The current wave of Artificial Intelligence investment, while seemingly boundless, is entering a new phase of scrutiny, according to Gene Munster, Managing Partner at Deepwater Asset Management. His recent analysis, presented on CNBC's 'Fast Money,' underscored that while the AI capital expenditure cycle still has "a few years left," investors are increasingly disinclined to "write blank checks for it." This sentiment reflects a maturation in market expectations, moving beyond speculative enthusiasm to demand concrete returns and strategic clarity from tech giants pouring billions into AI infrastructure.

Munster, a seasoned technology analyst, joined CNBC to offer his key takeaways from the recent slate of Big Tech quarterly results. The discussion provided an insightful dissection of the underlying dynamics shaping the tech landscape, particularly the intense race for AI dominance, the resilience of established behemoths, and the evolving demands of capital markets. His commentary serves as a critical guide for founders, venture capitalists, and AI professionals seeking to understand the nuanced investment environment.

One of the most compelling insights from Munster centered on NVIDIA, which he characterized as the "hidden winner" of the week, despite its stock performance not fully reflecting the underlying strength. He highlighted CEO Jensen Huang's recent GTC keynote, which "effectively raised Nvidia's outlook versus the street by about 15% at least for the next five quarters." This substantial upward revision, largely driven by demand for AI infrastructure, points to the enduring and critical role of NVIDIA's hardware in powering the AI revolution. The market may grapple with NVIDIA's already lofty valuation and the long-term trajectory of hardware cycles, but the immediate demand for its advanced GPUs remains a powerful tailwind. It is "just a mind-bender to think that we're still early in this capex build-out," Munster observed, suggesting that the sheer scale of necessary AI infrastructure investment continues to be underestimated by many.

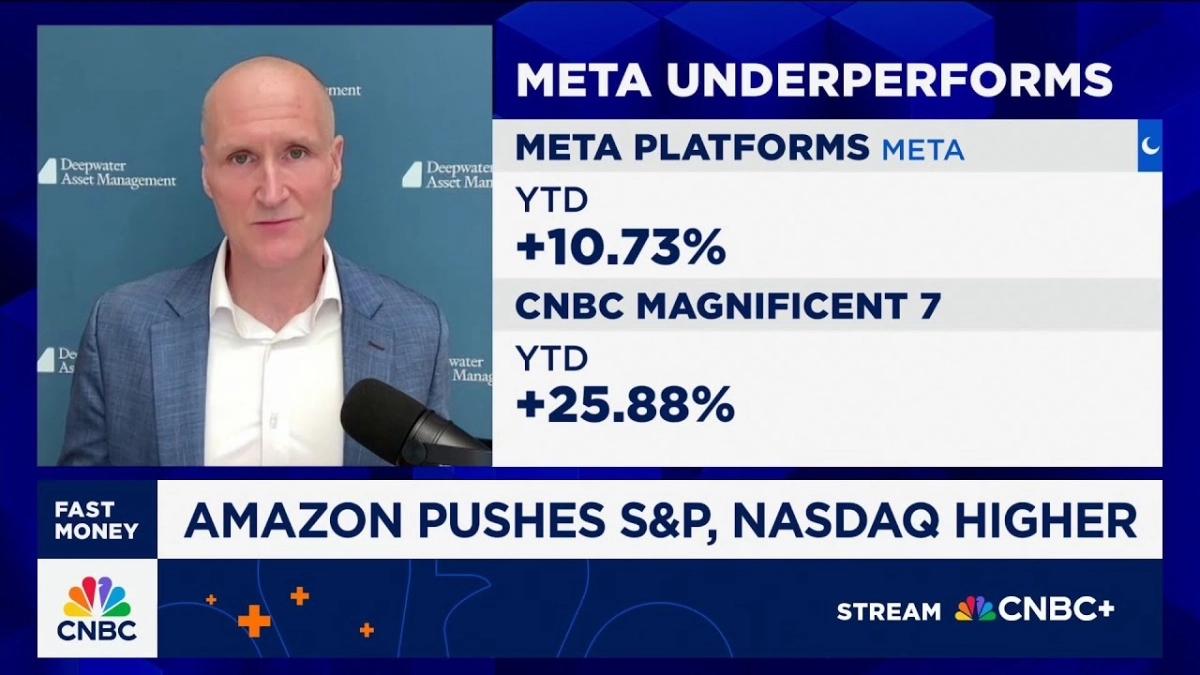

Beyond NVIDIA, Munster delved into the broader strength of the Magnificent Seven tech companies. He noted Apple's resurgence driven by iPhone upgrades, Google's consistent growth in search, and Meta's accelerating daily active user (DAU) numbers. These examples illustrate that despite macroeconomic headwinds and increasing competitive pressures, these companies possess formidable moats and powerful network effects that continue to drive engagement and revenue. The habitual behavior around Google Search, for instance, allows the company to continuously angle more questions into better search growth, reinforcing its dominant position.

The market's initial skepticism towards Meta's ambitious AI investments highlights a critical tension. Investors demand clarity on returns, even as the race for AI dominance intensifies.

Related Reading

- Amazon's AI Vision Captivates Investors Amidst Hyperscaler Spending Spree

- Meta's AI Patience Test: Goldman Sachs on Divergent Tech Fortunes

- Amazon's AI Investments Drive AWS Re-acceleration and Retail Innovation

Munster addressed the investor reaction to Meta's increased capital expenditure forecast for 2026, which initially caused a dip in its stock. He acknowledged that the market's response represented a "flipping of the script" where investors reacted negatively to growth in expenses. However, he underscored the strategic rationale behind Meta's substantial investment in talent, stating unequivocally, "Talent matters in this race." Meta has been aggressively recruiting top-tier AI researchers and engineers, a move Munster believes is a long-term play that will ultimately yield significant returns. This strategic acquisition of human capital, while costly in the short term, is crucial for developing cutting-edge AI capabilities and maintaining a competitive edge.

When questioned about the sustainability of current AI spending levels, especially given reports that AI expenditure accounts for a significant portion of recent GDP growth, Munster remained optimistic for the foreseeable future. He attributed the intense capital expenditure to the fierce competition among tech giants vying for leadership in AI. While acknowledging that the "law of large numbers will catch up" eventually, leading to a potential deceleration or even decline in absolute dollar growth, he believes this inflection point is "several years away." For now, the imperative to innovate and secure a leading position in AI continues to drive substantial investment across the sector. This sustained capital allocation, propelled by competitive dynamics and the vast, untapped potential of AI, suggests a prolonged period of opportunity for those engaged in building and deploying foundational AI technologies.