The tectonic plates of Big Tech are shifting, not with the dramatic tremors of mass layoffs that once dominated headlines, but through a more subtle, yet profound, "quiet restructuring." This strategic realignment is sweeping across the industry, driven by an insatiable demand for AI innovation and the staggering capital expenditures required to fuel it. For founders, venture capitalists, and AI professionals alike, understanding this nuanced evolution is paramount, as it dictates the future landscape of talent, investment, and market dominance.

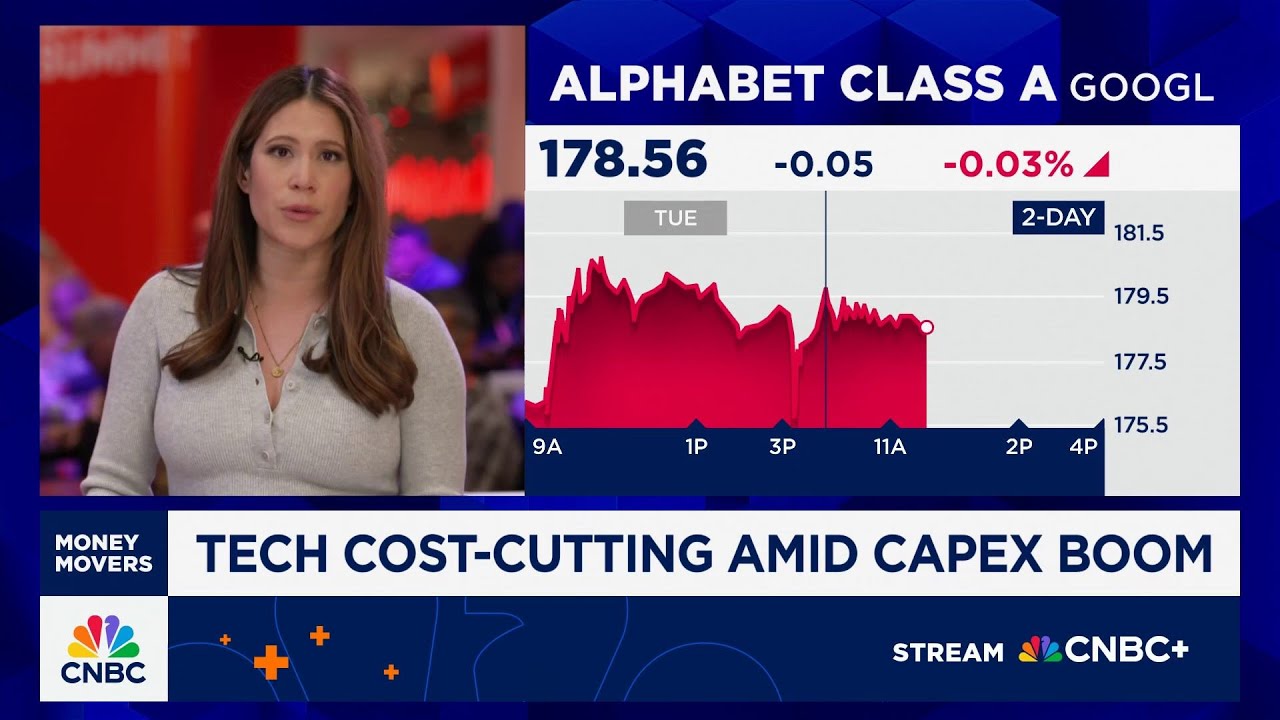

This pivotal transformation was a key focus of a recent discussion between CNBC’s Carl Quintanilla and TechCheck Anchor Deirdre Bosa at the Databricks Summit in San Francisco. Their conversation delved into Google’s recent voluntary buyout offers to employees, illuminating a broader trend where tech giants are meticulously recalibrating their workforces and financial priorities in the burgeoning AI era.

Deirdre Bosa articulated this new reality, stating, "This is the new norm in Big Tech. It's part cost discipline, part AI era reality, and making way for a new kind of workforce." Companies like Amazon, Microsoft, and Meta are exhibiting similar patterns, demonstrating a concerted effort to streamline operations even as they pour billions into AI infrastructure.

This isn't merely about cutting costs; it's about strategic re-prioritization.

Google’s voluntary buyout program, notably extending into its core Search and Ads divisions, underscores the depth of this shift. A memo to employees from Google VP Nick Fox, obtained by Jennifer Elias, explicitly outlined the program as offering "a supportive exit path for those of you who don’t feel aligned with our strategy.” This statement reveals a clear directive: talent must be aligned with the AI-first future, or they are encouraged to seek opportunities elsewhere. This directive is particularly striking given that Search and Ads remain Google’s primary profit engines, signaling that no division is immune to the AI-driven re-evaluation of headcount needs.

The underlying financial imperative for this restructuring is stark. Tech behemoths are committing unprecedented sums to AI infrastructure. Meta is projected to spend $72 billion by 2025, Alphabet $75 billion, Microsoft $80 billion, and Amazon a colossal $100 billion. As Bosa highlighted, a top priority for Google’s CFO is "cost-cutting to offset a surge in AI infrastructure spending." This massive capital outlay, coupled with the escalating "talent wars" for elite AI scientists—who can command up to $20 million over four years—necessitates significant operational efficiencies elsewhere. Workforces are becoming leaner, optimized by the very AI tools they are building.

The implications for the broader tech ecosystem are profound. While the immediate future of traditional revenue streams like search and advertising in an AI-dominated landscape remains somewhat opaque, the fundamental shift in workforce composition and strategic focus is undeniable. Companies are not just investing in AI; they are becoming AI companies, demanding a specialized talent pool and a willingness to shed roles that do not contribute directly to this new strategic direction. The quiet restructuring of today may well be laying the groundwork for the industry's next, more efficient, and AI-centric chapter.