The recent demonstration of Claude’s capabilities in accelerating private equity workflows showcases a significant shift in how complex financial analysis can be executed. This is not merely an incremental improvement but a fundamental re-imagining of the entire deal process, compressing tasks that once spanned days into mere minutes or hours. The core narrative of the video highlights this transformation, following two financial professionals as they leverage AI to navigate a complex M&A scenario.

The demonstration unfolds with Sarah, an associate at Riverside Partners on the sell-side, tasked with creating a deal teaser for Horizon Health Group, an $85 million healthcare services business. On the buy-side, Jen, a VP at Wealth Capital, receives this teaser and initiates a comprehensive screening and modeling process. Both professionals leverage Claude to expedite and enhance their respective workflows, demonstrating an integrated AI assistant that profoundly impacts efficiency and the depth of analysis.

Sarah’s initial task, the creation of a client-ready deal teaser, traditionally involves sifting through vast amounts of data to extract key financials, customer retention metrics, and operational details. With Claude, this labor-intensive process is dramatically streamlined. Sarah simply prompts Claude to "Create a deal teaser for Horizon Health Group using the attached Riverside template and the Deal Teaser Skill. Extract key metrics from the data room in Egnyte—look for financials, customer retention data, and operational metrics." Claude then autonomously searches Egnyte, identifying and extracting revenue, margins, retention metrics, and facility details. The result is a professional, client-ready presentation in less than two minutes. The voiceover emphasizes this speed, stating, "In under two minutes, Sarah's got a professional teaser ready to send." This immediate turnaround exemplifies the first core insight: AI’s ability to drastically reduce the time spent on data aggregation and initial document creation, freeing up valuable human capital.

