Millions of skilled professionals and international students face financial barriers when moving to a new country. Despite earning significantly above the national average—the typical international household in the U.S. earns $135,000 per year—newcomers often struggle to access credit due to the lack of a local financial history. Zolve, a cross-border neobank, is addressing this challenge and has secured $251 million in equity and debt funding to scale its services globally.

The financing includes a $51 million Series B round led by Creaegis, with participation from HSBC, SBI Investment, GMO Venture Partners, DG Daiwa Ventures, and existing investors Accel, Lightspeed Venture Partners, Sparta Group, and DST Global. Additionally, a $200 million warehouse line from Community Investment Management will support the expansion of Zolve’s credit offerings. This funding comes as the company surpasses 750,000 customers and processes over $1.2 billion in transactions.

For many skilled professionals, financial integration into a new country is a significant hurdle. Without a local credit history, obtaining a credit card is difficult, and building credit requires prior access to financial products. Traditional banks often provide only secured credit cards with high deposit requirements and low credit limits, while opening a bank account can be time-consuming.

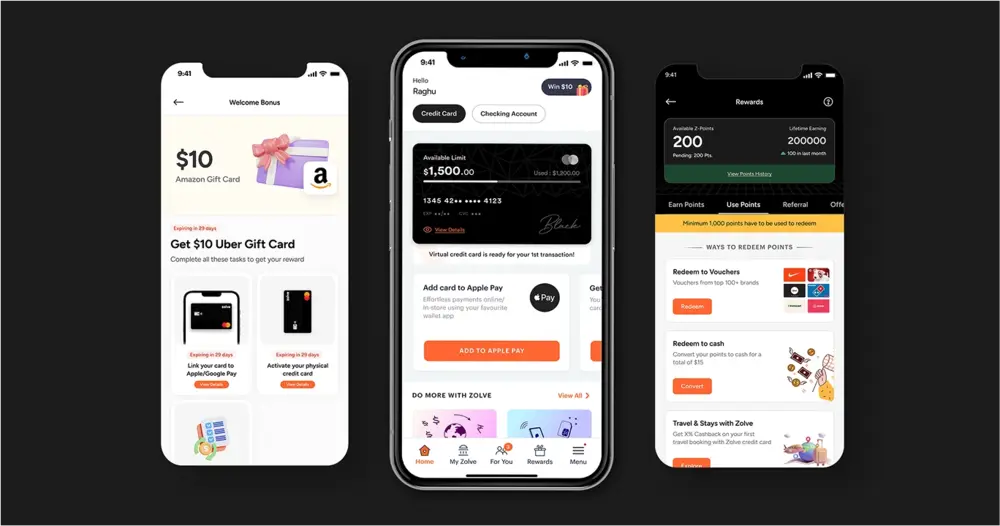

Zolve has developed a solution that allows global citizens to access credit and banking services immediately upon arrival in a new country. By leveraging financial data from customers’ home countries, Zolve provides U.S. credit cards and checking accounts to professionals and students moving to America, eliminating the barriers to financial access.

“The global financial system isn’t designed for mobility,” said Raghu G, Founder and CEO of Zolve. “When skilled professionals and students move abroad, their financial history resets, making it difficult to access credit. We’re changing that by ensuring financial continuity from day one.”

Founded by Raghu G, a serial entrepreneur who previously built and sold TaxiForSure for $200 million in 2015, Zolve has seen rapid growth since its launch in 2021. The company became customer-level profitable in early 2024 and is on track to reach overall profitability by the end of 2025. Organic growth has played a key role in its success, with 70% of new users joining through referrals.

The funding comes at a time when global migration continues to rise. The U.S. alone has 47.8 million foreign-born residents with a collective spending power of $1.7 trillion, presenting a significant market opportunity. While several fintech startups have attempted to serve this segment, many have struggled to scale. Zolve differentiates itself with a unique business model—operating with costs in Indian Rupees while generating revenue in U.S. dollars—focusing on prime customers and establishing itself as their primary financial institution from the start.

“We are excited to support Zolve’s mission to provide seamless financial services to global professionals,” said Prakash Parthasarathy, Managing Partner and CIO, and Nitish Bandi, Partner at Creaegis, in a joint statement. “Our experience investing in global fintech and SaaS companies aligns with Zolve’s vision to bridge financial gaps for international students and professionals.”

Looking ahead, Zolve plans to expand into Canada, followed by the UK and Australia. The company will also broaden its credit offerings to include auto loans, personal loans, and education financing. Long term, Zolve aims to evolve into a full-service financial platform for global citizens, providing international money transfers, insurance, and investment products.

“Our goal is simple,” said Raghu G. “Wherever global citizens move, Zolve moves with them.”