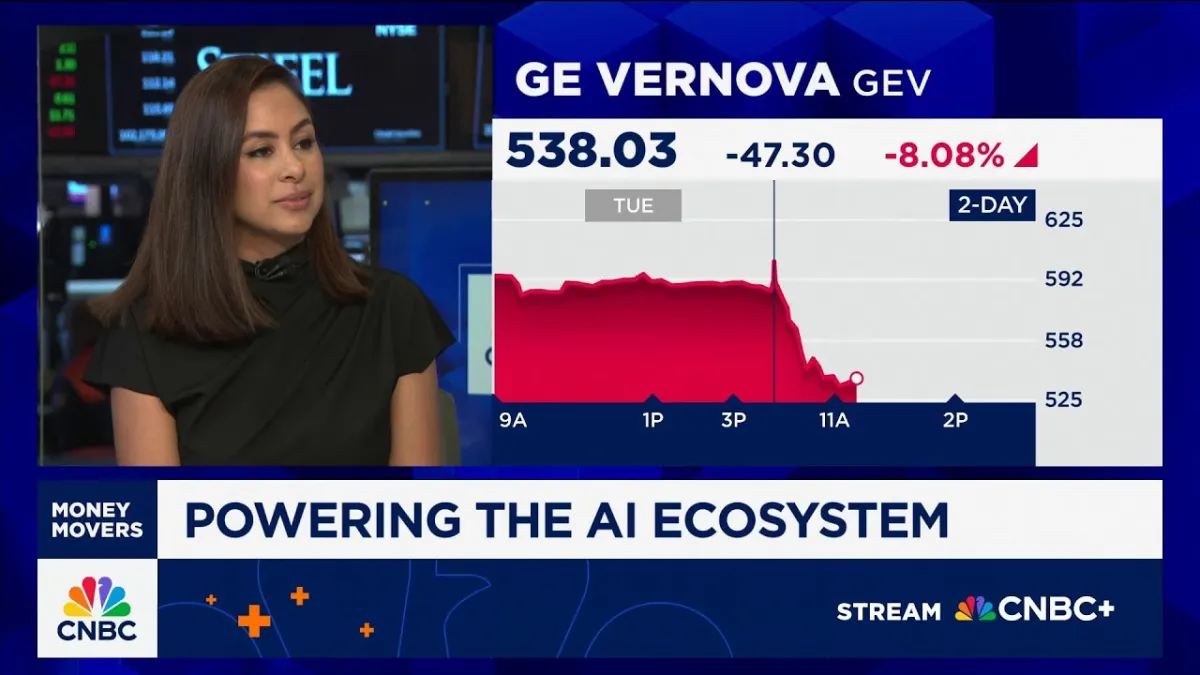

GE Vernova’s latest third-quarter earnings report, which surpassed revenue expectations, served as a potent indicator of its strong market position. The company has solidified its reputation as a preferred power provider for hyperscalers, the colossal entities constructing the data centers that fuel AI. This recognition is not merely anecdotal; it is reflected in tangible financial metrics and strategic engagements. The market, however, remains a complex beast, with stock performance sometimes diverging from underlying operational strength, as evidenced by GE Vernova’s shares dipping despite robust results.

A core insight from the interview centers on GE Vernova’s deepening relationship with OpenAI, a collaboration that highlights the critical intersection of advanced AI development and robust energy infrastructure. CEO Scott Strazik revealed a dynamic and evolving partnership, stating, "I met with Sam [Altman] multiple times over the past few weeks. It is a relationship that continues to evolve. ... I've been with his team over the last 72 hours. Clearly OpenAI is a critical piece of this growth trajectory with a lot of ambition." This direct engagement at the highest levels underscores the strategic importance of reliable, scalable power solutions to OpenAI’s ambitious projects, including the much-discussed "Stargate" expansion. GE Vernova is not just a vendor; it is an integral enabler of the future of AI.

The financial trajectory of GE Vernova’s engagement with the hyperscaler segment provides further clarity. Year-to-date, the company has secured an impressive $900 million in electrical equipment orders from these major players, a substantial increase over prior periods. This surge in demand is projected to continue, with a strong backlog of orders extending through 2028, suggesting a sustained growth curve driven by the insatiable appetite for AI computing power. This long-term visibility into demand is a significant advantage in the often-volatile infrastructure sector, offering a degree of predictability for investors and strategic planners.

Beyond OpenAI, GE Vernova’s influence extends across the broader AI ecosystem. The company is actively working with other prominent hyperscalers, including Nvidia and XAI, to supply gas turbines and other essential power infrastructure situated near their expansive data centers. This strategic placement ensures efficient power delivery, minimizing latency and maximizing operational uptime, which are paramount for AI workloads. The recent acquisition of the remaining 50% stake in a company specializing in transformers further solidifies GE Vernova's vertical integration in the power delivery chain, enhancing its ability to provide comprehensive solutions that increase voltage and accelerate electricity flow to these critical facilities.

Despite these significant advancements and strategic partnerships, GE Vernova is not immune to external pressures and industry-specific headwinds. The offshore wind sector, a critical component of its renewable energy portfolio, continues to face regulatory hurdles and capacity constraints. Compounding these issues are evolving tariff policies, which the company has ballparked to incur an impact of approximately $300 to $400 million this year. These challenges highlight the delicate balance required in managing a diverse energy portfolio while simultaneously capitalizing on emerging opportunities in AI infrastructure.

The market’s reaction, specifically the dip in GE Vernova’s stock despite positive earnings and bullish outlooks, offers another layer of insight for founders and VCs. It often signifies that investor expectations, fueled by the intense excitement surrounding AI, have been exceptionally high, perhaps even "priced in" beyond the reported numbers. This phenomenon, reminiscent of Oracle’s recent performance, suggests that even strong operational beats and strategic partnerships may not always translate to immediate stock appreciation if the bar for growth has been set astronomically high. It underscores the importance of tempering expectations against the backdrop of an overheated market narrative, focusing on sustainable, long-term value creation rather than short-term market euphoria.

Ultimately, GE Vernova’s journey through the AI boom is a testament to the fundamental truth that cutting-edge technology relies on robust, often unglamorous, foundational infrastructure. Its evolving partnership with OpenAI and its broader engagement with hyperscalers position it as a quiet but powerful force, powering the data centers that are redefining industries and economies. The company’s ability to navigate both the immense demand from the AI sector and the complexities of its other energy ventures will dictate its long-term success in this rapidly transforming global landscape.