Corgi, a new AI-native insurance carrier, has secured $108 million in funding to launch its full-stack Corgi startup insurance platform. The company, which recently received regulatory approval, aims to solve a persistent problem for high-growth companies: legacy insurance systems built on manual workflows and brokers that cannot keep pace with rapid scaling.

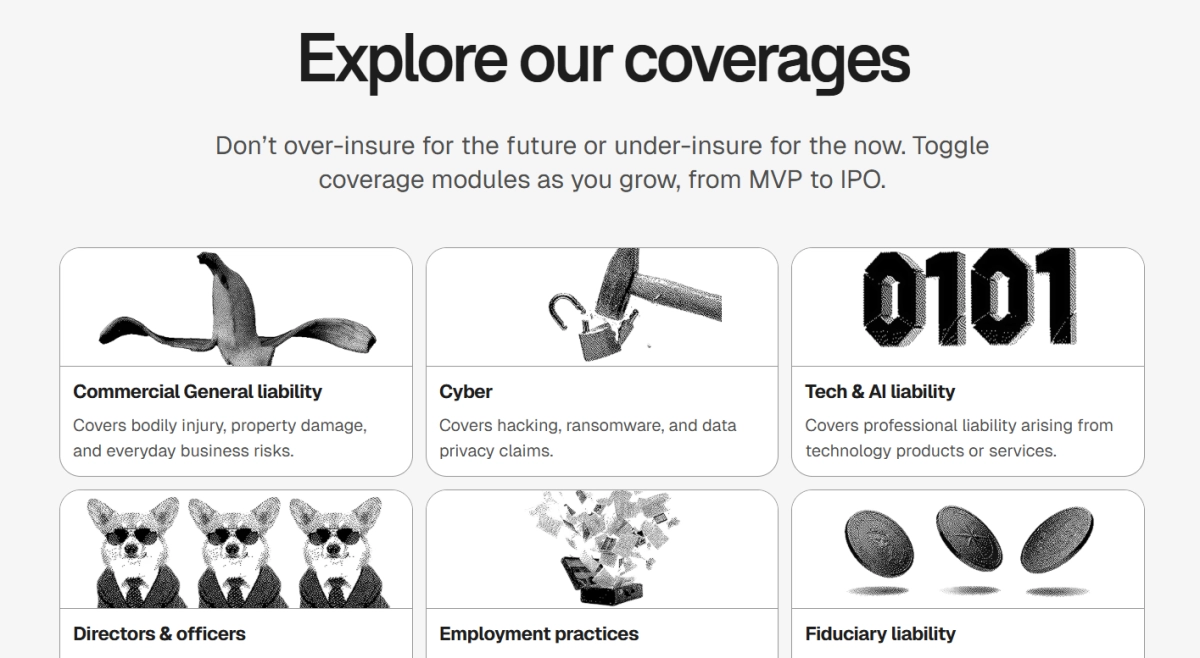

This isn't just another Insurtech broker. Corgi is a licensed carrier, meaning it controls the entire process—from underwriting and policy design to claims management—all powered by AI. Co-founder Nico Laqua argues that founders should not have to compromise speed or coverage quality. Corgi’s system promises instant quoting and adaptive coverage, crucial for venture-backed firms needing D&O, E&O, Cyber, and specific AI liability coverage.

The Full-Stack Advantage

True innovation in this sector requires owning the infrastructure. Unlike traditional insurers built around annual cycles, Corgi operates on modern systems designed for speed. The $108 million capital injection, backed by Y Combinator and Kindred Ventures, will be used to scale coverage and enhance the underlying AI. This momentum suggests a strong market appetite for infrastructure built for the modern operating realities of tech companies, challenging the decades-old dominance of traditional carriers in the high-risk startup sector.

Corgi has already surpassed $40 million in annual recurring revenue since receiving full regulatory approval in July 2025.