Alphabet’s recent earnings report, particularly its robust cloud performance, serves as a powerful indicator for the accelerating Artificial Intelligence trade, suggesting a significant tailwind for the sector. While the market celebrates new highs, veteran investors are urged to proceed with a degree of caution.

BD8 Capital Partners CEO & CIO Barbara Doran spoke with CNBC about Alphabet’s latest quarterly results, the burgeoning AI market, ongoing U.S. trade negotiations, and the broader implications for investor strategy. Her insights offered a nuanced perspective on the current financial landscape.

Doran highlighted Alphabet’s impressive 32% year-over-year growth in its cloud division, underscoring its position as the third largest player after Microsoft and Amazon. She noted, “Their results were very strong and very encouraging because, of course, we know the demand that’s happening there.” This vigorous demand for cloud infrastructure is a direct reflection of the escalating need for computing power to fuel AI advancements, confirming AI as a dominant force.

The exponential growth in generative AI, exemplified by ChatGPT’s user base doubling twice in a few months, necessitates immense computational resources. This undeniable demand ensures the AI trade is "just getting more and more powerful."

However, despite these bullish indicators, Doran's "word of the day" for professional investors was "cautious." The market, particularly the Nasdaq and S&P, is reaching new all-time highs, with valuations at 22.5 to 23 times earnings.

This elevated market presents a challenging environment for deploying fresh capital. The resurgence of "meme stock" activity, often a precursor to market froth, signals an overheated climate where professional investors need to be discerning.

Regarding international trade, Doran suggested the market has largely priced in an eventual resolution to U.S.-China tariffs, anticipating an average rate of 15-16% rather than the more draconian figures initially proposed. She views President Trump's aggressive tactics as a leverage tool designed "to bring people to the table quickly."

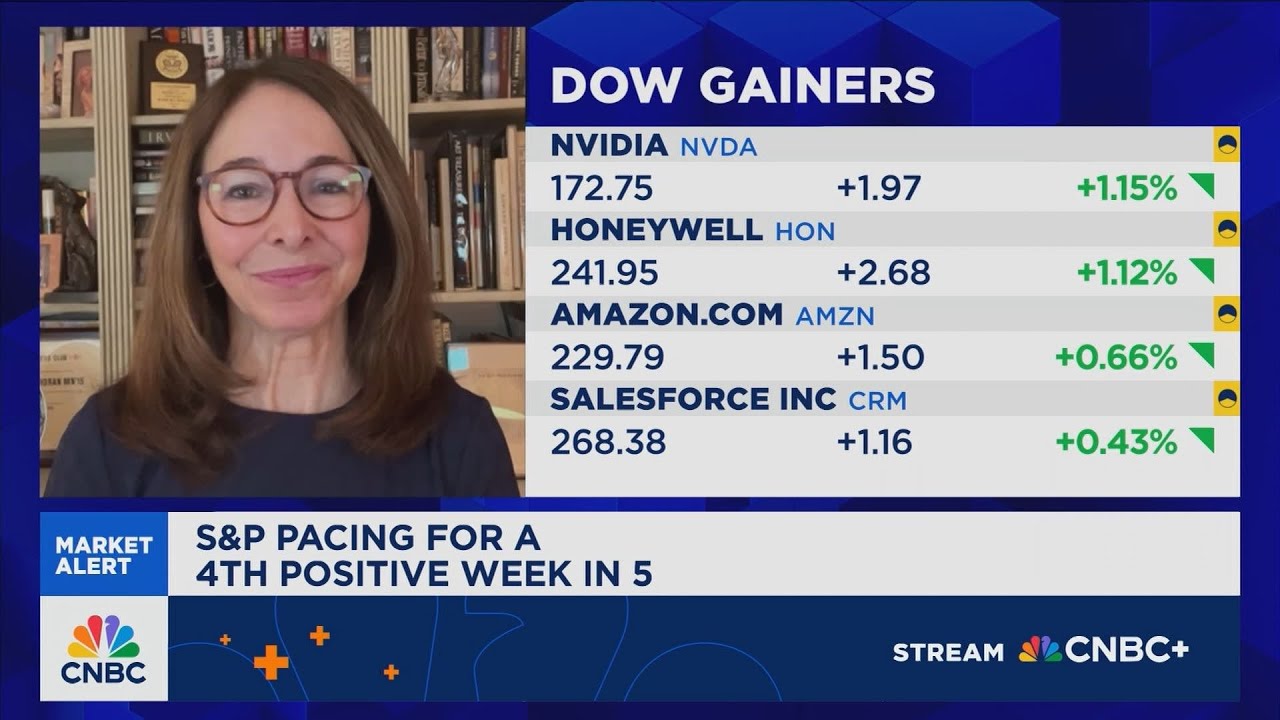

For those invested in AI-focused stocks like NVIDIA, Broadcom, Meta, and Microsoft, many of which are near their all-time highs, Doran advises a proactive risk management approach. She unequivocally states, “As they run up… you must take some off the table.” For those not yet positioned, establishing "at least a toehold" is recommended, acknowledging the long-term potential while advocating for prudent entry points.