"The way that we look at AI is that it's one of the most profound technologies of our lifetime." This declaration from Apple CEO Tim Cook, highlighted by CNBC's Steve Kovach, underscores the seismic shift artificial intelligence is bringing to the tech industry. Yet, as other megacap companies detail massive capital expenditures to build out their AI infrastructure, Apple's strategy remains notably opaque, signaling a distinct path in the burgeoning AI race.

During a segment on CNBC's 'Money Movers,' Technology Correspondent Steve Kovach discussed Apple's recent earnings call where Tim Cook revealed a "significantly increasing" spend on AI, encompassing both talent and compute. This came amidst broader reporting on Big Tech's annual capital expenditure outlooks, revealing a collective surge in AI investment across the sector.

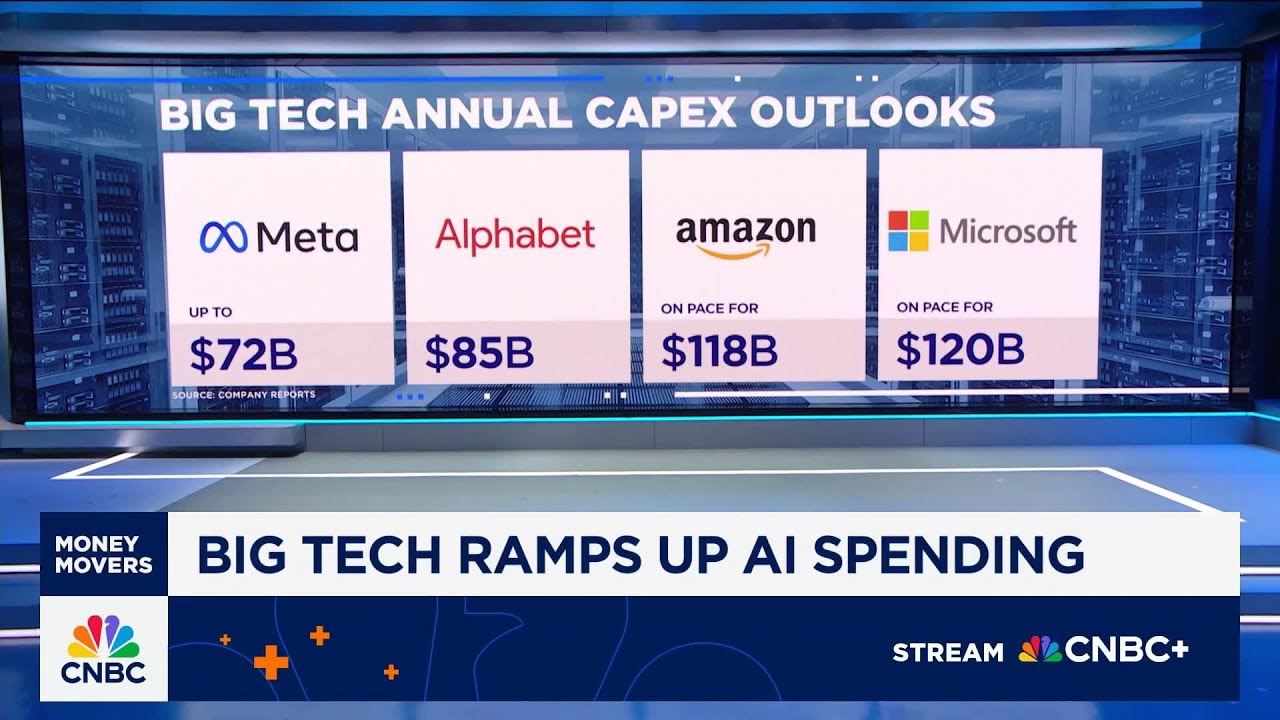

The financial commitments from tech giants are staggering. Microsoft is on pace to spend $120 billion, Amazon $118 billion, Alphabet $85 billion, and Meta up to $72 billion. These figures paint a clear picture of an industry pouring resources into AI. Meta, for instance, focuses on "core AI" to drive immediate ad growth, acknowledging that generative AI's return on investment will take longer, aligning with their "scale first, monetize later" philosophy. Amazon and Microsoft, as the dominant cloud hyperscalers, are deploying their capital to support cloud growth, recognizing their role as the foundational "cloud backbone of artificial intelligence." Alphabet, similarly, is investing to bolster consumer products like Gemini and search, alongside its cloud infrastructure.

Apple, however, stands as an outlier in its disclosure, providing no specific dollar figure for its increased AI spending. This lack of quantitative detail, coupled with Cook's cautious remarks, offers a critical insight into Apple's strategic approach.

When pressed on whether AI models are becoming commoditized, Cook demurred, stating, "What pieces of the chain are commoditized and not commoditized, I wouldn't want to really talk about today because that gives away some things on our strategy." This reticence suggests a deliberate strategy diverging from the hyperscalers' full-stack, build-it-all approach. Rather than investing colossal sums in foundational models and massive compute infrastructure from scratch, Apple appears poised to leverage existing, proven AI technologies through strategic partnerships. This approach could significantly reduce capital expenditure while allowing Apple to integrate cutting-edge AI capabilities directly into its ecosystem, focusing on user experience and product differentiation.

Apple's history often involves integrating best-in-class components and technologies from external partners, then optimizing them for its tightly controlled hardware and software ecosystem. This could be their playbook for generative AI. By partnering with leading AI companies like OpenAI or Anthropic, as suggested by Kovach's analysis, Apple could rapidly deploy advanced AI features without incurring the immense upfront costs and development cycles associated with building proprietary large language models from the ground up. This allows them to focus on what they do best: product integration and user experience. The contrasting strategies highlight a pivotal moment in AI development. While some companies are betting big on owning the entire AI stack, others, like Apple, seem to be opting for a more capital-efficient and potentially faster route to market by focusing on application and integration.