In the high-stakes arena of artificial intelligence, where colossal capital expenditure is the new norm, Amazon has successfully distinguished its strategic vision, earning a significant vote of confidence from investors. While the broader market grapples with the sheer scale of investment required for AI infrastructure, Amazon’s approach has been met with enthusiasm, validating its long-term bets on foundational compute and custom silicon. This discerning market reaction, highlighted in a recent CNBC segment, underscores a critical shift: mere spending is no longer enough; a clear path to return on investment is paramount.

Contessa Brewer, anchoring CNBC’s "The Exchange," spoke with reporter MacKenzie Sigalos about the winners and losers from the latest megacap tech earnings, specifically focusing on how major players are navigating the AI boom. The discussion centered on the differential market response to the significant capital expenditures (CapEx) being funneled into AI infrastructure by the industry's giants. Sigalos succinctly captured the market sentiment, noting that the "Q3 print was all about Amazon selling the street on its AI vision and investors bought it," a direct reflection of the company's robust performance following its earnings report.

Amazon’s strategy, as articulated by CEO Andy Jassy, is remarkably straightforward yet profoundly impactful: to "own the compute backbone powering the next generation of AI companies." This isn't just about constructing more data centers; it's about building the essential, underlying infrastructure that AI innovators and enterprises will rely upon. This strategic clarity has manifested in Amazon Web Services (AWS) demonstrating impressive growth, expanding "just over 20%, its fastest pace in three years." Such a resurgence in AWS’s growth, following a period of deceleration, signals a powerful re-acceleration driven largely by AI-related demand. Jassy’s confidence further reinforced this, stating that demand is "so strong that momentum like this should continue for a while," a sentiment echoed by the significant future deal pipeline, with October alone securing more unannounced deals than the entirety of Q3.

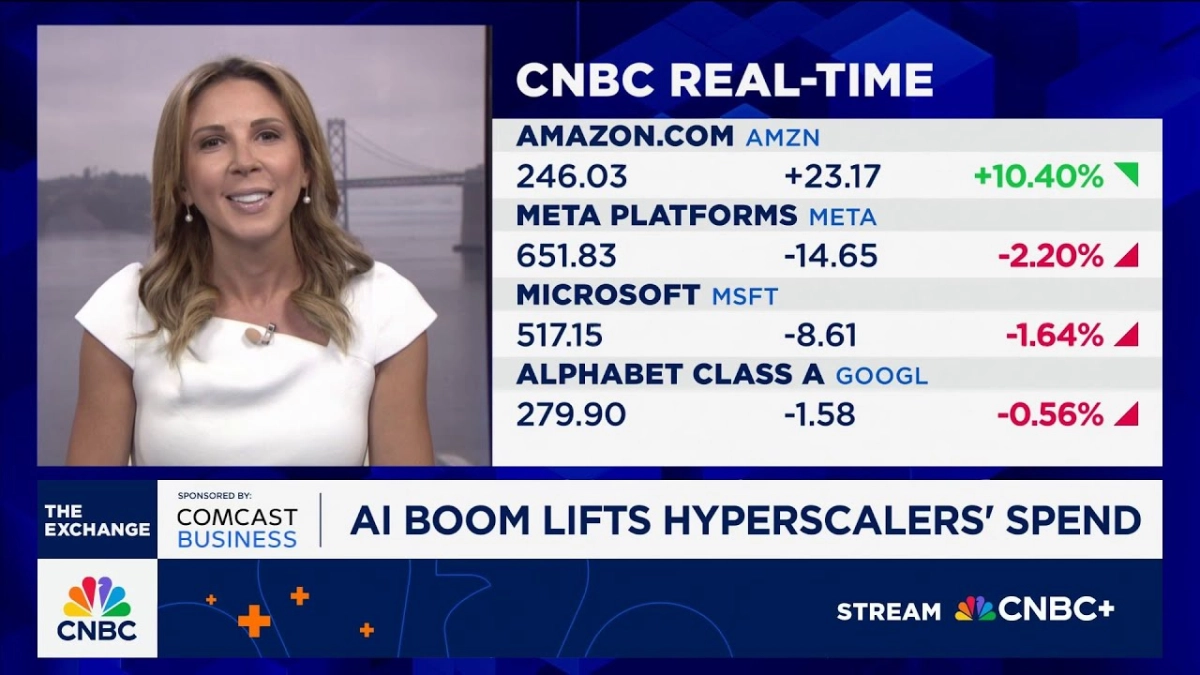

The scale of investment across the tech landscape is staggering. The "big four hyperscalers"—Amazon, Alphabet, Microsoft, and Meta—are collectively projected to spend nearly $400 billion in combined CapEx this year. This deluge of capital is indicative of the intense race to establish dominance in the burgeoning AI domain. However, Wall Street's response has been far from uniform. While Amazon and Alphabet were rewarded with fresh all-time highs, Microsoft and Meta experienced stumbles in their stock performance despite also upping their compute commitments. This divergence reveals a crucial insight for founders and venture capitalists: not all AI investments are created equal in the eyes of the market.

The market's discerning eye is now firmly fixed on the return on investment (ROI) from these massive capital outlays. Microsoft and Meta’s dip, particularly Meta’s, was attributed in part to shareholders not fully grasping "the Meta hyperscale narrative given it doesn't have a cloud service like the others." This highlights a fundamental advantage Amazon possesses through AWS: a direct, established, and revenue-generating channel for its AI infrastructure. Amazon's commitment of $125 billion into custom chips and new infrastructure specifically "built for AI giants like Anthropic" is not just spending; it's an investment into a proven business model that directly monetizes compute power.

Related Reading

- Alphabet's AI Investments Drive Record Revenue, Defying Cannibalization Fears

- Beyond the Magnificent Seven: Unearthing AI's Hidden Investment Gems

- Meta's AI Patience Test: Goldman Sachs on Divergent Tech Fortunes

This approach positions Amazon as a foundational enabler, providing the very bedrock upon which the future of AI will be built. For startup founders, this means a reliable, scalable, and increasingly optimized platform for their AI models and applications, reducing the burden of building proprietary infrastructure. For VCs and AI professionals, it signifies a robust ecosystem where innovation can thrive without needing to reinvent the underlying hardware and cloud services. The ability to turn CapEx directly into revenue, as Amazon is demonstrating, sets a new benchmark for how AI investments are evaluated.

The new playbook for hyperscalers, therefore, transcends mere capacity expansion. It is about converting that immense spend into tangible ROI. Jassy’s assertion that "as fast as they are adding capacity, Amazon is making money off of it" encapsulates this critical distinction. This isn't speculative spending; it is strategic investment in a core business unit with clear revenue streams and a rapidly expanding client base. Amazon is not just participating in the AI race; it is building the very track on which the race is run, and the market is taking notice.