Cognition has raised nearly $500 million in Series C funding at a $9.8 billion valuation, according to reports. The round, led by Founders Fund, comes a month after the startup acquired rival Windsurf in one of the most chaotic episodes in recent Silicon Valley history.

The funding caps a wild summer for AI coding tools. Windsurf was originally set for a $3 billion OpenAI acquisition before IP tensions with Microsoft killed the deal. Google then swooped in with a $2.4 billion reverse acqui-hire, poaching CEO Varun Mohan and key researchers while licensing the technology. That left 250 employees in limbo until Cognition stepped in with a weekend rescue deal.

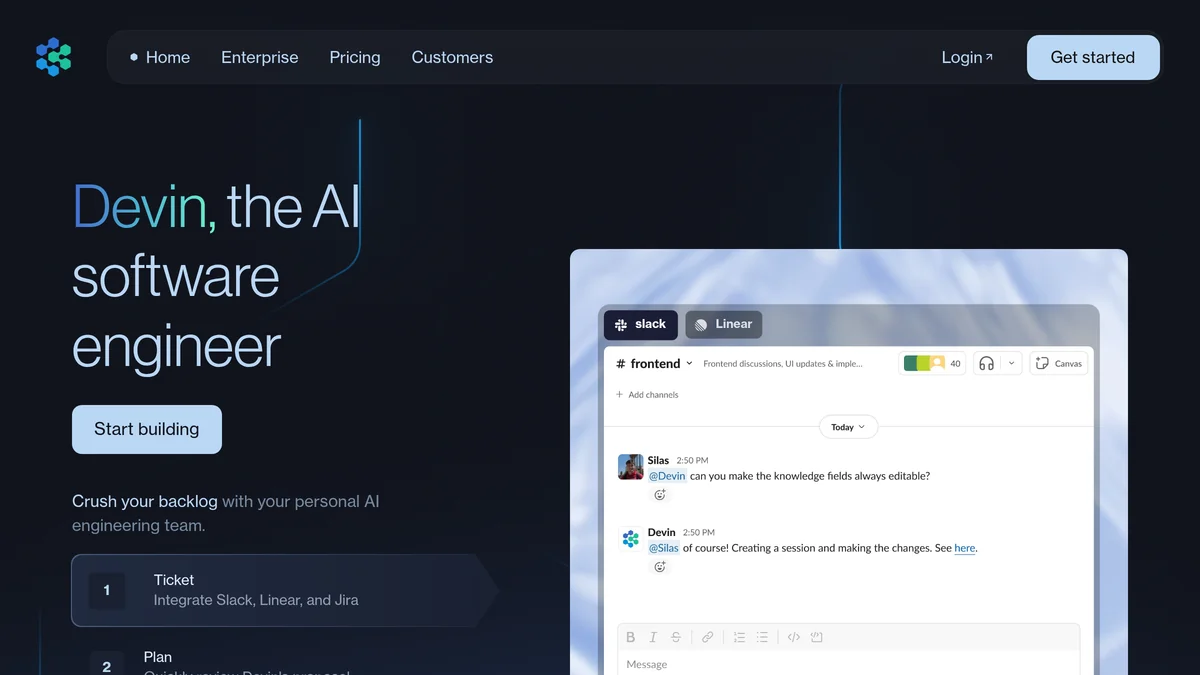

The Devin bet

Founded in late 2023 by competitive programming champions, Cognition built Devin as an autonomous AI software engineer that handles entire projects rather than just code completion. The company claims enterprise customers including Goldman Sachs and Nubank, though revenue remains minimal relative to its valuation — estimated at $180K-$360K ARR as of early 2025.

The Windsurf acquisition brought $82 million in ARR and 350+ enterprise customers, plus an AI-native IDE that complements Devin's autonomous capabilities. Three weeks later, Cognition offered buyouts to roughly 200 Windsurf employees, signaling the acquisition was more about IP than talent.

Market dynamics

The AI coding space has become a strategic battleground. GitHub Copilot generates over $500 million annually for Microsoft, while Cursor has reached similar ARR with its agent-based approach. The shift toward "agentic IDEs" — tools that can refactor across files, run tests, and handle complex workflows — represents a fundamental change from traditional autocomplete.

But Cognition's $9.8 billion valuation for a company with limited revenue reflects Silicon Valley's bet that autonomous software development will reshape a $500+ billion market. Whether that bet pays off depends on proving Devin can reliably handle production codebases at enterprise scale.

The funding gives Cognition significant resources to compete with tech giants scrambling to control the future of software development. The question is whether extreme valuations for early-stage AI companies signal innovation or bubble dynamics.