Global HR and payroll platform Deel has just announced a massive $300 million strategic investment in its Series E round, catapulting its valuation to an eye-watering $17.3 billion. This isn't just another funding announcement; it's a clear signal that the race to dominate the infrastructure for the future of work is heating up, with Deel positioning itself as a formidable frontrunner.

The funding round saw participation from new investor Ribbit Capital, alongside long-time partners Andreessen Horowitz and Coatue Management, with additional backing from General Catalyst and Green Bay Ventures. The sheer scale of the investment underscores Deel's aggressive growth trajectory and its ambition to become the definitive platform for managing global teams.

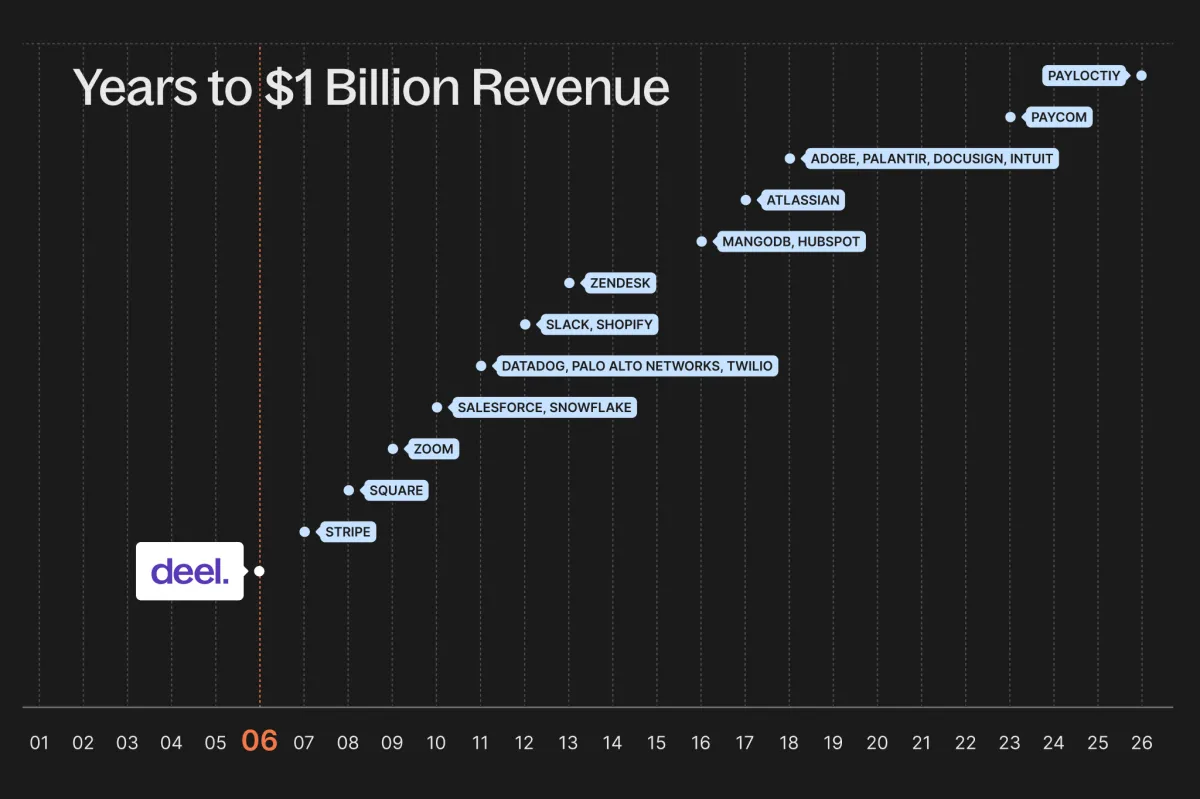

Deel’s financial performance has been nothing short of meteoric. The company recently surpassed $1 billion in annual recurring revenue (ARR), a milestone it reportedly reached faster than many high-growth tech industry peers, according to S-1 Filings, GS Research, and FactSet data. This impressive organic growth engine has also led to three straight years of profitability, culminating in its first $100 million revenue month in September 2025. Currently, Deel serves over 37,000 businesses and 1.5 million workers across 150+ countries, processing a staggering $22 billion in payroll annually.

Alex Bouaziz, Deel’s Co-founder and CEO, emphasized the strategic nature of this investment. “This round is about doubling down on the global payroll infrastructure we’ve built from the ground up,” Bouaziz stated. He articulated a vision for payroll that is “fluid, real-time, and truly borderless,” aiming to create a single, comprehensive platform for companies to build, manage, and pay teams anywhere.

The capital infusion will be channeled into several key areas. Deel plans to accelerate strategic acquisitions to expand both its product capabilities and global reach. Crucially, the company will also invest heavily in building out its owned systems and operations, with an ambitious target of delivering native payroll in over 100 countries by 2029. AI innovation is another significant focus, aimed at enhancing automation across its HR and payroll suite and attracting top-tier AI talent.

Deel’s product diversification and market penetration are evident in its recent growth figures: a 1,500% surge in US products (PEO and US payroll), 600% growth in HR products, and 450% in global payroll. Even niche offerings like Deel Immigration and Deel IT saw 220% and 410% growth, respectively. The platform's stickiness is also increasing, with a 480% rise in customers using three or more products. Its expanding roster of enterprise clients, including LEGO, Puma, Virgin Media, Klarna, Capgemini, FedEx, and Pepsi, highlights its transition from a niche solution to essential global infrastructure.

The Global HR Arms Race Heats Up

Micky Malka, Founder at Ribbit Capital, expressed confidence in Deel, noting, “Deel – itself a fully remote, global company with employees in over 100 countries – is uniquely positioned to build products for global expansion.” This sentiment was echoed by Ben Horowitz of Andreessen Horowitz, who praised Deel’s pursuit of building the best HR platform and its "essential infrastructure" status.

This Series E round isn't just about Deel's balance sheet; it's a bellwether for the entire global HR tech sector. As distributed work models become the norm rather than the exception, the demand for seamless, compliant, and integrated solutions for hiring, paying, and managing international talent will only intensify. Deel's aggressive strategy of acquisitions, deep infrastructure build-out, and AI integration suggests a future where geographical boundaries are increasingly irrelevant for talent acquisition and management. The company is not just adapting to the future of work; it's actively trying to define it.