Gelt, the AI tax firm serving high-net-worth individuals and scaling businesses, today announced it has raised $13 million in Series A, bringing its total funding to $21.2 million. The series A funding was led by Zvi Limon of the Rimon Group, Vintage Investment Partners, and TLV Partners. The company has also appointed Yoram Tietz, former Managing Partner at EY and current Senior Advisor at General Atlantic, as Chairman of the Board.

Since its launch three years ago, Gelt has tripled its user base year over year while helping clients achieve significant annual tax savings through its AI-powered platform and CPA team. At the same time, the company has increased its profit margins from a historical average of 20-30 percent to a current range of 55-66 percent, a level rarely seen in service-based industries.

Unlike traditional firms that only focus on annual filings, Gelt's proprietary AI-powered platform scans the tax code and immediately implements it on a per-client basis. When the system spotted that one of its venture partners was overpaying through a standard W-2 salary, Gelt restructured the income through an S-Corp, cutting payroll taxes and revealing federal deductions that saved the client more than $100,000 in a single year. By surfacing opportunities like this in real-time, Gelt enables its CPAs to focus on strategy while clients see immediate, measurable results.

"Most successful individuals and businesses are stuck with once-a-year tax scrambles that miss opportunities all year long," said Tal Binder, founder and CEO of Gelt. "We've built the first tax firm where AI handles the complex analysis so our elite CPAs can deliver a proactive strategy that saves clients significant money and removes the compliance burden entirely. By combining state-of-the-art AI with licensed expertise, we allow our professionals to focus on strategic insights and client relationships, leading to better results in a fraction of the time. We are here to speed up the offering and fundamentally change what a tax professional can achieve.”

Gelt's technological core is a proprietary AI platform composed of 17 specialized AI agents. This multi-agent system is designed to perform the full scope of a tax engagement, transforming a "super complex" tax return of 100 pages into a clear, actionable strategy. The agents work in concert: one agent may be responsible for breaking down multiple PDFs and extracting all relevant data, while another analyzes that information to find missed opportunities. This sophisticated engine generates both gap analyses (GPAs) and strategic opportunities that were overlooked in previous years.

Gelt's AI also features a reasonable salary calculator that generates a supporting report for the salary an individual should take, offering options from aggressive to conservative based on risk tolerance. This AI-driven insight provides clients with the data needed for audits and compliance.

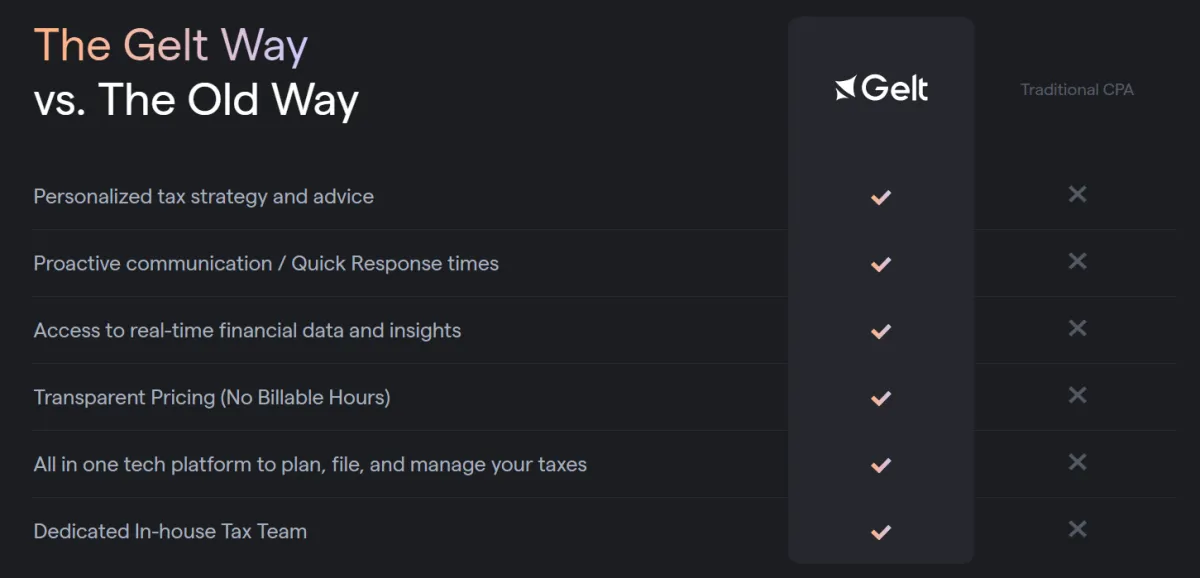

According to Shahar Tzafrir, Managing Partner at TLV Partners, Gelt is transforming the tax advisory industry by reimagining the business model itself. Instead of simply selling software to accountants, Gelt has built an "AI-native service" where technology and human experts work directly with clients to provide proactive, continuous guidance and greater value. Gelt's new Chairman, Yoram Tietz, adds that by combining advanced technology with licensed expertise, the firm is modernizing a critical category and is uniquely positioned to reshape how successful individuals and businesses manage their taxes, ultimately delivering clarity, control, and measurable value.

Gelt plans to launch advanced estate planning integration, expand multi-state capabilities, and introduce predictive tax modeling for major financial decisions.

The company is actively recruiting senior CPAs and expanding into key markets, including real estate, healthcare, and financial services.