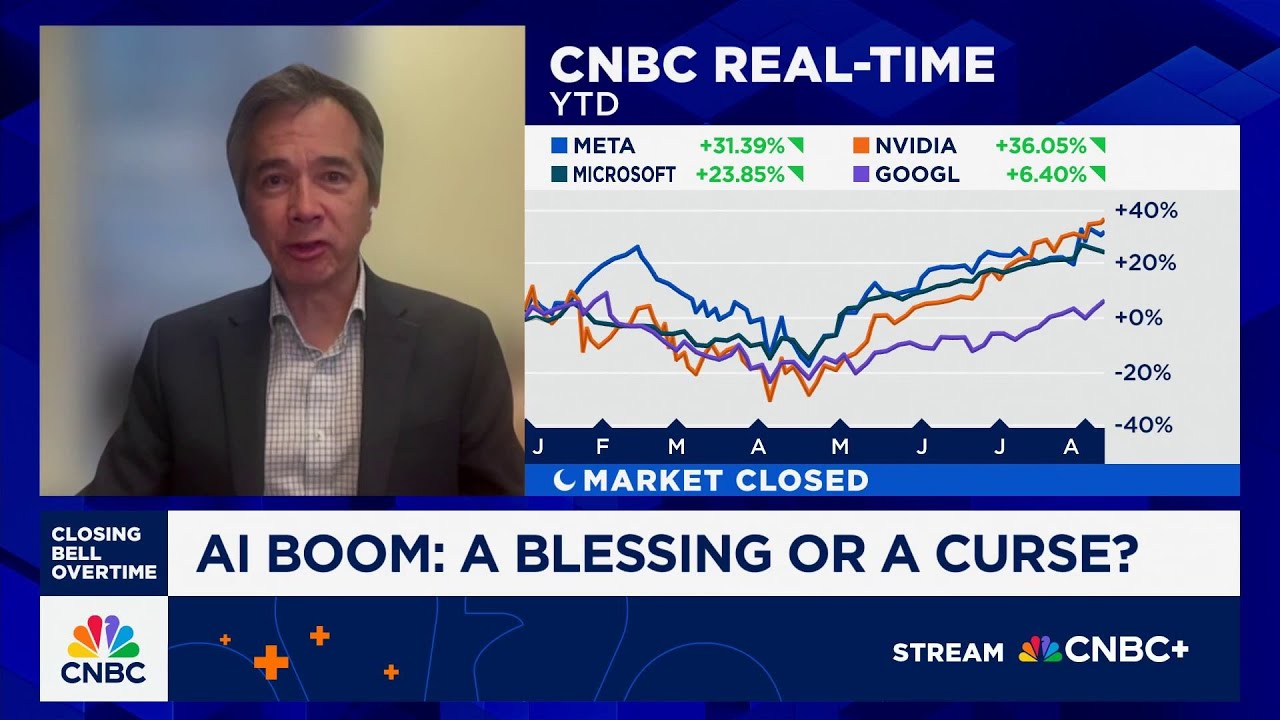

The unprecedented capital expenditure by tech giants in artificial intelligence, while propelling economic growth, presents a hidden risk that echoes past tech bubbles. Greg Ip, the Wall Street Journal's Chief Economics Commentator, joined CNBC's "Closing Bell: Overtime" to dissect the economic implications of the current AI boom, questioning the sustainability of the massive investment in the absence of commensurate profits.

Ip highlighted that the sheer volume of AI-related spending is acting as a significant economic "prop." He noted, "in the first half of the year the economy grew about 1.2% annual rate, half of that came from information processing equipment investment and that was by and large data processing and all that's AI related." This influx of capital into data centers, hardware, and product development is undeniably fueling a segment of the economy.

However, a critical concern emerges when examining the financial returns on this investment. The substantial spending by companies like Alphabet, Amazon, Meta, and Microsoft, projected to reach $340 billion this year alone, can only be justified if it translates into significant profits. Ip cautioned that "the kind of spending they're doing can only be justified if they start to put up profits that are commensurate with that investment. And it could happen, smart people say it will happen, but it's not happening right now and you're seeing that basically in the big drag on cash flow that this CapEx has created." This divergence between capital outlay and immediate cash flow generation warrants careful observation from investors and industry insiders.

For those familiar with the dot-com era, the current AI frenzy evokes a sense of déjà vu. Ip drew a direct parallel, recalling how "anybody who literally put .com in their name got a halo effect." While acknowledging the internet revolution's genuine impact on productivity and economic growth, he pointed out that intense competition ultimately "competed away all the margin."

This competitive landscape is precisely what poses a challenge to the formation of sustainable "moats" in AI. With new models and innovations emerging almost weekly, the rapid pace of development and the open-source nature of much foundational AI research make it difficult for any single entity to establish an enduring competitive advantage that guarantees consistent, strong profits. "It just strikes me that these are difficult conditions for anybody to be able to claim with confidence that they're going to be able to have a kind of a moat around the business, the sort of moat that generates consistent, strong profits," Ip stated, contrasting it with the established profit engines like Microsoft's Windows or Apple's iPhone. The fundamental question for founders and VCs remains: can today's massive AI investments translate into the durable, profitable businesses that justify current valuations, or are we witnessing a speculative surge where competition will ultimately erode the very margins sought?