The prevailing narrative of a market buoyed by artificial intelligence is far from settled, according to Stephanie Guild, Chief Investment Officer at Robinhood. Despite a recent market rebound, particularly in mega-cap technology, Guild asserts that the long-term returns on AI remain a significant question mark for investors. Her analysis, shared during a recent CNBC interview, underscores a bifurcated economic reality and a call for discerning investment strategies beyond the obvious tech giants.

Guild spoke with a CNBC anchor about the current market landscape, characterized by lingering AI uncertainty and notable dispersion across sectors. Her insights painted a picture of "two economies" — the buoyant Wall Street market, often driven by a handful of tech behemoths, and the broader economy, which experiences different pressures and opportunities. This divergence necessitates a more granular approach to portfolio construction, moving beyond broad market bets to identify specific pockets of value.

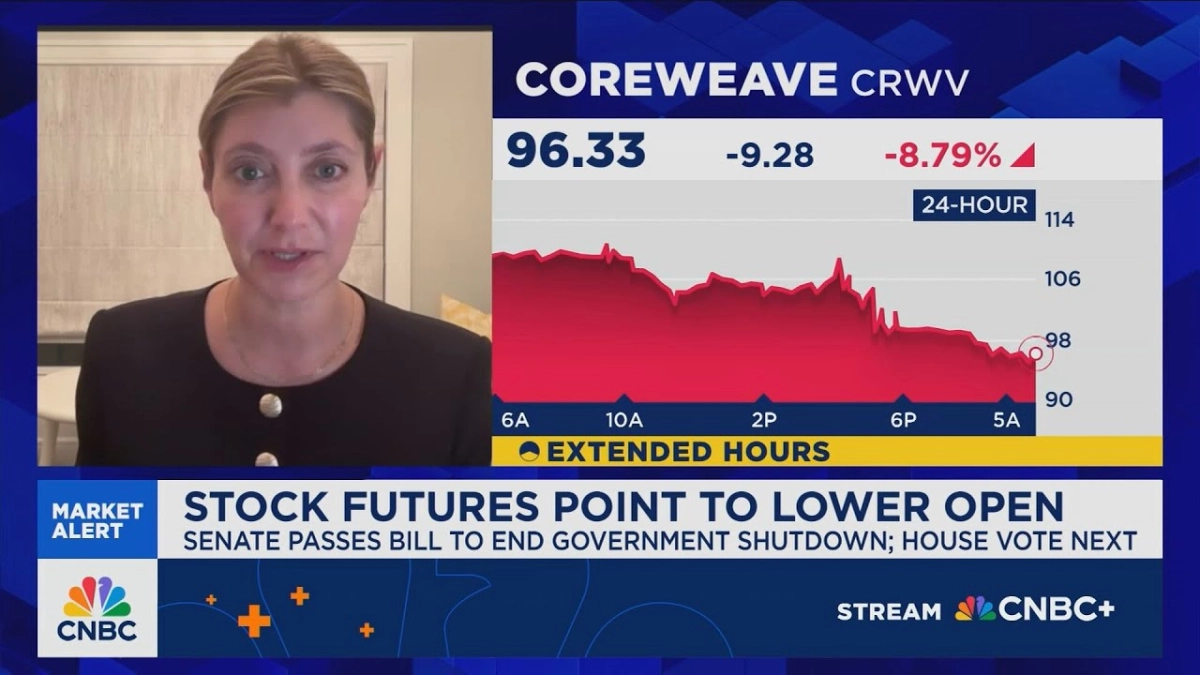

The volatility observed in the tech sector, even after significant gains, is not new, Guild noted, having made a call for elevated volatility at the end of last year. This ongoing fluctuation highlights the speculative nature of the AI trade in its nascent stages. "The AI trade is certainly still in question," Guild stated, emphasizing that "the question of the returns on AI, at least in the near term, is still certainly out there." For founders and VCs entrenched in the AI ecosystem, this serves as a critical reminder that while innovation is rampant, the path to sustained, measurable financial returns for public market investors is not yet fully clear. The rapid shifts in market sentiment around AI-driven companies demand careful valuation and a clear understanding of underlying business models beyond the hype cycle.

This market dispersion, Guild’s "word of the day," is a defining characteristic of the current environment. She likened it to Europe post-2008, where a single currency and interest rate policy had to contend with vastly different economic realities across member nations. Today, the U.S. market faces a similar challenge, with varying performance among different company sizes and sectors. This divergence creates both risk and opportunity, requiring investors to look beyond headline indices.

While mega-cap tech has seen immense gains, Guild pointed to positive stories emerging from "some of the cheaper tech names, some of the smaller tech names, pharmaceuticals." This suggests that value is increasingly found in overlooked or less-hyped segments. Her analysis implies that the current market environment rewards fundamental analysis and a willingness to explore less crowded trades, rather than simply chasing momentum in established leaders.

For strategic positioning, Guild highlighted several areas. Healthcare, particularly niche pharmaceutical companies, presents a compelling case. She specifically cited Neurocrine Biosciences, held within Robinhood's strategies portfolios, as an undervalued "high-quality company" focused on neurological disorders. Its consistent earnings and future pipeline, including Ingrezza, are "just sort of underappreciated." This focus on micro-stories, companies with strong fundamentals and specific market niches, offers a counter-narrative to the macro-driven volatility.

Related Reading

- AI is a "Buy the Dip" Market, Driven by Surging Earnings

- Tom Lee: AI Trade Fundamentals Remain Robust Amidst Market Scrutiny

- Siegel: AI Trade Endures Amidst Market Jitters

Another sector poised for growth, according to Guild, is mid-cap defense. She noted that while major aerospace and defense players have seen significant runs, there is still "a lot of room to run" in smaller, more specialized companies within the sector. The renewed government focus on capital expenditure and defense initiatives, supported by legislative actions, is expected to provide a tailwind. Guild specifically mentioned Kratos Defense and Security, suggesting that companies contributing to advancements like drone technology could see substantial benefits. This segment appeals to defense analysts and tech insiders monitoring government spending and emerging military technologies.

Finally, select consumer names also offer value, particularly those positioned to perform well even in a constrained economic environment. TJX Companies, for example, is a name Robinhood holds, reflecting a strategy to identify resilient businesses that can navigate potential consumer pressures. These picks collectively underscore a strategy of seeking out quality, value, and micro-stories that are less susceptible to the broad swings of the AI-dominated narrative or wider economic uncertainties.