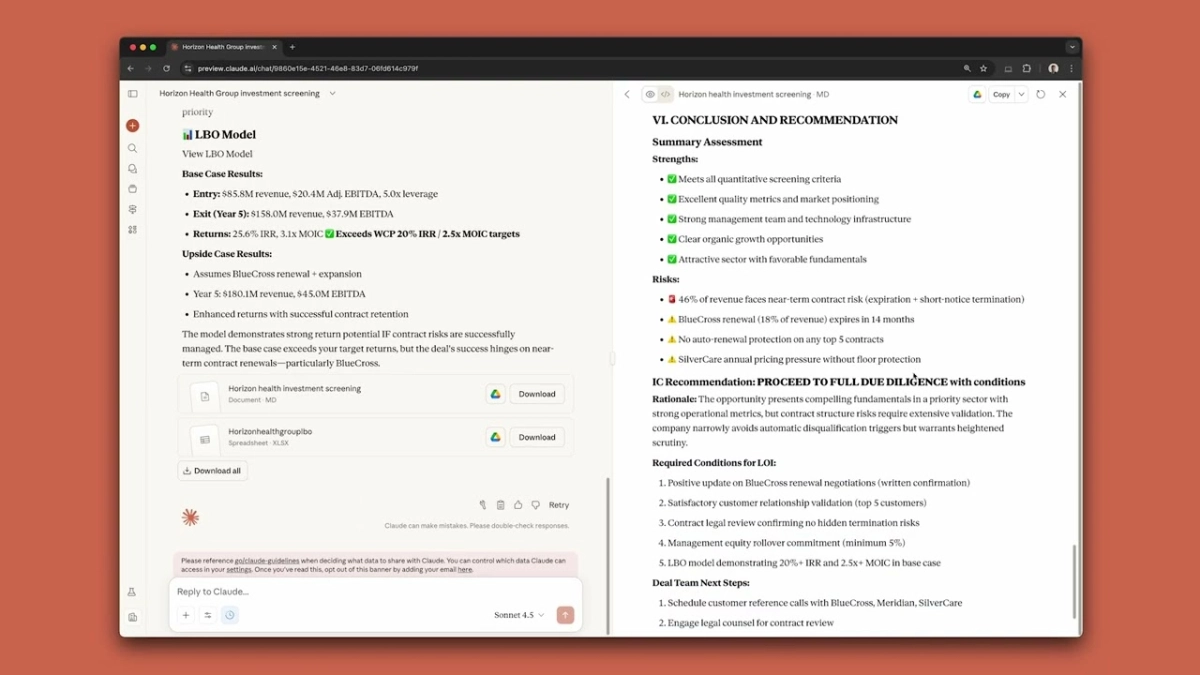

Upon receiving the teaser, Jen at Wealth Capital begins her due diligence. Her prompt to Claude is multifaceted: "Screen this Horizon Health Group teaser against our Wealth Capital investment criteria from SharePoint. Flag any risks in customer contracts (which can be found in Egnyte data room). Make a quick write-up of this. Then build an LBO model assuming 5.0x leverage, 5-year hold, and 8% revenue growth in year 1 tapering to 3% by year 5. Make a base and upside case. Use the attached Excel template and the LBO skill." Claude’s response is equally impressive. It pulls investment criteria from SharePoint, extracts relevant data from the teaser, and, critically, delves into the Egnyte data room for contract specifics.

This deep dive into contract analysis reveals a high-priority risk that might easily be overlooked in a manual review. Claude identifies that a BlueCross contract, representing 18% of Horizon Health Group’s revenue, expires in December 2025, just 14 months from the diligence date. Furthermore, 28% of revenue is exposed to short-term termination clauses. The video’s narrator highlights this crucial discovery: "Claude is deeper diligence. It searches the Egnyte data room to find that BlueCross Regional is 18% of revenue with a contract that expires December 31, 2025." This uncovers a material contract risk, demonstrating the second core insight: AI's capacity for enhanced due diligence and precise risk identification. By autonomously analyzing granular data, Claude provides a more thorough and less fallible assessment than traditional methods, preventing potential deal-breakers from advancing unnoticed.

Beyond risk identification, Claude’s ability to construct and manipulate financial models is a standout feature. It generates a full LBO model, complete with five-year cash flow projections and debt amortization schedules, in minutes. This task, historically an intensive, multi-hour endeavor for analysts, is almost instantaneous. "Claude built a complete model in minutes, which would have taken an analyst hours," the voiceover notes. Jen then stress-tests the model by requesting a downside case with 10% lower revenue and EBITDA assumptions, watching Claude update the Excel spreadsheet in real-time. She further requests a sensitivity table for IRR and MOIC across exit multiples ranging from 8x to 12x, which Claude promptly delivers. This dynamic modeling and scenario analysis capability underscores the power of AI to not only automate but also to augment complex financial tasks, providing instant insights into deal viability under various conditions.

Related Reading

- Private AI Losses Fuel Big Tech's Public Gains

- Fundrise CEO Ben Miller: It’s time to democratize access to private tech companies like OpenAI

- Financial Services Embraces AI at Unprecedented Pace, Redefining Industry Structure

The final stage of Jen’s workflow involves preparing an Investment Committee (IC) presentation. Claude synthesizes all the gathered information – screening results, contract risks, LBO model outputs, and a recommended Letter of Intent (LOI) range – into a comprehensive HTML artifact. The presentation recommends a "Conditional Pass," explicitly flagging the BlueCross renewal as a pre-LOI condition. The base case projects a 25.6% IRR, while the downside yields 19.2%, just below the 20% hurdle. This entire process, from initial screening to a detailed IC presentation with flagged conditions, takes Jen "48 hours" with Claude, a fraction of the time it would typically require. The demonstration concludes with a powerful statement encapsulating the overarching benefit: "This is better diligence. Faster."

The implications of such AI capabilities are profound for the startup ecosystem, VCs, and tech insiders. For founders seeking funding or M&A, this means faster, more rigorous evaluations from potential investors. For venture capitalists and private equity firms, it translates to a significant competitive advantage: the ability to process more deals, conduct deeper diligence on each, and allocate human talent to higher-value strategic work rather than data crunching. This is the third core insight: AI acts as a force multiplier, democratizing access to sophisticated analysis and elevating the strategic capacity of financial professionals. Claude, in this context, is not just a tool but an intelligent co-pilot, fundamentally altering the economics and timelines of private equity deal-making.