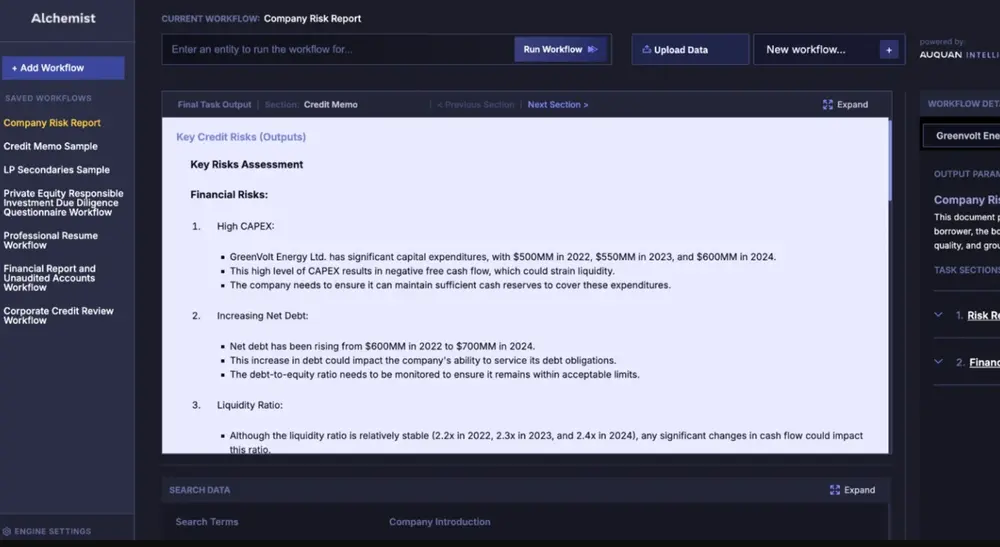

Auquan has unveiled a new AI-powered tool designed to automate risk monitoring and reporting workflows across investment and credit teams. The product, called Risk Agent, is positioned as the first AI solution in the industry capable of executing end-to-end workflows for detecting early signs of portfolio risks without requiring manual intervention.

Unlike traditional AI tools that assist analysts, Risk Agent independently handles everything from sourcing and analyzing information to producing structured reports. This shift enables financial professionals to focus more on analysis and decision-making rather than spending time on repetitive monitoring tasks.

Used by 40% of the top 50 global financial institutions, Auquan’s technology addresses growing concerns over non-financial risks — such as operational, compliance, reputational, and governance risks — that are becoming increasingly important in investment performance but remain difficult to track through conventional methods.

Auquan’s system continuously monitors global data sources in over 65 languages, including regulatory filings, local and global news, NGO reports, and subscription data services. This wide coverage ensures early detection of potential issues across portfolios, such as supply chain disruptions, regulatory investigations, community backlash, executive turnover, and cybersecurity breaches.

According to Dr. Paul Jourdan, CEO of Amati Global Investors, “Auquan offers fund managers critical peripheral awareness — it surfaces faint warning signs that are often overlooked but can have significant implications.”

Built with deep financial domain knowledge, Risk Agent not only tracks risk signals across public and private companies but also helps teams assess potential investments. It consolidates disparate information sources, standardizes risk categories, quantifies qualitative data, and adapts to evolving regulatory requirements.

“We’re focused on eliminating the manual burden financial professionals face," commented Chandini Jain, CEO of Auquan. "Our Risk Agent enables teams to identify and act on risks before they become material issues.”

Since launching its AI platform in 2023, Auquan reports having saved clients more than 50,000 hours in manual work. The company serves firms in private equity, credit, asset management, and other institutional investing sectors.

Risk Agent is available now, both through direct engagement with Auquan and via the Microsoft Azure Marketplace.