FurtherAI, a startup building an AI-powered workspace for the insurance industry, has raised a $25 million Series A led by Andreessen Horowitz. The round, one of the largest ever for an insurance AI company at this stage, comes just six months after a $5 million seed round, bringing its total funding to $30 million.

The rapid-fire funding underscores a growing investor appetite for domain-specific AI that can tackle the complex, document-heavy workflows of legacy industries. The $7 trillion insurance sector, long bogged down by manual processes, disconnected systems, and a reliance on PDFs and spreadsheets, is a prime target for this technological overhaul.

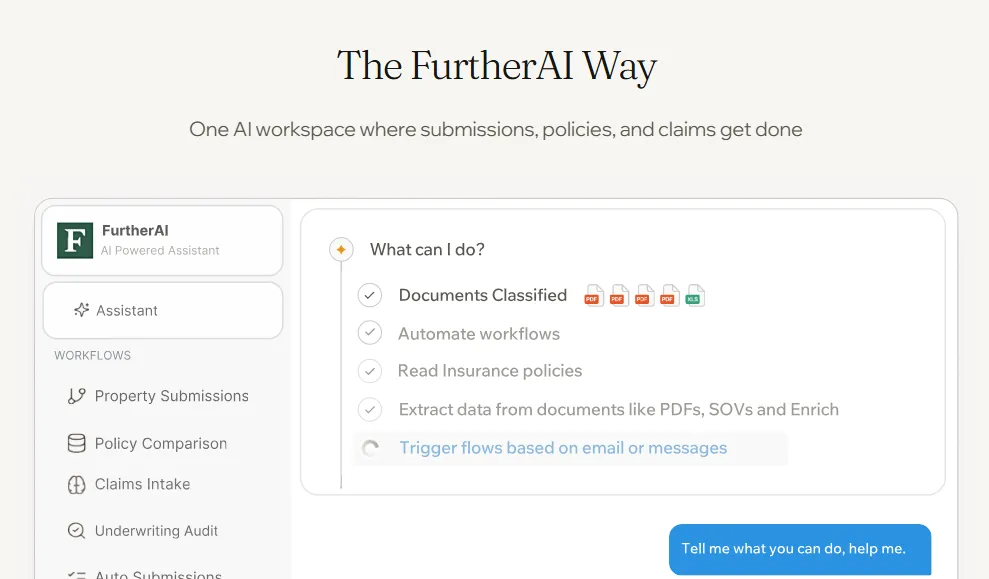

FurtherAI claims it’s building the solution by automating tedious but critical tasks across underwriting, claims, and compliance. Instead of a generic AI tool that struggles with industry nuance or a point solution that only solves one small problem, the company offers an "insurance-native" platform. According to the announcement, this allows teams to start with a single workflow, like submission processing or policy comparisons, and expand across their operations.

The AI Co-Pilot for a Trillion-Dollar Industry

The goal isn't to replace insurance professionals but to augment them. "Insurance is the backbone of the economy, but the people running it have been stuck with outdated tools," said Aman Gour, Co-Founder and CEO of FurtherAI. "With this funding, we’re doubling down on building AI workflows that give underwriters, brokers, and claims teams superpowers."

The company reports it's already processing billions in premiums for clients like Accelerant, MSI, and Leavitt Group. The results, it claims, are tangible: teams doubling productivity, improving submission-to-quote ratios by 15 percent, and generating proposals 10 times faster. "Implementing FurtherAI has been game-changing — faster turnarounds, higher accuracy, and a platform we can keep expanding,” said Laurie Flanagan of Leavitt Group in a statement.

With the new capital, FurtherAI plans to expand its library of insurance-specific workflows, deepen integrations with existing carrier and broker systems, and scale its go-to-market teams to handle what it calls "surging demand."

The investment signals a clear bet from a16z on the company's vertical-specific approach. "Aman and Sashank are technical founders whose customers see them as true AI partners, not just AI tools," said Joe Schmidt, Partner at Andreessen Horowitz. "Their early traction signals a generational opportunity to transform insurance."

As the insurance industry grapples with talent shortages, rising climate risk, and increased regulatory pressure, the push for modernization is becoming urgent. FurtherAI’s funding suggests that specialized AI, not generic chatbots, may be the key to finally unlocking that transformation.