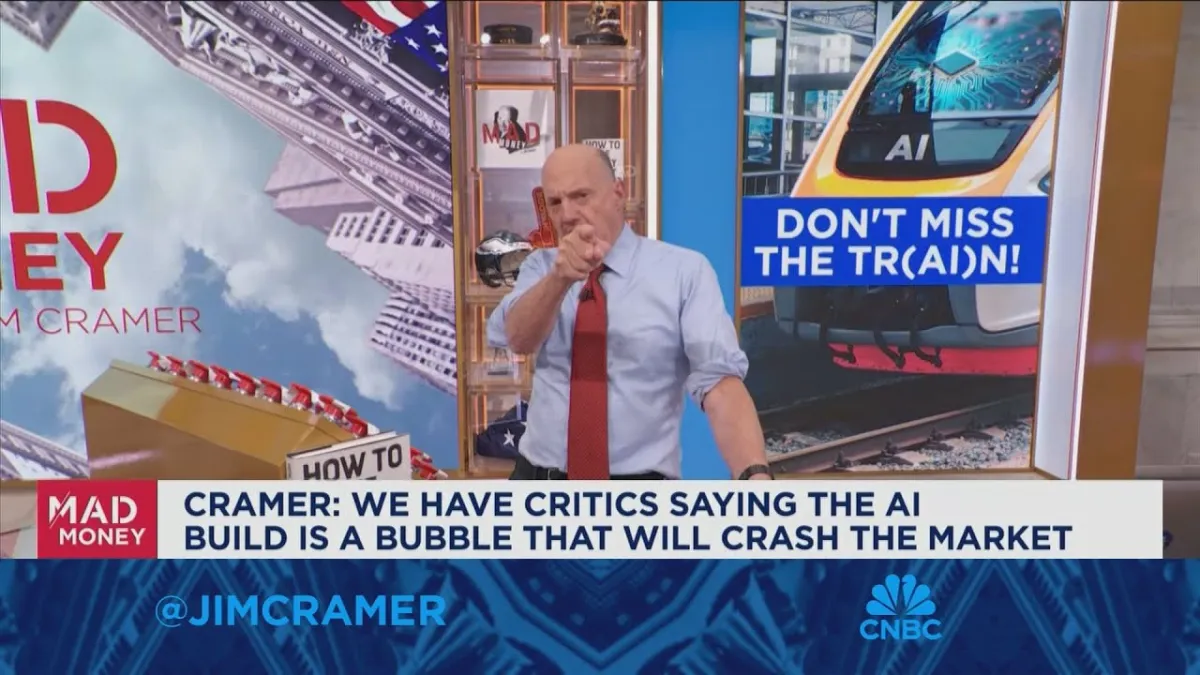

"I trust the judgment of Jensen Huang, the father of generative AI," Jim Cramer declared on CNBC's Mad Money, cutting through the prevailing market anxieties surrounding the artificial intelligence boom. This statement formed the bedrock of his commentary, directly confronting "billionaire critics" who he believes are propagating "promotional pessimism," labeling the massive AI data center build-out an "outrageous bubble." Cramer’s analysis, delivered with his characteristic fervor, underscored a fundamental belief in the long-term, transformative power of AI, driven by the strategic foresight of industry titans rather than speculative frenzy.

Jim Cramer spoke on Mad Money about the day's market action, specifically addressing the widespread concern that the substantial investment in AI infrastructure signals an impending market bubble. He argued forcefully against this bearish sentiment, positioning the current AI build-out as a necessary and justified expenditure by the world's most robust corporations. His perspective offers a critical counter-narrative for founders, venture capitalists, and AI professionals navigating this dynamic landscape, suggesting that the current wave of investment is rooted in profound technological shifts and strategic imperatives rather than mere hype.

Cramer highlighted the paradox of market performance against the backdrop of this "gloomy chorus." Despite the dire warnings from some quarters, the Dow, S&P 500, and Nasdaq all registered gains on the day of his broadcast, suggesting a market resilient to, or perhaps even dismissive of, these cautionary tales. He drew a parallel to past periods of "dazzling stock performance" that were similarly met with skepticism, implying a historical pattern where critics often fail to grasp the true magnitude of technological shifts.

A core insight Cramer offered is that the substantial capital expenditure driving the AI revolution is not coming from speculative, debt-laden startups, but from the "vast cash flow of the richest companies on earth." These "hyperscalers," as he termed them, possess the financial muscle and strategic imperative to invest heavily in AI data centers, recognizing it as the next frontier for growth and competitive advantage. This distinction is crucial; it suggests a more stable and deliberate investment cycle than the dot-com era's speculative bubble.

Cramer's unwavering confidence in Jensen Huang, CEO of Nvidia, is central to his argument. He credits Huang not only with "accelerated computing" but also as "the father of generative AI." This isn't just a nod to innovation; it's an endorsement of leadership. He recounted how Huang has "been met with skepticism every step of the way," yet "constantly proves them wrong." This historical pattern of vindication, Cramer believes, is repeating itself with generative AI, making Huang's vision a powerful counter-indicator to bubble theories.

The implication for founders and VCs is clear: the current investment in AI infrastructure is foundational, driven by established giants with deep pockets and a clear understanding of the technological trajectory. This is not a fleeting trend but a strategic pivot by the most influential players in tech. Their commitment validates the long-term potential of AI, creating a fertile ground for startups that can build upon this infrastructure and deliver innovative applications.

For AI professionals, Cramer's commentary reinforces the notion that the demand for AI capabilities, particularly in data centers, is robust and sustained. The ongoing build-out represents a significant expansion of the computational backbone necessary for advanced AI development and deployment. This translates into continued opportunities for talent, research, and product development across the AI ecosystem.

Cramer’s argument ultimately rests on the idea that the "reckless spending" critics decry is, in fact, a calculated and necessary investment by those best positioned to understand and capitalize on the AI revolution. His trust in Huang's judgment and the financial prudence of the hyperscalers paints a picture of a robust, if rapidly expanding, AI market. The narrative shifts from one of irrational exuberance to one of strategic imperative, driven by visionary leaders and well-resourced corporations.