Messaging apps are where business conversations start, but they are rarely where they finish. When it comes to moving money, opening accounts, or signing documents, customers are routinely punted out of WhatsApp and into clunky portals or call centers. Jelou, a company that has spent years embedding transactional AI within Latin America’s highly regulated banking sector, just announced a $10 million Series A round to fix that friction point and expand its platform, Brain, into the US market.

The funding, led by Wellington Access Ventures, with participation from Krealo and Collide Capital, brings Jelou’s total capital raised to $13 million. This investment validates a model that has already processed over $100 million in financial operations—including payments, credit underwriting, and identity verification—entirely within messaging apps across 13 countries.

Jelou’s success reflects a critical shift: conversational AI is moving beyond simple Q&A and into secure, high-stakes execution. While most enterprise chatbots are limited to answering frequently asked questions, Jelou’s agents are built to connect directly to existing financial infrastructure and move work forward.

The shift from talking to executing

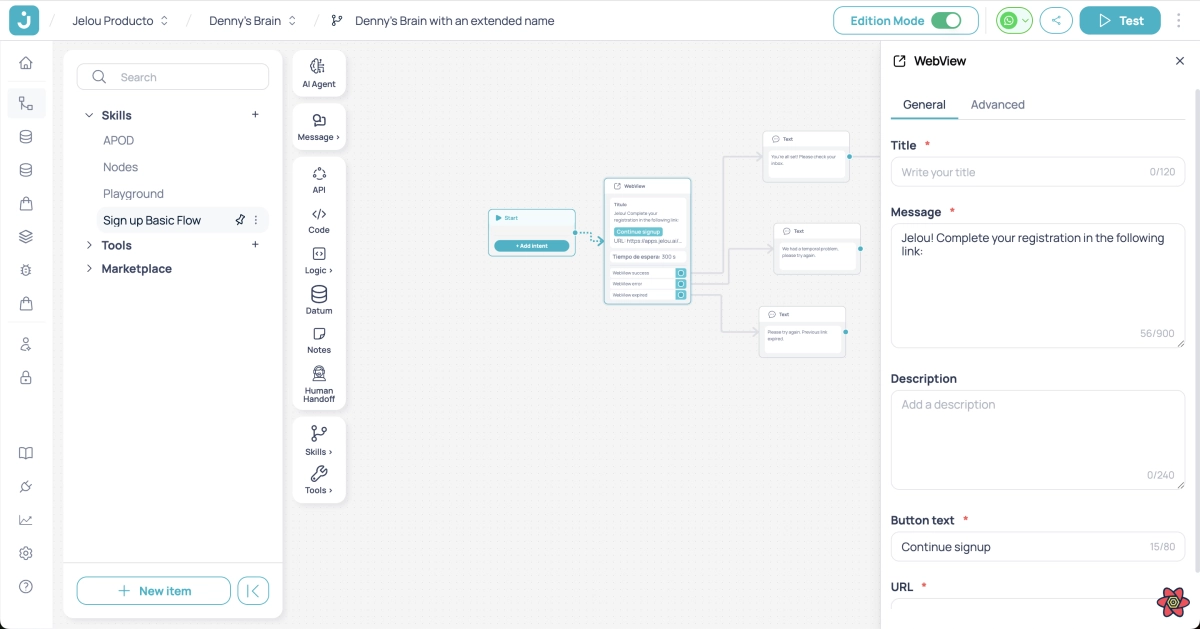

Jelou’s core product, Brain, is designed to be an operating system for conversational business. It allows developers to build AI agents that connect directly to existing enterprise systems via over 3,000 integrations. This tight integration is crucial, especially in finance, where compliance and security cannot be compromised.

The platform allows companies to deploy agents that communicate with customers over WhatsApp, collect missing information, verify identity, trigger payments, and advance complex financial workflows using live system data.

As CEO Luis Loaiza notes, "When customers are most ready to act, things usually fall apart. They get redirected out of the conversation, put on hold, or asked to repeat themselves across systems. We built Brain so businesses can meet customers where they already are and complete the entire operation securely inside chat.”

The company’s journey began in Ecuador in 2017, where messaging had already become the dominant interface for commerce. By proving its ability to handle sensitive operations like opening bank accounts and underwriting credit in diverse regulatory environments, Jelou has positioned itself as an early leader in transactional AI.

For US businesses and SMBs, this expansion means the possibility of deploying high-volume, secure financial workflows without forcing customers off the platform they use every day. Jelou’s vision is to make WhatsApp the primary operating layer for businesses across the region, providing the platform that powers everything built on top of it.