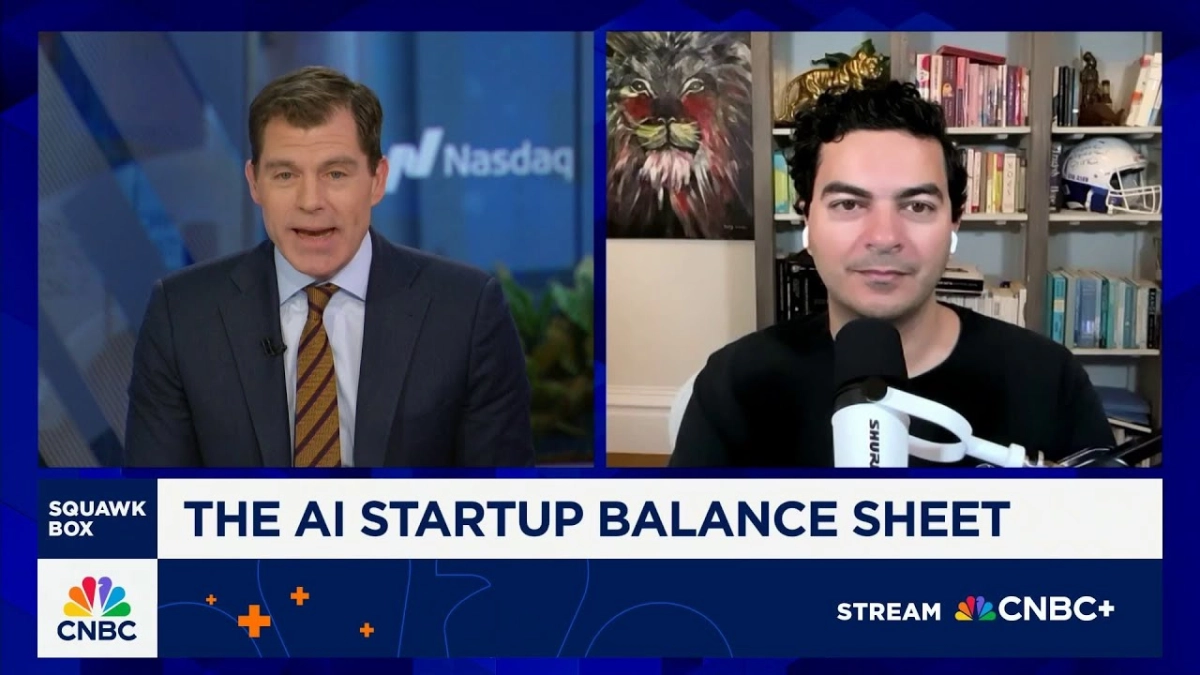

The current landscape of artificial intelligence is characterized by insatiable demand, a phenomenon starkly illuminated by Immad Akhund, co-founder and CEO of Mercury, in a recent CNBC Squawk Box interview. Akhund, whose fintech firm provides banking services to a significant portion of early-stage startups, offered a unique vantage point into the financial flows underpinning the AI revolution. His insights painted a picture of rapid reallocation of capital towards AI tools, driven by an urgent need for productivity and innovation, rather than speculative exuberance alone.

Akhund spoke with the CNBC interviewer about Mercury’s role in the startup ecosystem and the latest trends in AI spending. Since its inception in 2017, Mercury has aimed to provide "radically different banking to startups," offering an integrated suite of financial services from basic accounts and corporate credit cards to bill pay, invoicing, and treasury management. This comprehensive approach has made Mercury a central financial hub for approximately one in three early-stage startups, granting Akhund unparalleled visibility into their spending habits and strategic shifts.

The appeal of Mercury, Akhund explained, stems from a pervasive dissatisfaction with traditional banking services among entrepreneurs. He humorously noted, "Do you like your banking? I think most entrepreneurs, most consumers as well, just don't like their bank; it's a really painful product, lots of fees." Mercury addresses these pain points with streamlined features, such as collaborative card management—allowing users to set spending controls for team members, even their nanny in a personal banking analogy—and automated transfers between accounts to optimize yield. This user-centric design, now extended to personal banking, underscores the company's commitment to simplifying financial operations for its tech-savvy clientele.

Mercury’s internal data, detailed in an August 2025 report, reveals compelling trends in startup expenditure. A striking 79% of early-stage companies are increasing their overall spending. More specifically, 73% are boosting their investment in AI and automation, while 55% are actively reallocating budgets from traditional tools to AI solutions. This data confirms a decisive shift, with AI not merely augmenting existing operations but fundamentally reshaping how startups allocate their financial resources.

The AI services attracting this capital are diverse, yet concentrated in areas promising immediate productivity gains. Akhund observed that beyond the major foundational models like OpenAI and Anthropic, significant spending is directed towards "vibe coding and coding assistant type things like Replit and Cursor," alongside general productivity tools such as Fixie for email and Notion for documentation. This indicates a broad adoption of AI across various functional areas, from core development to daily operational efficiency. Startups are not just building AI; they are actively integrating AI into their fundamental workflows.

When pressed on whether this AI boom mirrors the dot-com bubble of the late 1990s, Akhund offered a nuanced distinction. He acknowledged the comparison but highlighted a critical difference: the current market is "very supply constrained." He elaborated, "Right now we're building data centers and as soon as we build them they're maxed out." This immediate and overwhelming demand for computational infrastructure, particularly AI chips and the energy to power data centers, suggests a robust underlying need rather than pure speculative investment. Akhund does not foresee this supply constraint easing within the next year, reinforcing the idea that the current growth is grounded in tangible, insatiable demand for AI capabilities.