Canva, the Sydney-based design software company, recently achieved a $42 billion valuation through a new funding round. This round also facilitated a significant employee share sale. Fidelity Management & Research Company, an existing investor, led the round. New investors JP Morgan Asset Management, US Equity Group, and Growth Equity Partners also participated.

Canva now boasts $3.3 billion in annualized revenue. The platform serves 240 million monthly active users. Furthermore, 27 million users subscribe to its paid products.

Employee Liquidity and Future Outlook

Eligible current and former employees, known as Canvanauts, can sell up to $3 million USD of their vested equity. This opportunity provides early liquidity for employees. Such share sales help attract and retain top tech talent in the competitive software market.

Industry experts anticipate a potential IPO for Canva around 2026. Tender offers, like this Canva employee share sale, have become more common. They offer liquidity alternatives given current market conditions. Competitor Figma also conducted a large tender offer before its public debut. Other design software providers include Adobe.

Canva's founders, Cliff Obrecht and Melanie Perkins, plan to transfer over 80% of their stake to the Canva Foundation for charitable causes.

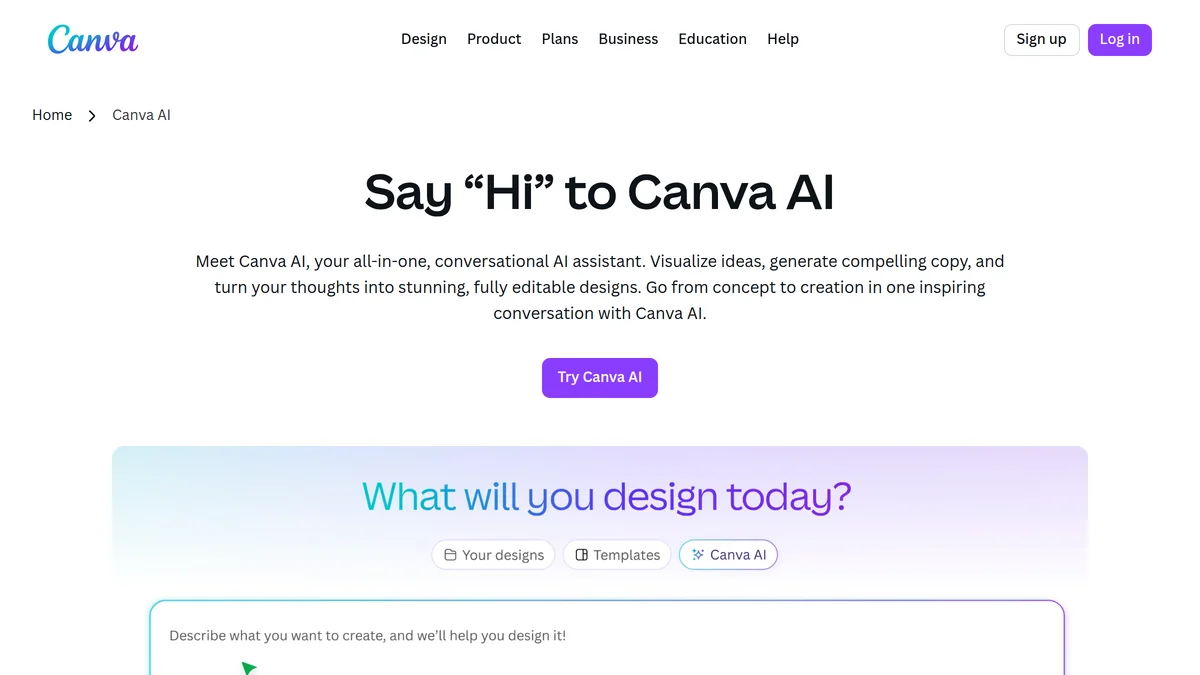

The company's robust growth signals a strong business nearing an exit. This valuation surpasses Figma's current public market valuation. Continued innovation, particularly in AI features, drives market momentum.