Auquan, a leader in generative AI for deep work in financial services, has launched its Sustainability Agent, the first and only AI solution specifically designed to free sustainability teams from the burden of manual, time-consuming tasks. One-quarter of the top 25 global financial services firms rely on Auquan to revolutionize how they gather and analyze intelligence for critical decisions, unlocking major productivity gains, expanded research coverage, and faster insights.

Sustainability professionals in finance spend countless hours manually researching performance and risks, structuring unstructured data into actionable insights, and drafting reports—leaving little time for the strategic work that first drew them to the field. Auquan’s Sustainability Agent transforms this process by autonomously handling entire workflows, from company screening and monitoring to generating framework-aligned reports and real-time alerts. This allows teams to focus on driving sustainable value creation and strengthening stakeholder engagement.

“Sustainability teams face two major challenges: quickly accessing and processing reliable data on private companies and keeping up with constantly evolving ESG regulations and investor demands,” said the head of sustainability at a top 25 global private markets firm. “Auquan bridges these gaps with AI. What once took days of manual work is now delivered as insights and reports exactly when we need them, enabling teams to assess risks, proactively engage with portfolio companies, and keep limited partners informed.”

Built with deep finance domain expertise, Auquan’s Sustainability Agent processes data from over 550,000 private and public companies, with new private company coverage added on demand within an hour. It continuously aggregates insights from more than 2 million sources in over 65 languages, drawing from corporate filings and disclosures, regulatory documents, legal filings, news and media coverage, NGO reports and research, industry analyses and reports, and web content.

To ensure alignment with global standards, Auquan’s Sustainability Agent automatically structures insights in accordance with key sustainability frameworks, including the Sustainable Finance Disclosure Regulation (SFDR), the Corporate Sustainability Reporting Directive (CSRD), the Sustainability Accounting Standards Board (SASB), the United Nations Global Compact (UNGC), the United Nations Sustainable Development Goals (SDGs), and modern slavery acts in the UK, Australia, and Germany’s Supply Chain Act.

“At Auquan, our mission is to free financial professionals from tedious manual tasks and allow them to focus on meaningful work,” said Chandini Jain, CEO of Auquan. “With the Sustainability Agent, we’re breaking the cycle of data gathering and report writing, enabling teams to focus on initiatives that mitigate risk, enhance stakeholder engagement, and drive lasting impact.”

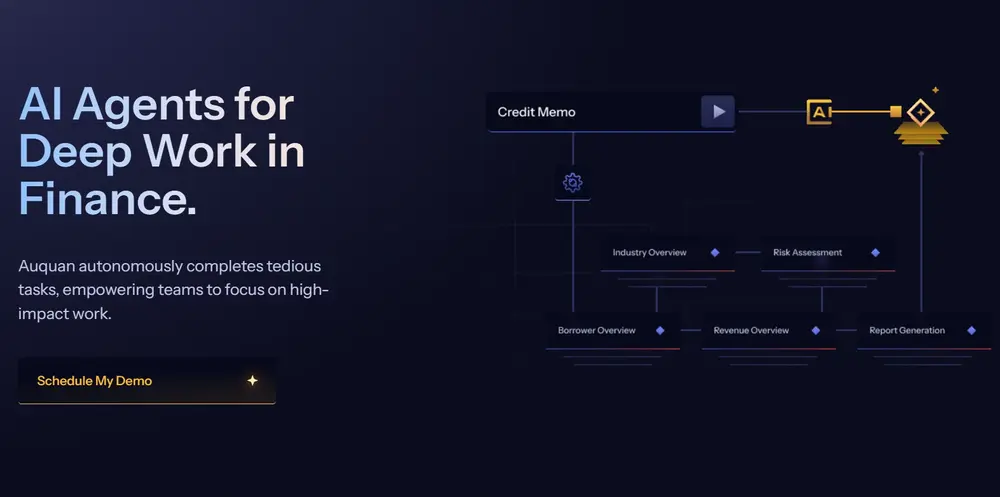

This launch builds on Auquan’s established track record of helping financial teams streamline complex, knowledge-intensive workflows. Since the introduction of its agentic AI platform in late 2023, Auquan has empowered professionals across private markets, asset management, and financial services to dedicate more time to high-value work in areas such as deal screening and due diligence, portfolio monitoring and risk assessment, regulatory compliance and reporting, reputational and regulatory risk monitoring, and impact investing and reporting.

Customers experience immediate benefits with turnkey solutions while also having the flexibility for custom implementations tailored to unique research and reporting needs. Teams begin saving hours of manual effort within days of deployment. Auquan’s Sustainability Agent is available now through direct purchase or via the Microsoft Azure Marketplace.