For decades, corporate M&A has been a slow, opaque process dominated by banker networks and fragmented research. Finding the right acquisition target often felt like guesswork, especially for mid-market deals that fall below the radar of major investment banks.

That dynamic is now shifting. GrowthPal, a Singapore-based startup, announced a $2.6 million funding round led by Ideaspring Capital to accelerate its AI-powered M&A copilot, designed to replace relationship-driven sourcing with data-driven conviction.

The core problem GrowthPal M&A addresses is decision scarcity in a world of data abundance. While platforms like PitchBook aggregate company data, GrowthPal applies AI reasoning to identify which companies actually matter based on strategic intent, sector context, and readiness to transact.

The M&A Copilot

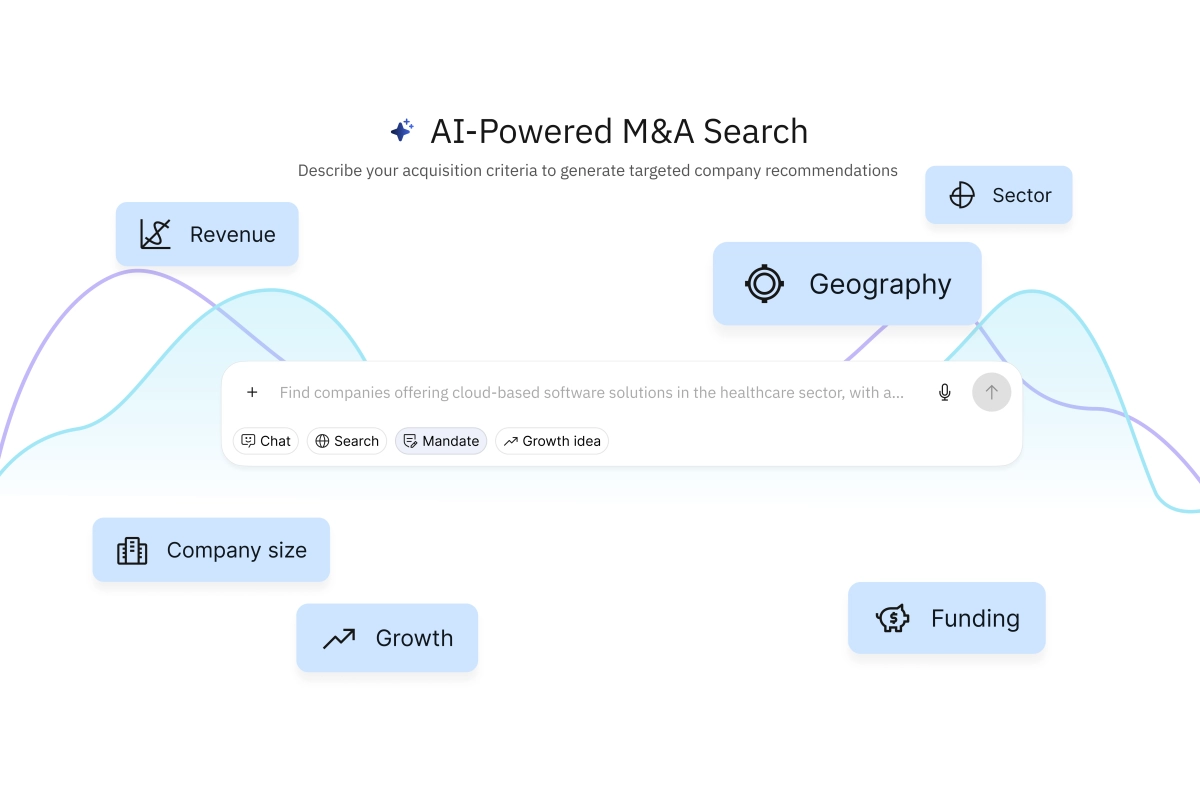

When a buyer defines a growth objective—say, acquiring a specific capability or entering a new geography—GrowthPal’s system translates that goal into a structured acquisition thesis. Its AI agents then scan an enriched database of more than four million technology companies, using signals like hiring trends, public filings, and web activity to generate a precision-fit shortlist.

This approach helps teams surface high-quality, often off-market targets that align closely with the buyer’s mandate, rather than broad lists of loosely relevant firms. According to CEO Maneesh Bhandari, this focus helps buyers move from mandate to meaningful conversations far faster, eliminating weeks wasted on chasing low-intent opportunities.

The platform has already supported over 42 completed M&A transactions globally, proving its ability to connect acquirers with the vast number of startups that struggle to find timely exits. As acquisitions become a primary growth lever for companies of all sizes, the ability to reason across signals and context is rapidly becoming a competitive advantage. GrowthPal plans to extend this intelligence deeper into the transaction lifecycle, supporting valuation reasoning and negotiation preparation.