The ongoing "AI talent war continues in tech without generating many jobs," according to Diane Swonk, Chief Economist at KPMG, highlighting a significant paradox at the heart of the current economic landscape. This keen observation from Swonk, made during a recent appearance on CNBC's "The Exchange" alongside Kelly Evans and Scott Wapner, cuts through the often-optimistic rhetoric surrounding artificial intelligence to reveal a more nuanced and potentially precarious reality for the labor market. Her commentary, following the release of the October and November jobs data, painted a picture of an economy grappling with mixed signals, consumer resilience, and persistent inflationary pressures, all while the transformative force of AI reshapes the tech sector's employment dynamics.

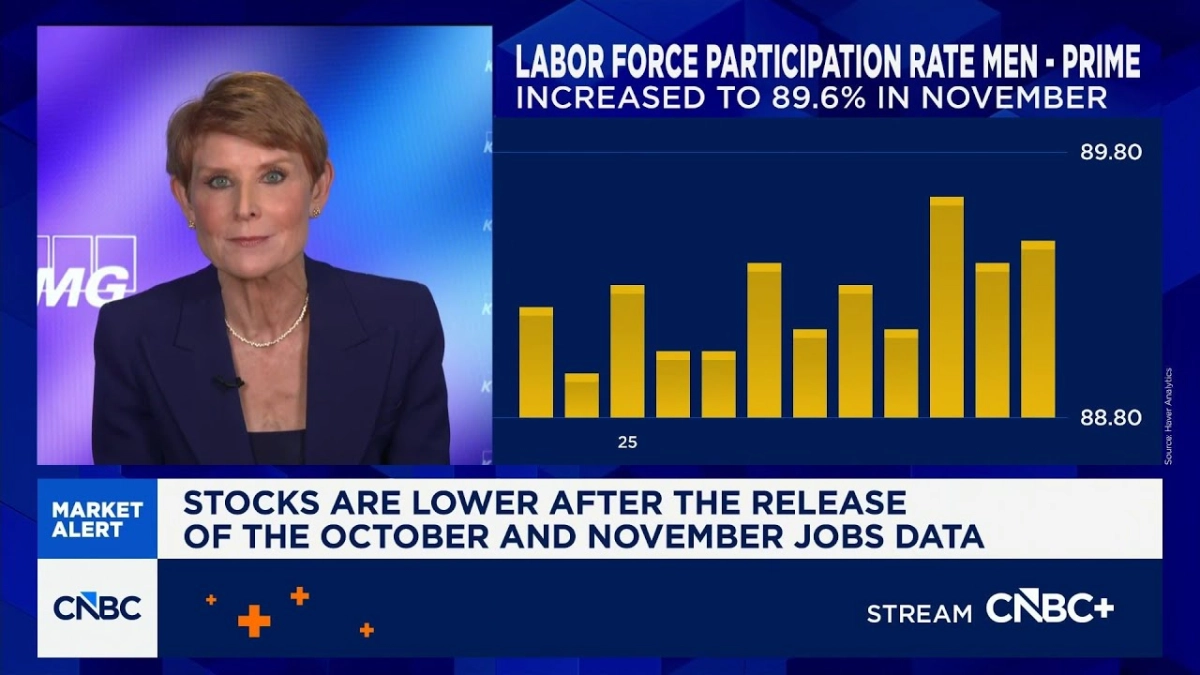

Swonk detailed how the employment data has "went into the red for two months on net," signaling a deceleration that belies some of the broader economic narratives. While consumers continue to spend, with core retail sales showing a surprising 0.9% increase, the underlying health of the labor market appears less robust. Payroll growth has remained largely stagnant since April, a "long time to be stagnant," as she put it, indicating a lack of dynamic job creation.

A particularly striking insight offered by Swonk concerned the structural weakness of the labor market. She characterized it as "a one-legged stool," with employment gains in the private sector almost exclusively driven by healthcare and social assistance. This over-reliance on a single sector for job growth is, in her estimation, "nothing to be excited about" and inherently "precarious." For founders and VCs, this suggests that while certain industries may thrive, the broader talent pool might not be expanding in a diversified manner, potentially leading to bottlenecks and wage inflation in specific, in-demand areas, even as overall job growth lags.

The AI talent war exacerbates this imbalance, creating intense competition for highly specialized roles within tech without a corresponding surge in overall employment. Instead, the rapid expansion of AI infrastructure, particularly data centers, is stressing utilities and leading to increased overtime hours for existing workers rather than widespread new hires. This dynamic implies that the immediate impact of AI on employment is less about mass job creation and more about a recalibration of skill sets, placing immense pressure on the existing workforce and infrastructure, rather than stimulating broad economic expansion through new employment opportunities.

Looking ahead, Swonk noted the potential for a strong December for job gains, mirroring last year's trend where the holiday season compression led to the "strongest month for job gains of the entire year." However, this seasonal boost might mask deeper issues. The prospect of Fed rate cuts and the retroactive expansion of tax cuts in 2025, which consumers tend to treat as "windfall gains," could fuel further consumer spending. While seemingly positive, Swonk warned this could make "the inflation data look even stickier," complicating the Federal Reserve's efforts to achieve price stability.

The Fed's challenge, as highlighted in the discussion, is compounded by the persistent stickiness of inflation. Despite five years into an inflationary period, price stability remains elusive. Swonk observed that while some increases might be "tariff-related," they are not "all at once" but rather "coming sequentially," mimicking and further normalizing inflation. This continuous, albeit sometimes gradual, rise in prices creates a "stagflationary nature" where the economy, despite looking stable or even growing on paper, "feels" worse to the average consumer due to eroded purchasing power.

For tech insiders and defense/AI analysts, Swonk’s analysis underscores a critical dichotomy. On one hand, the relentless pursuit of AI innovation fuels a specialized talent war and demands significant infrastructural investment. On the other, the broader economic environment shows signs of a fragile, uneven recovery, with employment gains concentrated and inflation proving stubbornly persistent. The implications are clear: while AI promises future productivity gains, its current integration is not a panacea for the labor market's structural issues, nor does it inherently ease inflationary pressures.

The current economic moment demands a keen eye for underlying trends. Swonk’s insights serve as a potent reminder that headline numbers can often obscure more complex realities. The "one-legged stool" of the labor market, the concentrated nature of AI's job impact, and the enduring challenge of inflation collectively paint a picture of an economy in transition, where the gains are unevenly distributed and the path to genuine stability remains fraught with challenges. Navigating this landscape will require more than just technological advancement; it will necessitate a deep understanding of these intricate economic forces.